April 2024 – Worker’s Comp – Electronics, Construction Class Code Changes

THE WORKERS’ Compensation Insurance Rating Bureau of California will recommend changes to class codes for some electronics manufacturing sectors, as well as increases to the wage thresholds for construction industry dual classifications.

The move comes after the Rating Bureau’s governing committee unanimously approved proposed changes, which will be sent in March to the state insurance commissioner for approval. If approved, the changes will take effect Sept. 1, 2024.

Here’s what’s on tap:

Dual-wage increases

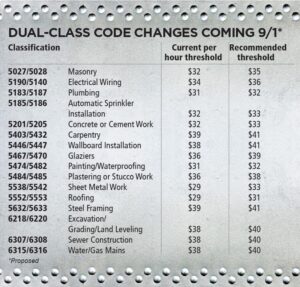

The Rating Bureau will also recommend increasing the thresholds that separate high- and low-wage earners in 16 dual-wage construction classes as shown below. These class codes have vastly different pure premium rates for workers above and below a certain threshold. Lowerwage workers have historically filed more workers’ comp claims. Rates for lower-wage workers are often double the rates for higher-wage workers.

Electronics manufacturing

Another proposed change would link two more classes to the 8874 companion classification, which was created in September 2022 to cover certain low-risk classes in the electronics industry group.

Currently, 8874 is a companion class that covers payroll for lower-risk jobs in hardware and software design and development, computer-aided design, clerical and outside sales operations for

two classes:

• 3681 (manufacturing operations for electronic instruments, computer peripherals, telecommunications equipment), and

• 4112 (integrated circuit and semiconductor wafer manufacturing).

The new proposal would move to 8874 similar low-risk white-collar personnel currently assigned to class 3572 (medical instrument manufacturing) and 3682 (non-electric instrument manufacturing).

The Bureau is also recommending merging class code 3070 (computer memory disk manufacturing) with 3681(2) (computer or computer peripheral equipment manufacturing). If this recommendation is okayed, the higher pure premium rate of $0.46 per $100 of payroll for class code 3681 will apply to the new combined code.

Class 3070 currently has a pure premium rate of $0.25 per $100 of payroll and the new rate would be phased in at 25% per year until class 3070 is eliminated and all employers are moved to class 3681.