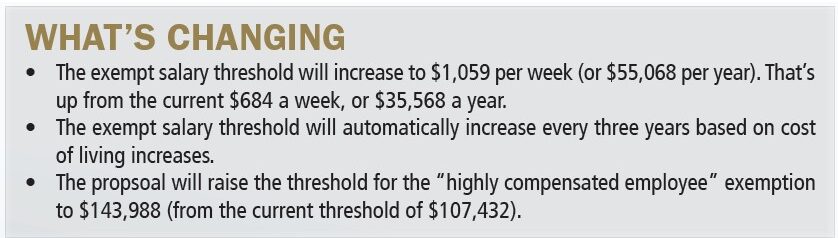

THE U.S. Department of Labor has issued its long-awaited proposed changes to the nation’s overtime rules for American workers, proposing to increase the threshold for exempt status by more than 50% to just over $55,000.

Under DOL rules, workers who are exempt from overtime rules — typically managers, executives, and certain administrators — must make at least the threshold amount, which is currently $35,568.

If the new threshold goes into effect, employers will have a choice to either raise the pay of their currently exempt staff to the new threshold (or above) or change those workers to non-exempt, meaning they must be paid overtime wages (typically time and a half) if they work overtime.

It’s rumored this proposal is on a fast track and that it could become permanent in the next few months, giving employers a short window to make changes.

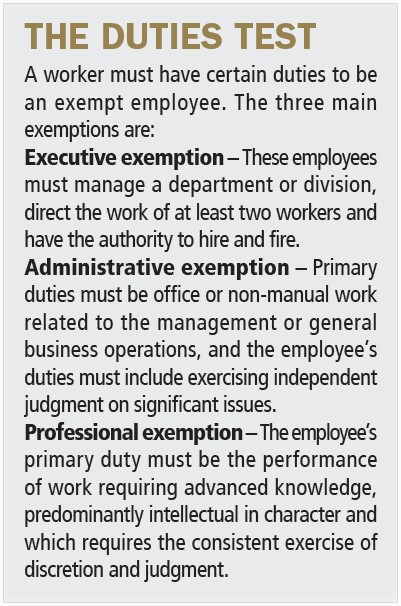

Title alone does not designate someone as “exempt.” There is a two-pronged test for classifying a worker as exempt from overtime pay:

- Their salary, which will have to be $55,068 per year, under the rule.

- The duties test, which outlines exactly what someone’s duties must be in order to qualify for exempt status (see box in the column on the right).

How to prepare

Start by making a list of all your current exempt employees who earn between $35,568 and $55,068 a year.

You will have a decision to make about these workers:

- Raise their salaries to meet the new threshold, or

- Change them to non-exempt status so they are eligible for overtime pay if they work extra hours. You’ll also have to put in place systems for tracking their hours worked, including overtime.

Also, you may have to change benefits for anyone whose status changes. You should plan how you are going to communicate these changes to your workforce.

The risk

The risk