Jan 2025 – Top 10 Laws and Regulations for 2025

WITH 2025 NOW upon us, so is a slew of new laws and regulations that will affect California businesses.

Last year was a busy legislative session in addition to a rash of important rulemaking.

The end result is another round of new legislation that California employers need to stay on top of.

1. ‘Captive audience’ meetings barred

Starting Jan. 1, California employers are prohibited from requiring employees to attend “captive audience” meetings where the employer shares its opinions on political or religious matters.

This includes topics such as unionization, legislation, elections or religious affiliations.

Employers are also barred from retaliating, discriminating or taking any adverse action against employees who opt out.

The law applies broadly to most employers, but does include some exceptions, including religious organizations, political organizations and educational institutions providing relevant coursework.

Employers who violate SB 399 could face significant consequences, including a civil penalty of $500 per employee, per violation.

2. ‘Egregious’ offenders

Cal/OSHA is working on new rules, expected to take effect in 2025, that would step up enforcement and penalties against California employers that commit “egregious” and “enterprise-wide” workplace safety violations.

A business cited for an egregious violation could be fined up to $158,000 “per instance,” meaning it can be applied for each employee exposed to the violation.

Violations that could be considered egregious include:

• The employer intentionally making no reasonable effort to eliminate a risk.

• The employer has a history of one or more serious, repeat, or willful violations.

• The employer intentionally disregarded its health and safety responsibilities.

3. Expanded paid sick leave

Two bills expanded the use of paid sick leave, starting Jan. 1.

The more far-reaching measure, AB 2499, expands current state law that allows employees who are victims of appearances, treatment, and various other reasons.

The new measure also expands the use of paid sick leave to cover certain “safe time” absences for issues like:

• Domestic violence,

• Sexual assault,

• Stalking, or

• Violence, brandishing a weapon, or making threats of physical injury

or death.

AB 2499 also permits workers to take time off to help family members who are victims of a crime.

The second measure, SB 1105, allows agricultural workers to use accrued paid sick leave to avoid wildfire smoke, excessive heat or flooding conditions.

The measure states that this is a clarification that existing law allows workers to take sick days for preventive care.

4. Freelance Worker Protection Act

Starting this year, California’s Freelance Worker Protection Act imposes new requirements on businesses hiring freelance workers for professional services worth $250 or more.

The law requires employers to provide freelancers with a written contract outlining key details, including the services provided, payment amounts and deadlines for compensation.

If no payment date is specified in the contract, freelancers must be paid no later than 30 days after completing their work.

Businesses cannot require freelancers to accept less pay than agreed upon or provide additional services after work has begun as a condition for timely payment.

Importantly, the law also prohibits retaliation against freelancers who assert their rights, such as raising complaints about violations or seeking enforcement of the law. Noncompliance can lead to significant penalties. If a written contract is not provided, employers may face a $1,000 penalty. Late payments can result in damages up to twice the amount owed, while other violations may require businesses to pay damages equal to the value of the contract or the work performed.

5. Indoor heat illness

These new requirements actually took effect at the end of last summer, so 2025 is the first full year they’ve been in effect.

Cal/OSHA’s indoor heat illness prevention rules require employers to protect workers in indoor workplaces when temperatures reach 82 degrees Fahrenheit or higher. These regulations apply to most indoor settings but mainly affect restaurants, warehouses, and manufacturing facilities. At 82 degrees, employers must ensure workers have cool, potable water nearby and access to a cool-down area where temperatures remain below 82 degrees. Workers should be encouraged to take rest breaks to prevent heat-related illness and be monitored for symptoms during these breaks. If clothing restricts heat removal or radiant heat sources are present, these measures apply immediately.

At 87 degrees, employers must take additional steps, when feasible, such as cooling work areas, providing personal heat protective equipment, and implementing work-rest schedules. Affected employers should evaluate options like installing air conditioning to maintain safe temperatures. While this is feasible for smaller spaces, larger facilities like warehouses may require

alternative compliance strategies.

6. PAGA reform

In July 2024, Gov. Newsom signed into law two measures aimed at curbing rampant abuse of the Private Attorneys General Act, which has become a costly thorn in the side of businesses in California.

PAGA allows workers who allege they have suffered labor violations, like unpaid overtime or being denied mandatory meal and rest breaks, to file suit against their employers rather than file a claim with the state Department of Labor Standards Enforcement.

The new laws aim to reward employers with reduced penalties if they address in good faith issues raised by an employee.

For example, the reforms cap the assessment at 15% of the available penalty for employers that take immediate and proactive steps to bring themselves into compliance with state law. Employers that take “reasonable” steps to address issues within 60 days of receiving a PAGA notice will face a maximum penalty of 30%.

The new PAGA also requires a worker to personally experience violations alleged in a claim if they want to bring action. It also increases workers’ share of awards to 35%, from 25%. The rest of the funds go to the Labor & Workforce Development Agency.

7. Family leave change

A new law, AB 2123, bars employers from requiring that workers who plan to take time off under the state’s Paid Family Leave Program first take up to two weeks of accrued vacation time before benefits kick in.

8. Driver’s license queries

Starting Jan. 1, employers are barred from listing in help wanted ads and job applications that having a driver’s license is a prerequisite for a job, unless the employer:

• Reasonably expects that driving will be part of the job, and

• Reasonably believes that allowing the employee to use alternative forms of transportation (including ridesharing, taxi, or bicycle) would take more time or require the business to incur higher costs.

9. Poster updates

Employers have to update two mandatory work posters this year.

The standard poster that informs employees about their rights under workers’ compensation laws, needs to be updated.

The new poster must include language stating that employees may consult with an attorney for advice about workers’ comp law and that they may have to pay attorneys’ fees if they hire a lawyer as part of their claim.

Also, businesses are required to post an updated paid leave law notice to reflect the changes ushered in by AB 2499, the paid leave law for crime and abuse victims discussed above.

10. Minimum wage

California’s minimum wage increased to $16.50 an hour on Jan. 1. This rate is for all areas of the state, except for those jurisdictions that have implemented their own minimum wage to reflect the higher cost of living in their area.

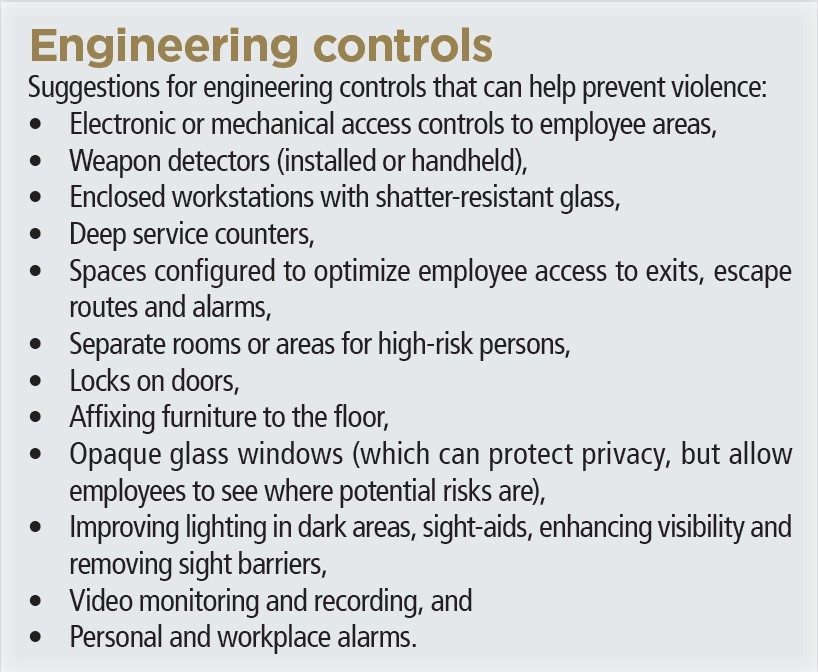

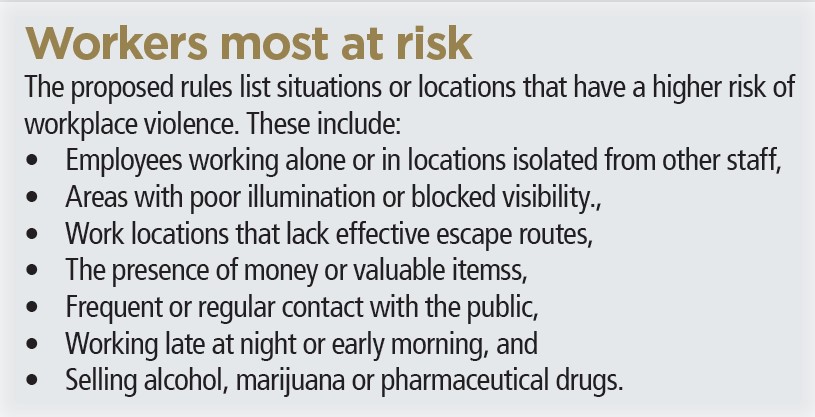

October 2024 – New Rulemaking – Proposed Workplace Violence Rules Sow Confusion

CAL/OSHA has proposed new regulations that would incorporate California’s new workplace violence prevention law — which took effect July 1 — into Title 8, the set of regulations that covers workplace safety in the Golden State.

However, the proposed rules add a number of new requirements that some safety observers say would be unworkable in many workplaces and may create burdensome new standards for employers to follow. Here’s how the new rules add to those requirements.

Workplace controls

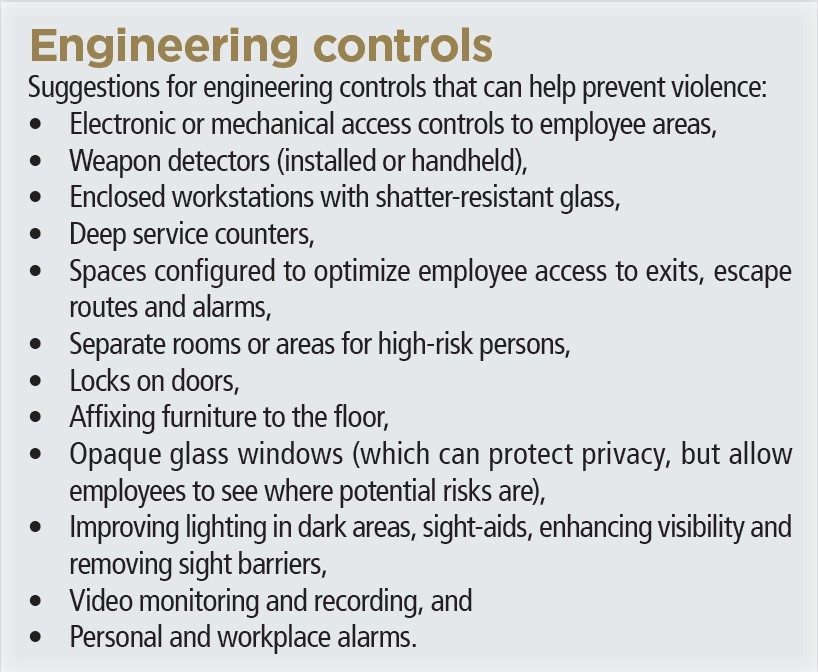

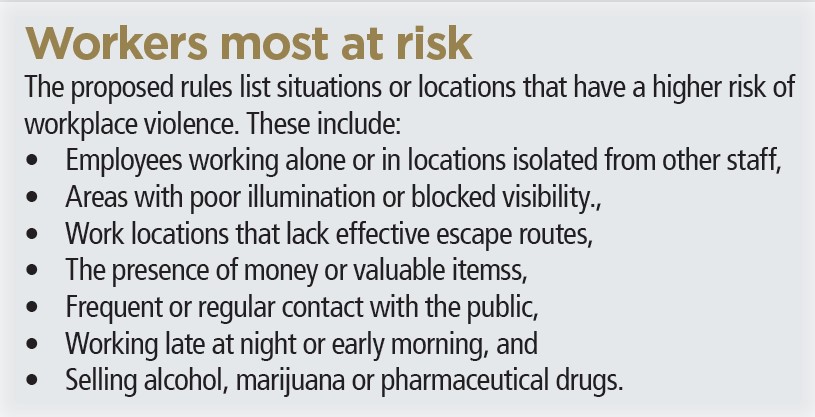

The proposed regulations list acceptable procedures and rules that can be used to effectively reduce workplace violence hazards:

• Appropriate staffing levels,

• Hiring dedicated security personnel,

• Effective means to alert employees of the presence, location, and nature of a security threat, and

• Control of visitor entry.

Response procedures

The draft rules outline steps employers can take when responding to and then investigating a case of workplace violence, post-incident:

• Provide immediate medical care or first aid to workers who have been injured in the incident,

• Identify employees involved in the incident,

• For employers with more than 25 employees, make available individual trauma counseling to those staff affected by the incident,

• Conduct a post-incident debriefing as soon as possible after the incident with employees and supervisors involved in the incident,

• Identify hazards that may have contributed to the incident,

• Identify and evaluate whether appropriate corrective measures developed under the firm’s workplace violence prevention plan were effectively implemented, and

• Solicit opions from employees involved in the incident about the cause of the incident, and what could have prevented it.

The takeaway

The proposed rules are just the first step. They still have to go through a public comment period and the Division of Occupational Safety and Health, which writes new regulations.

However, the rules have already received plenty of pushback from employers.

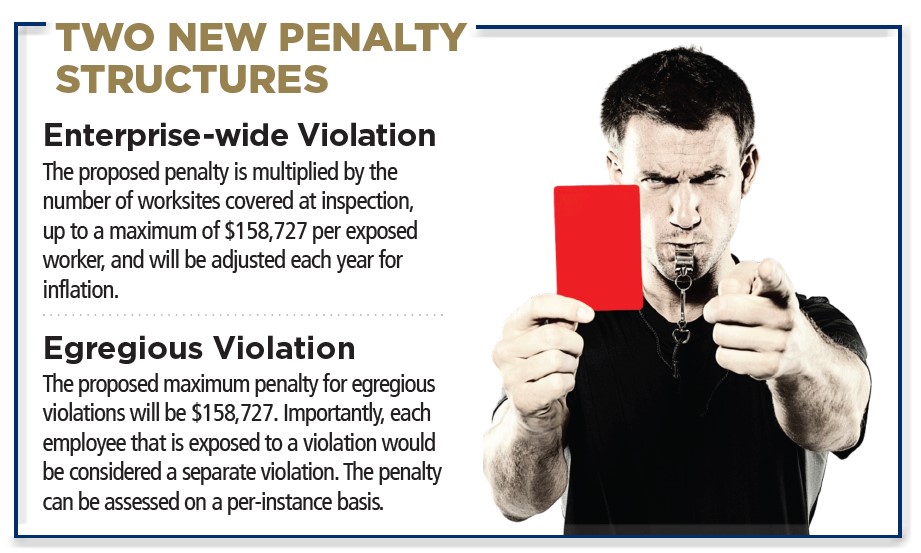

October 2024 – Proposed Rules Take Aim at ‘Egregious’ Violators

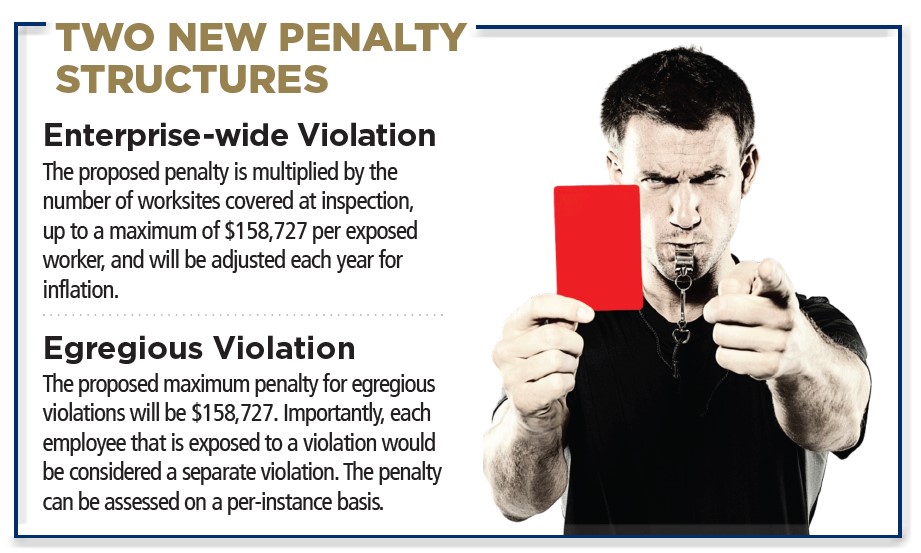

CAL/OSHA is working on new rules that would crack down on and step up enforcement and penalties against California employers that commit “egregious” and “enterprise-wide” workplace safety violations.

To enforce the impending rules, the agency is ramping up the hiring of investigators to identify egregious violators and to refer more employers for criminal prosecution.

The forthcoming rules would impose substantial penalties on companies that have shown a disregard towards California workplace safety regulations and the wellbeing of their employees.

Employers that are cited for egregious violations could be fined up to $158,000 “per instance,” meaning it can be applied for each employee exposed to the violation.

Here’s what’s on tap:

Enterprise-wide violation

Under the proposed rules, a violation is enterprise-wide if an employer has multiple worksites and either of the following is true:

• The employer has a written policy or procedure that violates occupational safety and health regulations; or

• The Division of Occupational Safety and Health has evidence of a pattern or practice of the same violation or violations involving more than one of the employer’s worksites.

Egregious violation

The proposed rules define an egregious violation as a willful violation where the employer has had a previous egregious violation in the past five years. One or more of the following must apply:

• The employer intentionally made no reasonable effort to eliminate a known violation.

• The employer has a history of one or more serious, repeat, or willful violations or more than 20 general or regulatory violations per 100 employees.

• The employer intentionally disregarded its health and safety responsibilities, such as by failing to maintain an Injury and Illness Program, ignoring safety hazards, or refusing to comply with regulations.

• The employer’s conduct amounts to clear bad faith in the performance of their duties to comply with occupational safety and health standards.

• Within the five years preceding a citation for an egregious violation, the employer has committed more than five violations of any Title 8 standard that has become TWO NEW PENALTY finalized.

• The violations resulted in worker fatalities, a worksite catastrophe, or five or more injuries or illnesses. Catastrophe is defined as inpatient hospitalization of three or more workers from a workplace hazard.

• Within the 12 months immediately preceding the underlying violation, 10% of all employees at the cited worksite sustained workplace injuries or illnesses.

The takeaway

The proposed regulations pose the largest risk for companies with multiple locations.

Fines will be adjusted each year to account for inflation. Employers should double down on their workplace safety efforts and ensure that there is buy-in to the program from top management down to supervisors and line workers at all locations.

July 2024 – Indoor Heat Illness Rules Coming Soon

THE CAL/OSHA Standards Board has voted to approve new heat illness prevention regulations that will require some workplaces to make significant adjustments to their operations in order to comply, possibly starting early this summer.

The vote has been challenged, and at the last minute, the California Department of Finance withdrew its approval of the regulatory changes due to a lack of full analysis on their potential financial impact on state entities, particularly state-operated correctional facilities.

However, Cal/OSHA is already in the process of creating a carveout for these entities to appease the Finance Department.

The indoor heat illness prevention standard applies to most indoor workplaces where the temperatures reach at least 82 degrees. According to Cal/OSHA, that includes facilities like warehouses, manufacturing and production facilities, greenhouses, wholesale and retail distribution centers, restaurant kitchens, and dry cleaners.

The rules

Applicable employers will need to create and maintain a written indoor heat illness prevention plan that includes the following:

82-degree trigger – When temperatures indoors reach this level, employers must:

• Have and maintain one or more cool-down areas when employees are present, which must be kept at a temperature below 82 degrees.

• Allow and encourage staff to take preventive cool-down rests in a cool-down area when they feel the need. They should be monitored for signs of heat illness during rests.

• Provide drinking water near the areas where employees are working.

• Observe all employees during heat waves when a workplace has no measures for controlling the effects of outdoor heat on indoor temperatures.

87-degree trigger – When the temperature exceeds 87 degrees, employers must measure the temperature and heat index, and identify all other environmental risk factors for heat illness. Firms must keep records of the temperature/heat index.

They must also implement control measures such as:

• Using air conditioners, swamp coolers, ventilation, or other measures to reduce the air temperature (engineering controls);

• Adjusting work procedures, practices, or schedules to minimize exposure to heat, such as changing shifts to start earlier and avoid the hottest parts of the day (administrative controls); or

• Using personal heat-protective equipment, such as water- or air-cooled garments or heat-reflective clothing.

Employers with affected workplaces must also observe new employees for 14 days when working under these conditions.

Emergency response – Employers must develop emergency response procedures, which must include:

• An effective communication system to allow workers to contact a supervisor or emergency services.

• Steps for responding to signs and symptoms of heat illness, including first aid and providing emergency medical services.

• Emergency response procedures for severe heat illness.

• Monitoring employees exhibiting signs of heat illness, and not leaving them alone without offering them onsite first aid or medical services.

Training – Employees and supervisors will need to be trained on:

• Personal risk factors for heat illness.

• Their employer’s procedures for complying with the regulations.

• The importance of frequent water consumption.

The takeaway

As mentioned, at this point there is no definitive date for these regulations taking effect, but Cal/OSHA insists they will be ready before summer starts in late June.

April 2024 – Workplace Safety – Overdose Meds May Be Coming to Your First Aid Kit

EFFORTS ARE afoot to create new laws and regulations that would require California employers to include the opioid overdose medication Narcan in their first aid kits. Cal/OSHA’s Standards Board has received a petition from a safety group asking it to create new regulations requiring workplaces to stock medications that can reverse opioid overdoses.

On the legislative front, two state assembly members have introduced bills that would require workplace first aid kits to include naloxone hydrochloride, the substance that can reverse overdoses.

More than 83,000 people died of an opioid overdose in 2022 in the U.S., including nearly 7,000 Californians, according to the Centers for Disease Control.

Naloxone, sold under the brand names Narcan and RiVive, is available in an over-the-counter nasal spray or as an injectable.

These medications temporarily reverse overdoses from prescription and illicit opioids, are not addictive, and are not harmful to people when administered.

In its Dec. 8 petition to Cal/OSHA’s Standards Board, the National Safety Council asked it to add naloxone to the list of required items in both construction sites as well as general industry workplaces.

“With the number of workplace overdose deaths on the rise, opioid overdose reversal medication is now an essential component of an adequate first-aid kit,” wrote Lorraine M. Martin, president and CEO of the NSC.

Legislation

Two bills are in play.

AB 1976: Authored by Assemblyman Matt Haney (D-San Francisco), this bill would require first aid kits on job sites to include Narcan. It would require the Standards Board to draft enabling regulations by Dec. 31, 2026.

AB 1996: Authored by Assemblyman Juan Alanis (D-Modesto), this measure would require operators of stadiums, concert venues and amusement parks to stock Narcan. It would not require Cal/OSHA to create new regulations as the measure is aimed at helping members of the public.

The takeaway

In light of the opioid overdose epidemic, more and more employers and operators of facilities that cater to the public have started stocking naloxone.

With opioid overdoses so prevalent in U.S. workplaces (18% in California alone), the simple addition of this over-the-counter medication can save the life of a worker.

Narcan is available for around $40 at most major retail pharmacies. It’s a simple and inexpensive addition to a first aid kit for any employer. It would be good practice to keep a pack in your safety kit… just in case.

Meanwhile, if any of the legislative and possible regulatory efforts become law or regulation, we’ll let you know.

January 2024 – Workers’ Compensation – Rules on First Aid Claims Reporting

THE CALIFORNIA Workers’ Compensation Uniform Statistical Reporting Plan requires that employers report small, medical-only first-aid claims to their insurance carrier.

Many employers fail to report these claims as they consider them too small since the worker doesn’t lose any time from work and they don’t have to go to a doctor. Under Rating Bureau rules, employers are required to report the cost of all claims for which any medical care is provided and medical costs are incurred — including those involving first aid treatment — even if the insurer did not make the payment.

The term “small medical-only claim” is also used to refer to first aid claims.

For workers’ comp purposes, that also means that the injured worker did not miss work because of the injury. Besides these rules, there is a very good reason for reporting these claims because what starts as a first aid claim can develop into a larger claim over time. At that point, if you never reported the claim in the first place, coverage issues may arise.

Additionally, any physician attending any injured employee must send copies of the Doctor’s First Report of Occupational Injury or Illness to the workers’ compensation insurance carrier or employer within five days of the initial examination. The insurer or employer must submit the physician’s report to the Department of Industrial Relations (DIR) within five days of receipt.

Penalties for non-compliance Any employer or physician who fails to comply with the submission of the Doctor’s First Report for first aid claims may be assessed a civil penalty of not less than $50 nor more than $200 by the DIR if a pattern or practice of violations or a willful violation is found.

FIRST AID CLAIM EXAMPLES

• Abrasions and cuts that require cleaning, flushing, or soaking.

• Using hot or cold therapy for a muscle injury.

• Drilling a fingernail to relieve pressure, or draining fluid from a blister.

• Removing foreign bodies from the eye using only irrigation or a cotton swab.

• Removing splinters or foreign material from areas other than the eye by irrigation, tweezers, cotton swabs, or other simple means.

January 2024 – Human Resources – Age Discrimination Cases Up; Set Strong Policies

THE EQUAL Employment Opportunity Commission continues seeing a steady flow of complaints for one of the more common forms of workplace bias — age discrimination.

The number of court filings the EEOC made under the Age Discrimination in Employment Act (ADEA) in fiscal year 2023 was more than double that of fiscal year 2022. As the EEOC steps up its efforts under the Biden administration, it’s crucial that employers have in place policies and employment standards to avoid any appearances of discrimination against workers based on age.

The ADEA prohibits harassment and discrimination on the basis of a worker’s age for individuals over 40. This extends to any aspect of employment, including hiring, job assignments, promotions, training, benefits and more. The law even applies to employers that use third party recruiters to screen job applicants, according to EEOC guidance.

What you can do

Age discrimination in the workplace doesn’t just negatively affect employees. It also affects your company. Over the past 15 years, age discrimination cases have accounted for 20- 25% of all EEOC cases — and such cases typically receive the highest payouts.

Ageism in the workplace is bad for business. Not only do you risk a large settlement, but you also miss out on a large talent pool of older workers in your hiring practices. You also miss out on the major contributions that older workers can make to your organization.

To prevent age discrimination at your firm:

• Train your managers and supervisors on age discrimination and that it won’t be tolerated. Have in place consequences (and follow through on them) for managers who discriminate against an employee due to any protected status, including age.

• Consider taking out any sections of your application that disclose information about an applicant’s age. Removing the date that an applicant graduated or completed their degree is helpful. This can allow hiring managers to focus on the skills and experience an applicant brings to the table rather than their age.

• If you have to go through a layoff, ensure you don’t make any decisions based on age. You should focus only on two things during this process: making choices solely based on performance and the necessity of the position they hold. Even a seniority-based system is acceptable.

The takeaway and insurance

Often when the EEOC settles these cases, it will require the employer to sign a consent decree requiring them to implement age-discrimination training for hiring managers. You shouldn’t wait for an order by the agency to do the same.

Finally: In the event you are sued for age discrimination, if you have in a place an employment practices liability policy, it may cover your legal costs and any potential settlements or verdicts.

Besides age discrimination, these policies will cover a host of other lawsuits by employees.

RECENT CASES

• In March 2023, Fischer Connectors settled with the EEOC for $460,000 over accusations that the manufacturer fired a human resources director and replaced her with two younger workers after she had spoken up about company plans to replace other older workers.

• In September 2023, two former IBM human resources employees who were both over 60, sued IBM after they were terminated, alleging age discrimination.

• Wisconsin-based Exact Sciences agreed to pay $90,000 to settle a lawsuit alleging that it discriminated against a 49-year-old job applicant based on his age after it had turned him down for a medical sales rep position in favor of a 41-year-old.

• A 52-year-old woman sued a Palm Beach restaurant, alleging violations of the ADEA and the Florida Civil Rights Act of 1992. She claims that after working for 10 years as a seasonal server, she was terminated on the grounds that the restaurant was moving to year-round employment, yet continued to hire young seasonal workers.

January 2024 – Top 10 California Laws, Regs for 2024

EVERY YEAR, bills passed by the state Legislature and signed into law by the governor take effect, and 2023 was a busy legislative session in Sacramento. The end result is another set of new laws that employers need to stay on top of in the New Year.

1. Sick leave law expanded

A new law that took effect Jan. 1 increased the amount of paid sick leave days California workers are eligible for to five days (40 hours), up from the current three, or 24 hours.

The new legislation applies to virtually all employees in the state. Under the law, businesses have two options for providing sick leave:

Up front: They can provide all five paid sick days up front for the year, and these days can be used immediately.

Accrual: They can build up paid sick leave by either accruing one hour of leave for every 30 hours worked, or providing 40 hours of leave by the 200th day of the year.

2. Pre-employment cannabis screening

Employers in California are no longer allowed to ask a job applicant about past cannabis use. The legislation, SB 700, bars employers from conducting pre-employment drug screenings for cannabis. In addition, the new law, which took effect Jan. 1, prohibits companies from penalizing workers for their off-the-clock cannabis use. Another measure, AB 2188, makes it unlawful for employers to “discriminate” against a person for failing a workplace drug test that only detects inactive cannabis compounds called metabolites.

3. FAIR Plan increases its limits

With more and more California businesses being forced to go to the California FAIR Plan for their property coverage, the market of last resort has increased its commercial property coverage limits to $20 million per location from the previous $8.3 million. This should bring a semblance of relief to companies located in wildfire-prone areas, who have seen their commercial

property insurance non-renewed and who have been unable to find replacement coverage.

4. Workplace violence law

A new law, which takes effect July 1, requires employers with at least one worker to have in place a workplace violence prevention plan, and conduct workplace violence prevention training

and keep a log of violent incidents in the workplace.

The prevention plan must include:

• Procedures for the employer to accept and respond to reports of workplace violence.

• Procedures to communicate with employees regarding workplace violence.

• Procedures for responding to workplace violence emergencies.

Employers will also be required to train their workers on the plan and on how to respond to violent incidents or threats of violence.

5. Treasury reporting rule

A new Treasury Department rule requires businesses with fewer than 20 employees and less than $5 million in revenue to report ownership and control information to the Financial Crimes

Enforcement Network (FinCEN) as part of an effort to cut down on fraud, money laundering and the funding of terrorism that could run through anonymous business entities.

The new rule was prompted by the passage of the Corporate Transparency Act enacted in 2021, but which took effect Jan. 1. Companies formed after Jan. 1 will have 30 days to file that

information with FinCEN. Existing companies will have to start filing that information starting Jan. 1, 2025.

6. No more non-competes

Under two new laws, non-compete agreements with employees are expressly illegal starting in 2024 and if an employer requires one be signed, it could provide grounds for a lawsuit by the worker. Here’s a rundown of the two laws:

AB 1076 – This law adds new requirements and penalties to existing cases that make it illegal for employers to include non-compete clauses in employment contracts or require an employee to sign a non-compete agreement that doesn’t meet exceptions under the law. The law also requires employers to notify current employees who signed non-compete agreements that they are now void

under California law by Feb. 14, 2024. This also applies to former employees who were hired after Dec. 31, 2021.

SB 699 – This legislation bars employers from enforcing a non- compete agreement that is void under state law. Most notably it would make void an agreement signed by an employee out of

state who later relocates to California. It also provides employees and job applicants a private right of action, including awards for injunctive relief, actual damages and attorney’s fees, and costs if an employer requires them to sign a non-compete. Additionally, it makes a violation of the statute an act of unfair competition — another possible legal risk.

7. New joint-employer rule

The National Labor Relations Board has issued a final rule that expands the definition of what’s considered a joint-employer relationship and increases employers’ potential liability.

Under the rule, two or more entities may be considered joint employers if they share one or more employees and they both can determine the workers’ essential terms and conditions of employment. If a company is deemed a joint employer with another entity, each can be held liable for labor law violations that the other commits.

The new NLRB rule applies to almost all industries, but will have the most effect on companies that use staffing or temp agencies, firms that are third party employers, and franchisors.

The rule took effect Dec. 26, 2023 on a prospective basis, meaning it applies to any cases filed on or after that date.

8. Reproductive-loss leave law

Starting Jan. 1, workers in the Golden State can take up to five days off for a “reproductive loss,” defined as a miscarriage, stillbirth, failed adoption or failed surrogacy experienced by an

employee, their spouse or partner. Under the new law, SB 848, workers are not required to take all five days consecutively, but they must use them all within three months of the event.

If an employee experiences two reproductive losses in a year, they will be eligible for 20 days off.

9. New telecommuter class code

If you have staff who work remotely, you’ll want to know that there is a new California workers’ compensation class code. After droves of employees starting working remotely after the

COVID-19 pandemic began in 2020, the Workers’ Compensation Insurance Rating Bureau created a new telecommuter class code (8871) and tethered its pure premium advisory rate to the 8810

clerical classification for easier administration.

Under Rating Bureau rules, code 8871 will receive its own rate which is 25% lower than the clerical rate. If you have remote workers, you’ll want to ensure they are in the telecommuter class

code to enjoy the lower premium.

10. Minimum wage hike

The state minimum wage increased at the start of 2024 to $16 from last year’s $15.50. While that wage is for the state, a number of cities and municipalities have minimum wage rates that are higher. Additionally, a new law, AB 1228, raises the minimum wage for fast food restaurant workers in the state to $20 an hour, starting April 1, 2024. This rate will increase annually through 2029 based on inflation. v

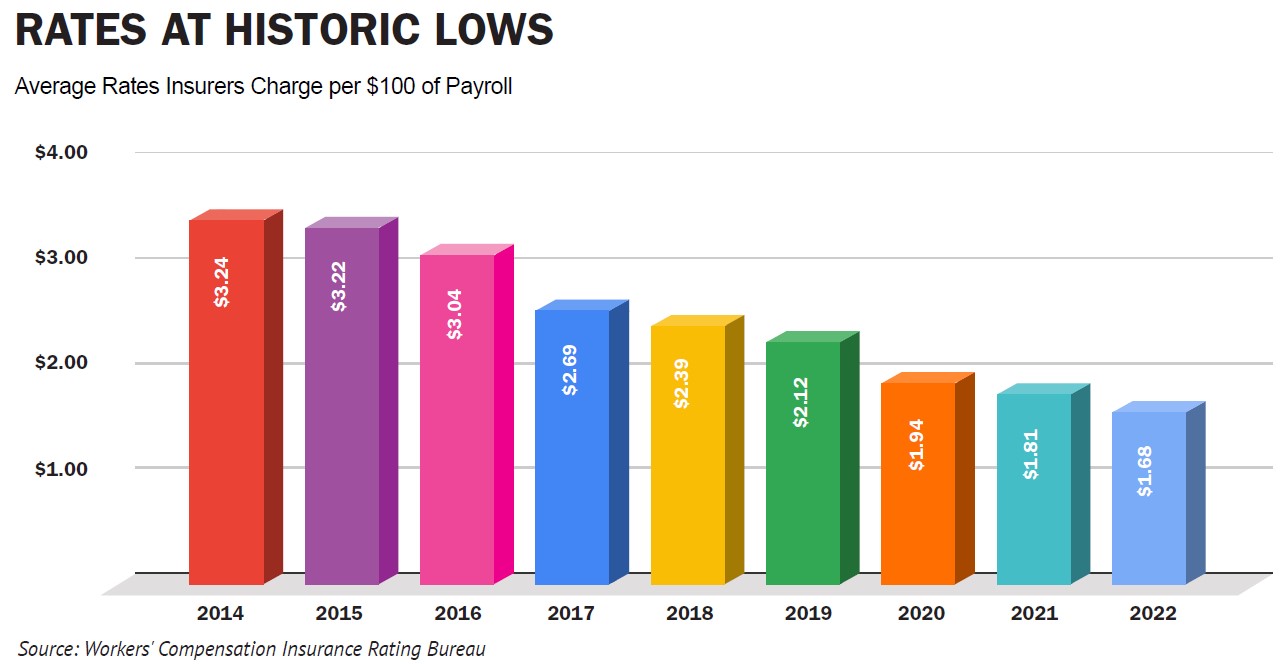

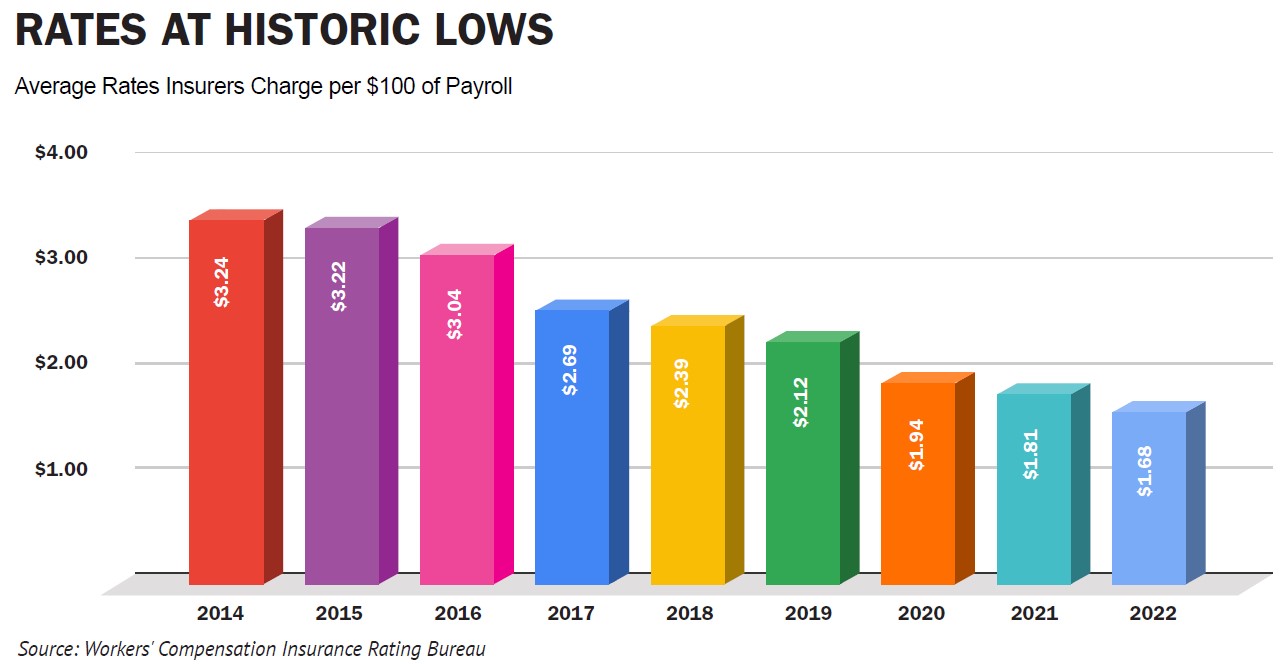

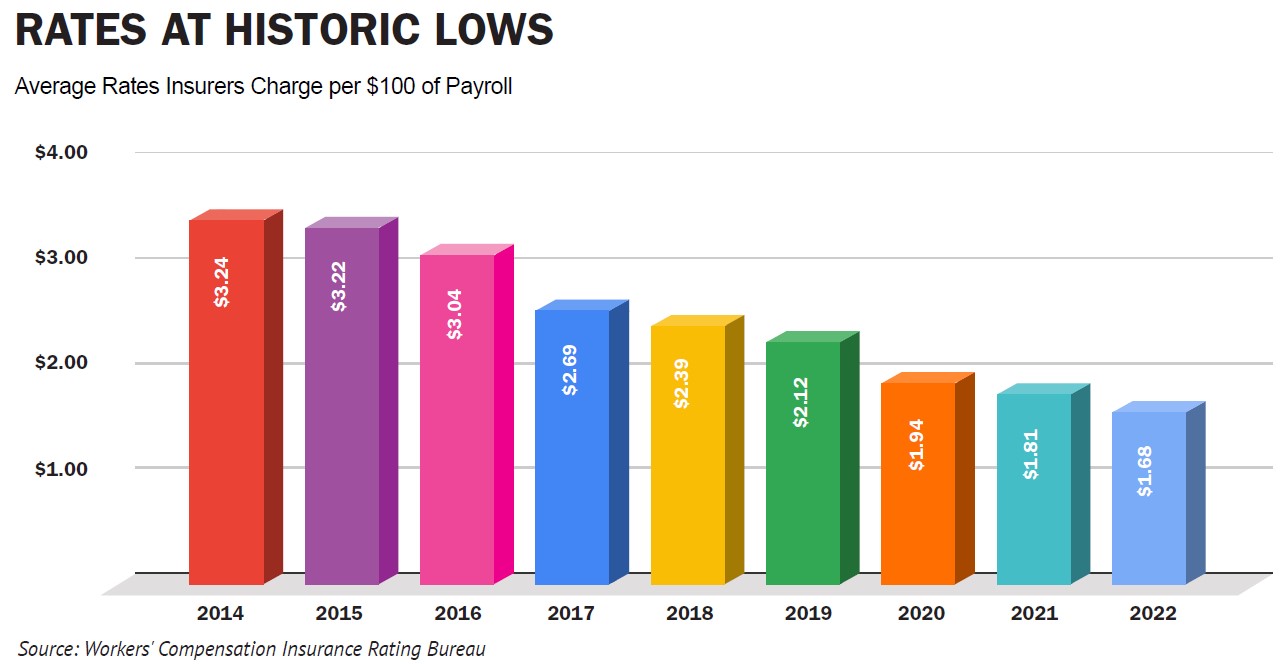

October 2023 – Workers’ Compensation – Insurance Commissioner Orders Rate Reduction

CALIFORNIA INSURANCE Commissioner Ricardo Lara has issued an order that cut the average advisory workers’ compensation benchmark rate across all classes by 2.6%, starting Sept. 1.

The benchmark rate, also known as the pure premium rate, is a baseline that covers just the cost of claims and claims adjusting, but not other overhead like rents, underwriting costs, and provisions for profit.

The rate is advisory, and insurers can use it as a guidepost for pricing their individual policies. Individual premiums that employers pay will depend on a number of factors, including the pure premium rate, the carrier’s own pricing methodology, and the employer’s claims and claims cost history, location, and industry.

Why the rate is falling

The insurance commissioner’s decision cuts the average published pure premium rate to $1.46 per every $100 of payroll, compared to the current $1.50.

Despite the average rate decrease of 2.6%, individual class codes may see swings as much as plus or minus 25%. Several factors are driving the lower rate decision:

- Slowing claims cost inflation

- Falling frequency of claims

- Lower overall claims costs

- Stable medical costs

- Fewer COVID-19 claims

- Lower claims-adjusting costs.

What insurers are doing

The most recently available industry average level of pure premium rates filed by insurers with the Department of Insurance is $1.71 per $100 of payroll as of Jan. 1, 2023, which is about 14.6% higher than the current published rate of $1.50. In 2022, carriers were charging $1.68 on average.

While the workers’ compensation market remains competitive and rates continue hovering around record lows, the final rate any employer will pay will depend on several factors beyond the pure premium rate. Some employers may see rate increases instead.

Factors that can influence the prices include the employer’s:

- Industry.

- Geographical location (employers in Southern California, for example, face a unique claims environment that results in a surcharge).

- Individual claims experience.

October 2023 – Transportation Hiring Alert – Always Check New Drivers’ Clearinghouse Record

FLEET OPERATORS face an increased risk of potential liability if they are not diligent about checking their drivers’ moving violation records with the state Department of Motor Vehicles, in addition to the Federal Motor Carrier Safety Administration’s Drug and Alcohol Clearinghouse.

As of 2020, it became mandatory that all motor carriers sign up their drivers in the Clearinghouse and run their driver rosters through the system to clear them for duty. But many companies are skipping this step and only checking their drivers’ records with the DMV, which may not reflect any suspensions issued by the Clearinghouse.

Clearinghouse rules require that drivers be tested for drugs prior to being hired and randomly throughout the year. This helps employers weed out drivers who may be at higher risk of both moving violations and accidents.

The Clearinghouse

The Clearinghouse was created to keep commercial drivers who have violated federal drug and alcohol rules from lying about those results and getting a job with another motor carrier.

This electronic database tracks commercial drivers’ license holders who have tested positive for prohibited drug or alcohol use, as well as refusals to take required drug tests, and other drug and alcohol violations.

The Clearinghouse tracks a driver’s drug and alcohol tests and bars them from operating commercial vehicles after they fail a test. If they want to return to driving, they must successfully pass a return-to-duty process that includes substance abuse treatment and a test to evaluate their readiness.

The restriction can be lifted if the driver signs up for a Clearinghouse program that will test them 14 times in two years, with the first 12 tests having to occur in the first year.

This cost all comes out of the driver’s pocket.

This system is an important check on drivers and helps employers reduce their exposure.

The Department of Motor Vehicles is required to check the Clearinghouse before issuing a new or renewing a commercial driver’s license.

The takeaway

While it is the law that employers follow Clearinghouse procedures, because it’s a new system, many companies are failing to follow the rules.

If you are relying only on pulling a driver’s moving violation record and not the Clearinghouse, you are in breach of regulations and could leave your firm exposed.

If you employ a driver who is under suspension from driving by the Clearinghouse and they are involved in an accident, the victims could build a case that your organization was negligent in letting the individual drive and not checking the Clearinghouse first.

If they can prove negligence on a fleet operator’s part, the business could be in for a hefty court judgment.