The new decade is starting off with a tsunami of new laws and regulations that will affect California businesses. Companies operating in California will have to be prepared for significant changes or open themselves up to potential litigation, fines, and other risks.

Here’s what you need to know coming into the new year:

1. AB 5

The controversial AB 5 creates a more stringent test for determining who is an independent contractor or employee in

California. Known as the “ABC test,” the standard requires companies to prove that people working for them as independent contractors are:

A) Free from the firm’s control when working;

B) Doing work that falls outside the company’s normal business; and

C) Operating an independent business or trade beyond the job for which they were hired.

Legal experts recommend that employers:

• Perform a worker classification audit, and review all contracts with personnel.

• Notify any state agencies about corrections and changes to a

worker’s status.

• Discuss with legal counsel whether they should now also include them as employees for the purposes of payroll taxes, workers’ compensation insurance, federal income tax withholding, and FICA payment and withholding.

2. Wildfire safety regulations

Cal/OSHA issued emergency regulations that require employers of outdoor workers to take protective measures, including providing respiratory equipment, when air quality is significantly affected by wildfires. Under the new regs, when the Air Quality Index (AQI) for particulate matter 2.5 is more than 150, employers with workers who are outdoors are required to comply with the new rules. These include providing workers with protection like respirators, changing work schedules or moving them to a safe location.

3. Arbitration agreements

Starting Jan. 1, the state will bar almost all employee arbitration agreements. AB 51 bars employers from requiring

applicants, employees and independent contractors to sign mandatory arbitration agreements and waive rights to filing

lawsuits if they lodge a complaint for discrimination, harassment, wage and hour issues. Businesses groups sued to overturn the law on the grounds that it is preempted by the Federal Arbitration Act.

4. Overtime rules

New federal overtime regulations are taking effect for non-exempt workers. Under the new rule, employers will be required to pay overtime to certain salaried workers who make less than $684 per week – or $35,568 per year – up from the current threshold of $455, or $23,660 in annual salary.

5. Consumer privacy

Starting Jan. 1, under the California Consumer Protection Act, businesses that keep personal data of residents are required to safeguard that information and inform website users how their personal data may be used. The law applies to firms with $25 million or more in annual revenues or those that sell personal information as part of their business.

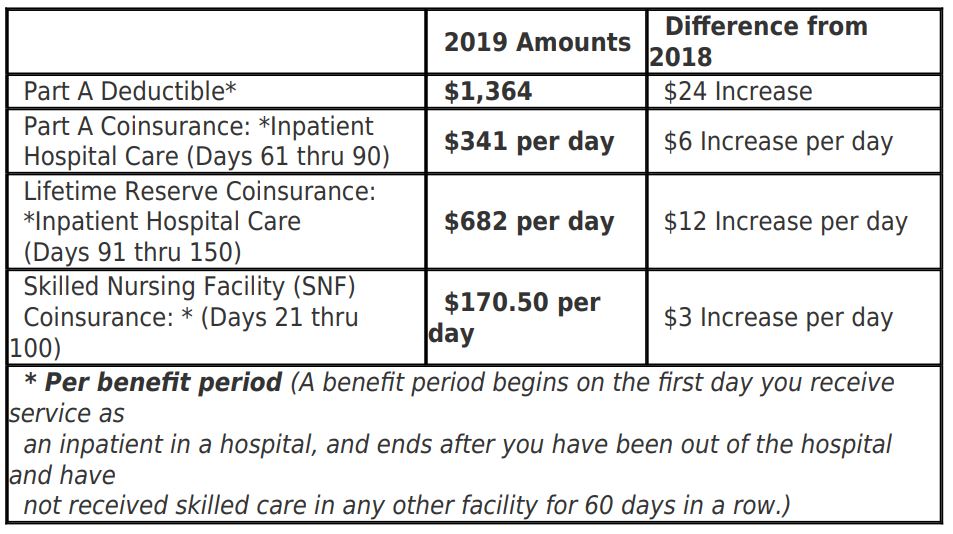

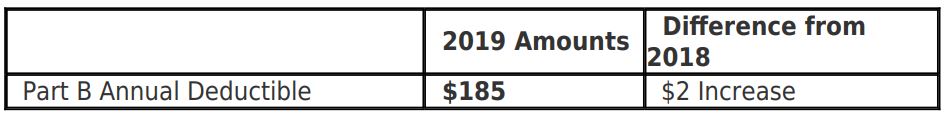

6. Return of the individual mandate

A new law brings back the individual mandate requiring Californians at least to secure health insurance coverage or face tax penalties. This comes after the penalties for not abiding by the Affordable Care Act’s individual mandate were abolished by Congress in late 2017. Starting in 2020, California residents are required to have health insurance or pay excess taxes. This will affect any of your staff who have opted out of your group health plan as it may mean they are going without coverage, unless they have opted to be covered by their spouse’s plan. If you have staff who didn’t enroll in your plan for 2020, they may have to wait until your group’s next open enrollment at the end of the year. That could force them to pay tax penalties.

7. New audit, X-Mod thresholds

The threshold for physical workers’ compensation audits for California policies incepting on or after Jan. 1 is $10,500 in annual premium, a drop from $13,000. This means that any employer with an annual workers’ comp premium of $10,500 or more will be subject to a physical audit at least once a year. On top of that, the threshold for experience rating (to have an X-Mod) has also fallen – to $9,700 in annual premium as of Jan. 1, from $10,000.

8. Harassment training partly pushed back

Employers with five or more workers were required to conduct sexual harassment prevention training for their staff by the end of 2019 under a California law passed in 2018. A new law extends the compliance deadline for some employers who had already conducted training prior to 2019. The original law, SB 1343, required all employers with five or more staff to conduct sexual harassment prevention training to their employees before Jan. 1, 2020 – and every two years after that. If you have never trained your staff, you should have done so in 2019.

But if you have, here are the new rules:

• If you trained your staff in 2019, you aren’t required to provide refresher training until two years from the time the employee was trained.

• If you trained your staff in 2018, you can maintain the two-year cycle and comply with the new Jan. 1, 2021 deadline. You did not have to repeat the training in 2019.

9. Hairstyle discrimination

A new law makes it illegal for employers to discriminate against employees and job applicants based on their hairstyle if it is part of their racial makeup. The CROWN Act (Create a Respectful and Open Workplace for Natural Hair), defines race or ethnicity as “inclusive of traits historically associated with race, including, but not limited to hair texture and protective hairstyles like braids, locks, and twists.” This new definition of race means that natural hair traits fall under the context of racial discrimination in housing, employment and school matters.

10. Reporting serious injuries

A new law broadens the scope of what will be classified as a serious illness or injury which regulations require employers to report to Cal/OSHA “immediately.” The new rules being implemented by AB 1805 are designed to bring California’s rules more in line with Federal OSHA’s regulations for reporting. It will mean that some injuries that were not reportable before will be, such as:

• Any inpatient hospitalization for treatment of a workplace injury or illness will need to be reported to Cal/OSHA.

• An inpatient hospitalization must be required for something “other than medical observation or diagnostic testing.”

• Employers will need to report any “amputation” to Cal/OSHA. This replaces the terminology “loss of member.” Even if the tip of a finger is cut off, it’s considered an amputation. As of yet, there is no effective date for this new law, as enabling regulations have to be written – a process that will start this year.