ARE YOU due for a workers’ compensation premium audit?

Audits are how insurance rates are determined, and it’s possible that an audit will uncover information that can actually save you money — or not if you’ve hired additional staff and haven’t notified your insurer.

In any case, it pays to be prepared and you can do so with the following tips:

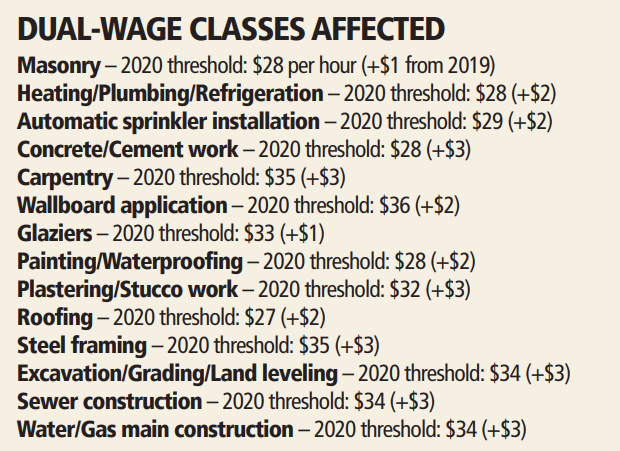

Note staffing changes – Let us know when there are changes in your staffing, payroll, or areas of operation. This is important not just at audit time, but all the time. Your rates are based on variable rating information, including the number of employees, job classifications, and the states in which you operate. Updated information results in more accurate premium assessments.

Get your records ready – Your auditor will need to see records such as federal and state tax returns, ledgers, checkbooks, contracts, and employee or contractor tax documents. If you prepare your records in advance, you’ll speed up the audit process.

Gather all payroll information – Make sure you break out various types of compensation in your records. For example, to set your premium, we consider pay but not contributions to employee benefits packages and other perks, so it’s important to make sure your records are clear on the various types of compensation. Also, make sure overtime pay is clearly defined since it’s classified as regular pay for workers’ compensation insurance purposes.

Ensure that contractors have their own insurance – This is important not only from an audit standpoint but from a liability perspective as well. If an uninsured contractor has an accident

while performing work on your behalf, you can be held liable. If an audit identifies contractors for whom you don’t have certificates of coverage, you can be charged for their premiums.

Remain on hand to answer questions – As your auditor reviews your material, he or she may have questions or need additional data. If you are available to provide answers, your audit will be completed more quickly.

The takeaway

By following these tips, you’ll be more prepared for your workers’ compensation premium audit. A fast, efficient audit process can save time for both you and your auditor, so it pays to be prepared.