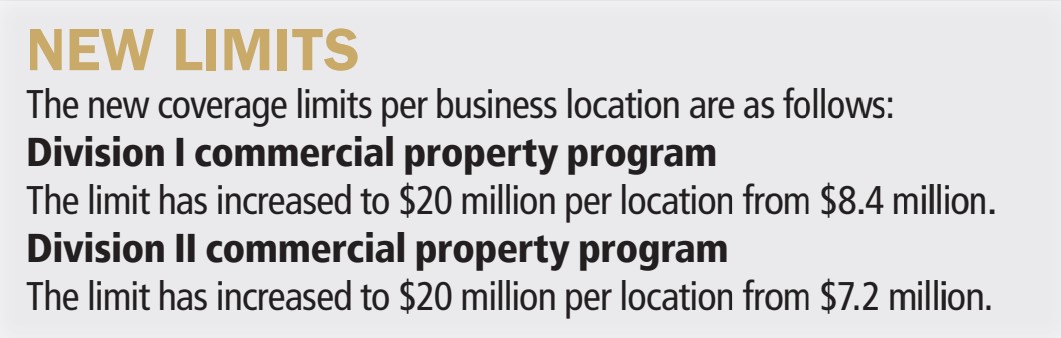

July 2023 – Commercial Property Insurance – FAIR Plan More Than Doubles Coverage Limits

With more and more California businesses being forced to go to the California FAIR Plan for their coverage, the market of last resort has moved to increase its commercial property coverage limits significantly.

This should bring a semblance of relief to companies located in wildfire-prone areas, who have seen their commercial property insurance non-renewed and who have been unable to find replacement coverage. The decision comes as commercial property rates continue rising due to inflationary pressures, but in particular for companies located in areas that are considered urban-wildland interfaces.

Insurers have pulled back on underwriting commercial properties as well as homes in these areas. They’ve taken a number of actions, including:

- Retreating from the California market altogether.

- Selectively underwriting properties that are not considered at-risk.

- Capping their exposures by only covering a set number of properties.

- Requiring property owners to create defensible spaces and take other measures to harden their properties against wildfires.

- Raising rates significantly.

Businesses whose policies are not renewed and who can’t find coverage in the market are able to go to the FAIR (Fair Access to Insurance Requirements) Plan for coverage. This is the market of last resort and premiums can be substantial, while the policy limits have often been inadequate to cover the full cost of the commercial enterprise’s property.

Policies cover damage caused by:

- Fire

- Lightning

- Internal explosion

Optional coverages are available at an additional cost, such as coverage for vandalism and malicious mischief.

If you have to go to the FAIR Plan, we can arrange for a “differences in conditions” policy that will cover the areas in which the plan is deficient compared to a commercial property policy.

The FAIR Plan will cover the following commercial structures:

Habitational buildings – Buildings with five or more habitational units such as apartment buildings, hotels, or motels.

Retail establishments – Shops such as boutiques, salons, bakeries, and convenience stores.

Manufacturing – Companies that manufacture most types of products.

Office buildings – Offices for professionals such as design firms, doctors, lawyers, architects, consultants, or other office-based functions.

Buildings under construction – Residential and commercial buildings under construction from the ground up.

Farms and wineries – Basic property insurance for commercial farms, wineries, and ranches, not including coverage for crops and livestock.