COMMERCIAL PROPERTY owners throughout California are getting hit with significant insurance rate hikes and non-renewal notices as a confluence of factors reverberate through the market.

The commercial property insurance industry is struggling with years of losses after paying out billions of dollars annually for increasingly costly and numerous wildfire claims in California and other natural disasters around the country.

While massive costs dominate the conversation, there is another factor that is contributing just as much to rising insurer costs: The role of reinsurance.

Reinsurance explained

Just like you mitigate your risks by buying insurance, your insurance company does the same by purchasing reinsurance.

This coverage pays claims when they reach catastrophic levels or a certain threshold, like those from massive wildfires.

These arrangements call for the reinsurer to cover the cost of claims for a certain region or for a certain risk, like wildfires or hurricanes. Each reinsurance treaty is different and they are often tailor-written for individual insurance companies.

Without reinsurers taking on a good portion of catastrophic claims, insurance rates would be much higher than they are today. But that’s changing.

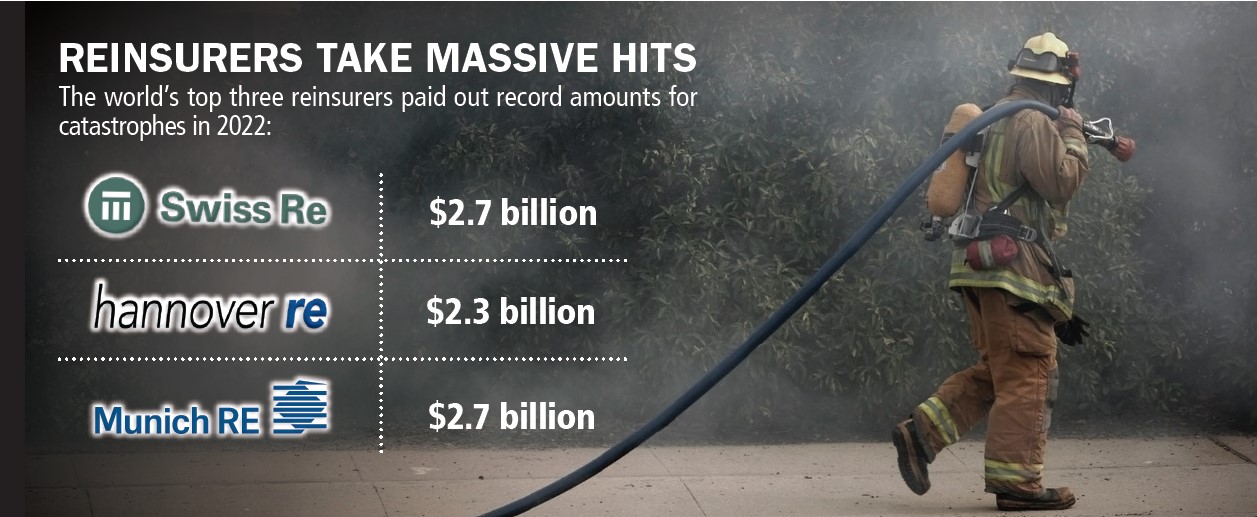

Reinsurers pay for a significant portion of any global catastrophe as they are the backstop for insurers around the world. And catastrophes have been growing in number and scope all over the planet.

During the first half of 2023, natural catastrophes caused $52 billion in insured damage globally, which is 18% higher than the average of $44 billion in the past 10 years and 39% higher than the 21st-century average of $38 billion, according to a report by Swiss Re.

The U.S. accounted for $34 billion of the world’s insured property losses in the first half. The nation also accounted for 13 of the 17 global natural catastrophe events that each caused more than $1 billion in insured losses, according to the report.

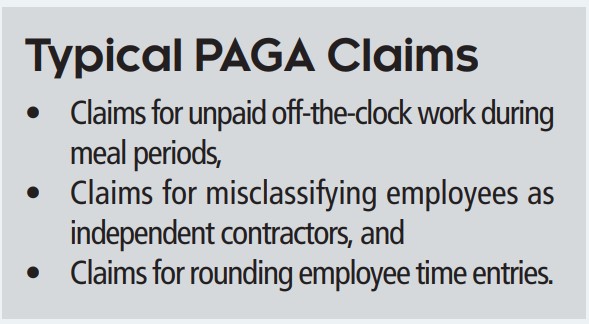

What reinsurers are doing

Raising rates – Reinsurance companies have been raising their rates significantly. A recent report on the trade news site Artemis.com said property catastrophe reinsurance rates had

seen a substantial average increase of approximately 30% during July 1 renewals.

Reconsidering where they provide coverage – Reinsurers have also started pulling back from covering properties in areas or regions that are at higher risk for natural disasters, particularly California and Florida, the latter due to increasingly costly hurricane damage and the former due to the increasing wildfire risk.

When reinsurers pull back, the primary insurers often have to take on more of the risk themselves.

Changing terms – Reinsurers are taking on less risk than they have in the past by raising attachment points, forcing primary insurers to take on more of the cost of claims.

Reinsurers are changing conditions for paying claims, getting more stringent in their definitions of various catastrophic events and triggers for paying claims.

The takeaway

While this hard reinsurance market continues, there is hope that rates will stabilize in the future bringing relief to insurers, and more importantly: You.

Both reinsurers and insurers are struggling to catch up with increasing costs and the “new normal.” Once they adapt, your premium may be more predictable.

The risk

The risk