October 2022 – AB 5 Court Decision – Tough Choices Ahead for Trucking Businesses

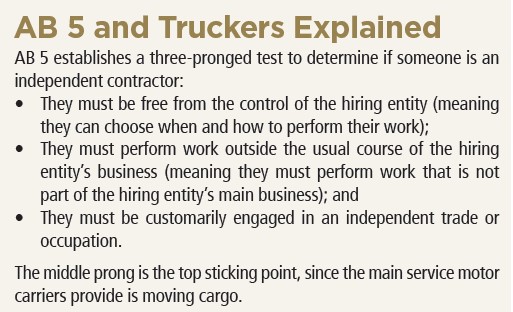

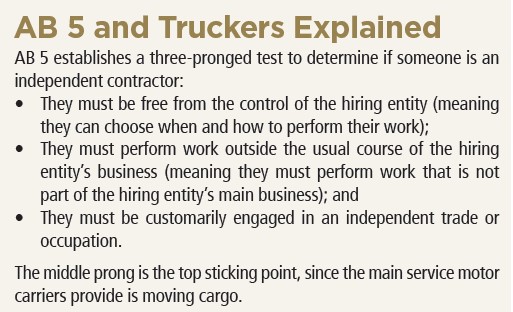

THE U.S. Supreme Court’s decision to not hear an appeal of the sweeping California independent contractor law known as AB 5 is likely to cause serious personnel headaches for motor carriers in the Golden State.

While the law is already in effect, there had been an injunction exempting trucking companies after the California Trucking Association had sued to overturn the law as it applies to the industry.

The Supreme Court’s decision effectively lifts the injunction, and the CTA is sounding the alarm on how it will wreak havoc on motor carriers.

The effects

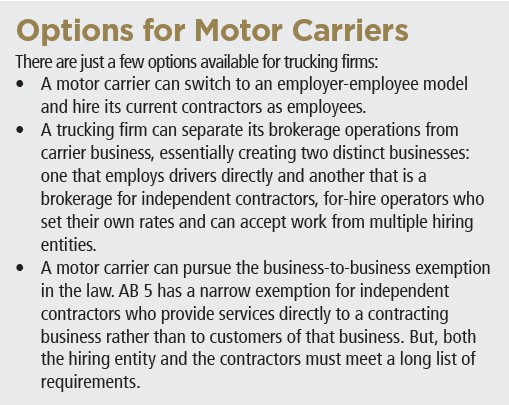

Owner-operators who are classified as employees under this test will be covered by California labor and employment laws. The hiring entity will have to treat them like employees, meaning they have to secure workers’ compensation coverage, pay employment taxes and extend benefits to them. They also have to abide by labor laws and wage and hour statutes.

Here’s how AB 5 will affect various owner-operators:

Exclusive leased owner-operators – These operators drive exclusively for a hiring trucking company and work under the latter’s authority. They may or may not own their

own trucking equipment (tractors and trailers) and do not have their own motor-carrier operating authority from the Department of Transportation.

They’ve operated as independent contractors because the lease agreements let them choose their own loads, but the agreements bar them from using their equipment to drive for other entities.

Effect: These operators will essentially be illegal.

Non-exclusive leased owner-operators – These contractors own their own equipment and have DOT motor-carrier operating authority. They move cargo primarily for a motor carrier with which they contracted but they can also work for other customers.

Effect: This group may or may not be affected depending on the arrangements they have with the motor carrier.

For-hire owner-operators – These operators own their own equipment, have their DOT motor-carrier authority and source loads through brokers or other means. They are their own bosses and they choose whom they will move freight for.

Effect: This subset is the least likely to be affected.

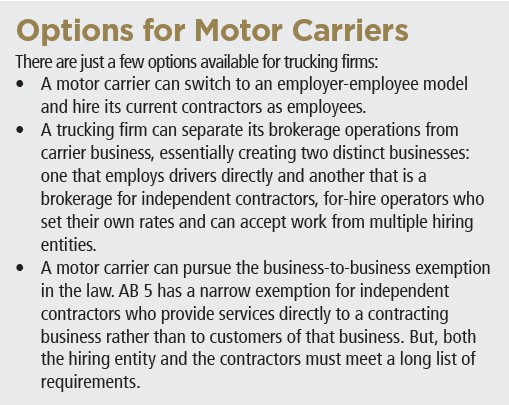

October 2022 – Big Changes for Dual-Wage Class Codes

AS INFLATION drives up salaries in all sectors, the workers’ compensation wage thresholds for construction dual class codes have increased in California as of Sept. 1, 2022.

State Insurance Commissioner Ricardo Lara in July approved the recommendation by the Workers’ Compensation Insurance Rating Bureau to increase the wage thresholds for highwage workers.

The new rates apply to workers’ comp policies that incept on or after Sept. 1.

In these dual class codes, workers’ compensation rates are different for workers above and below the wage threshold.

Rates are lower for workers whose hourly pay is above the threshold as statistics have shown higher-paid workers in these fields have fewer workplace injuries than those who are paid less.

Often the difference in premium rate between the workers who fall above and below the threshold can be significant.

Opposite are the new thresholds for each class code, that are now in effect.

July 2022 – Supreme Court Action – PAGA Ruling a Big Win for Employers

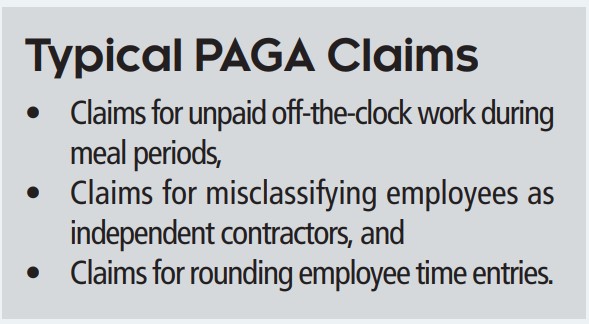

THE U.S. Supreme Court has put a significant dent in California’s Private Attorneys General Act, which in recent years has resulted in a surge in legal actions against California employers by their workers.

The law has been a huge thorn in the side of employers, who have been on the receiving end of litigation by workers who allege Labor Code violations.

The high court ruled that employers can compel arbitrations for employee-initiated PAGA actions. The court also held that if a plaintiff in a PAGA action is bound to arbitration, they automatically lose standing to prosecute claims on behalf of other “aggrieved” employees and remaining PAGA claims must be dismissed.

This is good news for businesses. Those that move to cement policies that comport with the new decision, will have a chance to drastically reduce their exposure should they be targeted by one of these actions. And because various court rulings have expanded the law’s breadth, PAGA has been a source of confusion among employers. The new ruling provides clarity.

The history of PAGA

The law was enacted in 2004, after the Legislature grew concerned that the state lacked the resources to fully enforce the California Labor Code.

PAGA permits employees to sue for civil penalties on behalf of themselves, fellow employees, and the State of California for alleged Labor Code violations. If they are filing on behalf of other employees, the other workers do not participate in the lawsuit.

The employee in essence acts as the state’s watchdog; they need not suffer any actual harm from an alleged violation in order to file a lawsuit. One employee has the ability to file a suit alleging multiple Labor Code violations.

For any provision of the Labor Code that does not specify a civil penalty, PAGA permits employees to seek a default penalty of up to $100 for each aggrieved employee per pay period for an initial violation, and up to $200 for each aggrieved employee per pay period for a subsequent violation.

If a suit is successful, the state receives 75% of the damages and the rest is distributed among the aggrieved employees.

The number of PAGA lawsuits filed in California on behalf of groups of workers has skyrocketed since 2014, when the California Supreme Court held that because PAGA plaintiffs step into the state’s shoes, their claims cannot be forced into individual arbitration.

A resounding decision

The U.S. Supreme Court’s 8-1 ruling in the case of Viking River Cruises Inc. vs. Moriana is likely to stem a flood of lawsuits filed in recent years accusing companies of widespread wage law

violations.

The court ruled that the Federal Arbitration Act, which states that in employer-worker agreements employees are required to arbitrate legal claims, trumps the earlier California Supreme Court decision barring forced arbitration.

SCOTUS ruled that PAGA plaintiffs can only establish standing to sue by first alleging an individual claim. And since the FAA requires individual claims to go to arbitration if a worker has

signed an arbitration agreement, the plaintiff cannot add additional claims for other employees, Justice Samuel Alito wrote in the decision.

Here’s what employers should take away from the decision:

• Individual PAGA claims can be arbitrated if an employee has signed a contract agreeing to arbitrate Labor Code and other employment-related actions.

• PAGA claims for other alleged aggrieved employees that the complaining employee includes in the lawsuit are not subject to arbitration, and those claims should be dismissed.

• If you have arbitration agreements for your workers, you should revisit them to ensure they allow you to compel arbitration of PAGA claims.

April 2022 – State Law Has Employers on the Defensive

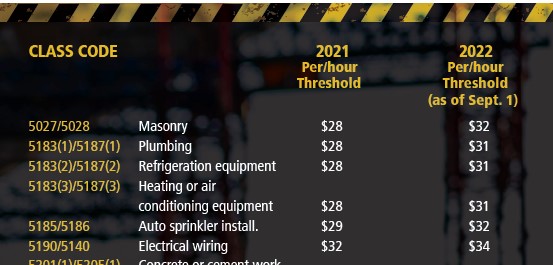

THE WAY courts have interpreted a California law – the Private Attorneys General Act (PAGA), which has been on the books for 18 years – has led to an explosion of lawsuits against employers during the last few years.

The law has generated more than 20,000 lawsuits since 2017 at an average cost of $1.1 million per case, according to one study.

PAGA permits employees to sue for civil penalties on behalf of themselves, fellow workers and the state for alleged labor code violations. If a suit is successful, the state receives 75% of the damages with the employee receiving the balance.

As a result, California employers face increasing litigation uncertainty that traditional insurance may do little to mitigate.

The employee in essence acts as the state’s watchdog; he or she need not suffer any actual harm from an alleged violation in order to file a lawsuit. One employee has the ability to file a suit alleging multiple labor code violations.

The result? An average of 15 PAGA notice letters arrive at the California Labor and Workforce Development Agency daily.

How did we get here?

The law was enacted in 2004 to improve California Labor Code enforcement by empowering employees to pursue violations when the state has insuffi cient resources to pursue them.

The growth in litigation started after a California Supreme Court decision in 2009, holding that PAGA suits did not have to meet the certification requirements that apply to class-action lawsuits.

Litigation activity jumped significantly again in 2014 after the state Supreme Court held that employees could not waive their rights to fi le PAGA claims when they reach arbitration agreements in disputes with their employers.

Three years later, the court ruled that employees were generally entitled to request and receive large amounts of information from employers early in the litigation.

The high cost of providing the information gives employers an incentive to settle claims quickly.

Finally, an appellate court ruling in 2018 gave employees the right to sue over alleged violations that do not directly affect them, so long as at least one violation does.

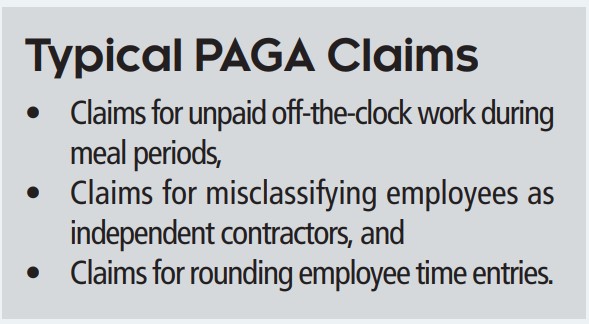

What’s being claimed?

PAGA claims can also involve allegations of discrimination, retaliation and failure to protect the health and safety of employees. There are even COVID-19-related claims. One allegation triggers multiple other ones related to the first, such as failure to pay all earned wages, failure to pay wages in a timely manner, and so on. One potential bright spot: In December 2021, the U.S. Supreme Court agreed to consider whether California employers may enter voluntary agreements with employees in which the employee agrees to pursue only their individual claim and

not bring a PAGA claim. A decision is expected this summer.

Insurance implications

One issue for employers is that employment practices liability insurance typically won’t cover wage and hour disputes or signifi cantly sublimit the amount of coverage available for defense costs only.

Also, EPLI policies usually carve out coverage for wage and hour claims under PAGA representative actions.

Directors and officers liability policies exclude wage and hour claims.

One option is wage and hour insurance, which most likely would provide defense and indemnity coverage for PAGA claims that allege violations of wage and hour laws and regulations.

However, these policies are expensive and usually have quite high retentions, which could price out most smaller employers.

April 2022 – Retirement Savings Law – CalSavers Registration for Small Employers

THE DEADLINE is fast approaching for employers with five or more workers in California, and who do not already off er their employees a retirement plan, to register their staff for the CalSavers Retirement Savings Program.

Only California employers that do not off er retirement plans are required to register for CalSavers and there are different registration deadlines depending on employer size, staggered over a few years as follows:

Employers with 100 or more workers – The deadline for registration was June 30, 2020.

Employers with 50 or more workers – The deadline for registration was June 30, 2021.

Employers with five or more workers – The deadline for registration is June 30, 2022.

Employers can register anytime to start the program for their workers. Firms with fewer than five employees are exempt, but they too can sign their workers up for CalSavers.

Employers that don’t provide a retirement plan for their workers, and who fail to register, can face a penalty of $250 per employee, as well as additional penalties for sustained noncompliance.

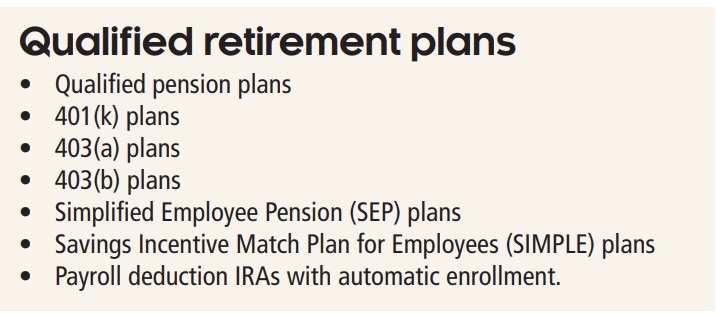

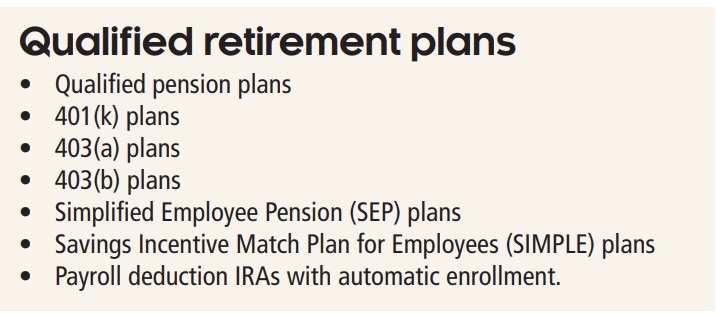

If you already have a qualified retirement plan for your employees, you do not have to participate.

How CalSavers works

Participating employers will deduct a default rate of 5% of pay from the paycheck of each employee at least 18 years old and deposit it into the individual’s CalSavers account. Employees can choose other rates as well.

Employee participation is voluntary, and they can opt out at any time. Regardless of whether any employees want to sign up for a plan, applicable employers are required to register and offer the program to all current employees and new hires.

The deduction amount will automatically escalate one percentage point each year to a maximum of 8%, unless the individual employee elects a different amount, elects out of autoescalation or completely opts out of the program.

Business owners who are employees of their business can also participate. Business owners who are not employees may enroll as an individual and make automatic contributions every month. There are no costs for businesses to sign up and facilitate the program for their employees.

Employers can register here. Once set up and employees have signed up, the employer will be responsible for taking off the chosen deduction for each employee and transferring it to CalSavers at each pay period.

For employees

A CalSavers account is a personal Roth Individual Retirement Account (Roth IRA) overseen by the CalSavers Retirement Savings Investment Board.

Here’s some information employees need to know:

• A portion of their pay is automatically deducted after taxes are taken out and transferred to an IRA that belongs to them.

• Employees can customize their account by setting their own contribution rate (between 1% and 8%), as well as choose the investments they want to put their money in.

• The account is portable: They keep it if they leave their job.

Jan 2022 – RISK REPORT – Stay on Top of New Laws, Rules in New Year

EVERY YEAR starts with a flurry of new laws and regulations that California employers have to contend with.

And 2022 is no different as the California legislature had a busy year and the stresses of the COVID-19 pandemic resulted in more activity. The end result is another round of new laws that employers need to stay on top of so they don’t run afoul of them.

With no further ado, here are the top regulations and laws affecting California businesses.

1. Big change to Cal/OSHA citations

SB 606 adds two new Cal/OSHA violation categories for purposes of citations and abatement orders: “enterprisewide” and “egregious” violations. Cal/OSHA can issue an enterprise-wide citation that would require abating the violation at all locations. And the employer can face a maximum penalty of $124,709 per violation.

The law also authorizes the agency to issue a citation for an egregious violation if it believes that an employer has “willfully and egregiously” violated a standard or order. Each instance of employee exposure to that violation will be considered a separate violation and fined accordingly.

2. Permanent COVID standard

On Sept. 17, 2021, Cal/OSHA released a draft text for proposed permanent COVID-19 regulations, which if adopted would be subject to renewal or expiration after two years and would replace the current emergency temporary standard, which is set to expire Jan. 14, 2022.

Adoption is expected in the spring of 2022. Here’s some of what the draft standard would do:

CDPH rules – It would require that employers follow California Department of Public Health COVID-19 prevention orders.

Masks for unvaxxed staff – Unvaccinated staff must wear masks. Employers must provide masks when the CDPH requires them.

Outbreak rules – During an outbreak in the workplace, all staff would be required to wear face coverings regardless of vaccination status. Employers would need to provide respirators during major outbreaks to all employees.

3. COVID exposure notification

On Oct. 5, 2021, AB 654 took effect, updating requirements for what an employer must do if there is an outbreak of COVID-19 cases at its worksites.

This law somewhat curtailed earlier outbreak-reporting requirements as well as other required notifications for certain employers, and updated several provisions of the 2020 outbreak notification law, AB 685.

Here are some highlights:

• Employers have one business day or 48 hours, whichever is later, to report a workplace COVID-19 outbreak to Cal/OSHA and local health authorities.

• Employers do not need to issue these notices on weekends and holidays.

• When an employer has multiple worksites, it only needs to notify employees who work at the same worksite as an employee who tests positive for coronavirus.

• The new definition of “worksites” for the purposes of the law has been changed to exclude telework.

4. Expansion of the California Family Rights Act

AB 1033 expands the CFRA to allow employees to take family and medical leave to care for a parent-in-law with a serious health condition.

More importantly, it adds a requirement that mediation is a prerequisite if a small employer (one with between five and 19 workers) is the subject of a civil complaint filed by one of its employees.

5. Workplace settlement agreements and NDCs

A new law took effect Jan. 1 that bars employers from requiring non-disclosure clauses in settlement agreements involving workplace harassment or discrimination claims of all types. This builds on prior law that barred NDCs only in cases of sex discrimination or sexual harassment.

The new law expands that prohibition to all protected classes, such as: race, religion, disability, gender, age, and more.

One important note: While employees can’t be prohibited from discussing the facts of the case, employers can still use clauses that prohibit the disclosure of the amount paid to settle a claim.

6. OSHA vaccine mandate

As of this writing, Fed-OSHA’s new emergency COVID-19 standard was set to take effect on Jan. 1, with the most contentious part of the rule mandating that employees who work for employers with 100 or more staff be vaccinated or submit to weekly testing.

Unvaccinated workers would also be required to wear masks while on the job under the new rules, which have faced fierce challenges in courts.

The U.S. Court of Appeals for the Sixth District recently reversed a stay of the order as challenges to it are litigated, meaning the order can take effect as scheduled as the legal process challenging the rule proceeds.

The U.S. Supreme Court will hear expedited arguments Jan. 8 on the U.S. Court of Appeals for the Sixth Circuit’s decision to lift the Fifth Circuit’s stay.

7. Wage theft penalties

AB 1003, which took effect Jan. 1, added a new penalty to the California Penal Code: Grand Theft of Wages. The new law makes an employer’s intentional theft of wages (including tips) of more than $950 from one employee, or $2,350 for two or more workers, punishable as grand theft.

The law, which also applies to wage theft from independent contractors, allows for recovery of wages through a civil action.

As a result, employers (and potentially managers and business owners) would be exposed to both criminal and civil liability for wage and hour violations like failing to pay staff accurately and in a timely manner.

Review your compensation policies and practices to make sure you are in compliance with current wage and hour laws.

8. COVID cases may be included in X-Mods

The Workers’ Compensation Insurance Rating Bureau of California has proposed plans to start requiring COVID-19 claims to be included when calculating employers’ X-Mods.

The proposal, which would have to be approved by the state insurance commissioner, would bring to an end current rules that exclude the impact of COVID-19 workers’ compensation claims on X-Mods.

If approved, the new rule would take effect on Sept. 1, 2022. That means that employers will be held accountable for COVID19-related workers’ compensation claims and, if any employee needs treatment or dies from the coronavirus, it could result in higher premiums in the future.

9. Notices can be e-mailed

A new state law authorizes employers to distribute required posters and notices to employees via e-mail. SB 657 adds e-mail as a delivery option to the list of acceptable notification methods, which also includes mail.

Required posters and notices will still need to be physically posted in the workplace.

10. Warehouse quota rules

A new law that took effect Jan. 1 makes California the first (and only) state to regulate quotas used by warehouse employers.

While the bill was written with Amazon Inc. in mind, it affects all warehouses with 100 or more workers, and violations of the new law can be costly for an employer.

Under AB 701, warehouse employees must be provided with a written description of the quotas to which they are subject within 30 days of hire. Common quotas include the number of tasks the employee is required to perform, the materials to be produced or handled, and any adverse employment action that may result from a failure to meet the quota.

While employers may still implement quotas, employees are not required to meet a quota if it:

• Prevents them from taking required meal or rest periods,

• Prevents them from using the bathroom (including the time it takes to walk to and from the toilet), or

• Contravenes occupational health and safety laws. The law also bars employers from discriminating, retaliating or taking other adverse action against an employee who:

• Initiates a request for information about a quota or personal work-speed data, or

• Files a complaint alleging a quota violated the Labor Code.

July 2021 – Workers’ Compensation – New Changes to X-Mods, Classification Rules

INSURANCE COMMISSIONER Ricardo Lara has approved a regulatory filing that will change the premium threshold for employers to qualify for an experience modifier (X-Mod).

The approval was part of a larger regulatory filing the Workers’ Compensation Rating Bureau made to also change expected claims costs, eliminate a few class codes and make new rules for companies that operate multiple enterprises.

The approved filing also updates expected claims cost rates for all 500-plus worker class codes that are used to calculate workers’ comp rates. Here’s a rundown of the changes:

X-Mod change

Currently, the minimum premium an employer must pay annually to receive an X-Mod is $9,900, but that is falling to $9,500, starting Sept. 1. That means any employer that has an annual premium of $9,500 starting on that date will be “experience rated.” The X-Mod is a number used by insurance companies to either discount or increase the premiums you pay for workers’ compensation insurance. It is based on your company’s workers’ comp claim history and reflects the most recent three years.

Multiple enterprises rule

The new rules make changes to what is known as the “multiple enterprises rule,” which applies to companies that have two or more operations that perform work that is classified differently. In those cases, the distinct operations must be classified under the multiple enterprises rule.

In the new rule, separation is the key requirement. If distinct operations are physically separated, each distinct location shall be separately classified.

Separation can be separate operations:

• Located in separate buildings,

• Located on separate floors of a building, or

• Separated by walls if they are on the same floor.

However, if two or more of the distinct operations are not physically separated, they must be assigned to the highest-rated classification applicable to the operations conducted in the common workspace.

The rule also addresses personnel that may float between multiple enterprises, performing different types of work at each operation.

Under the rule, such an employee’s work may be divided into two classifications. If you plan to classify them this way, make sure to keep accurate and complete records supported by time cards or time book entries that show how much time they spent performing each distinct work task for each entity.

If the employer fails to keep those records, the entire pay of the worker will be assigned to the highest-rated classification applied to any part of the work they perform.

Classification changes

There are also changes being made to some construction classes.

The 8110 – Stores Welding supplies classification is being eliminated and covered operations will be reassigned to 8010 – Stores hardware, electrical or plumbing supplies. Also, the iron or steel erection classes 5057 and 5059 will be eliminated, as well as subclasses 5102(3), 5040(2) and 5040(3).

Operations in those eliminated classifications will instead be assigned into one of two consolidated classes:

• 5040 – Structural Iron or Steel operations, or

• 5102 – Iron, Steel, Brass, Bronze or Aluminum Erection – non-structural.

July 2021 – Masks for Vaccinated Staff No Longer Required

THE CAL/OSHA Standards Board has approved changes to the COVID-19 Emergency Temporary Standard that greatly loosen workplace restrictions that were implemented last year to protect California workers.

The biggest news in the changes is that workers who have been fully vaccinated are no longer required to wear face masks as protection or physically distance, regardless of the vaccination status of co-workers.

After the decision, Gov. Gavin Newsom issued an executive order enabling the revisions to take effect without the normal 10-day approval period by the state Office of Administrative Law. They came into effect when the office received the changes.

The main changes Here are the main changes affecting employers in California:

Physical distancing and barrier requirements – These are eliminated regardless of an employee’s vaccination status, except where an employer determines there is a hazard and for certain employees during major outbreaks.

Testing – Fully vaccinated employees do not need to be offered testing or be excluded from work after close contact with someone who has COVID-19, unless they have symptoms. Employees who are not fully vaccinated and exhibit COVID-19 symptoms must be offered testing by their employer.

Masks – Vaccinated workers are not required to wear face masks generally. For unvaccinated workers, masks will be required indoors or when in vehicles, with limited exceptions.

Employees are not required to wear face coverings when outdoors regardless of vaccination status, except for certain employees during outbreaks.

Document vaccination status

– Employers must document the vaccination status of fully vaccinated employees if they do not wear face coverings indoors.

No mask retaliation – Employees that choose to, are explicitly allowed to wear a face-covering without fear of retaliation from employers.

Respirator availability – Employees who are not fully vaccinated may request respirators for voluntary use from their employers at no cost and without fear of retaliation from their employers.

Businesses that need help in securing N95 respirators for unvaccinated employees can find distribution locations for state-provided N95 respirators here.

Review rules – Review the Interim Guidance for Ventilation, Filtration, and Air Quality in Indoor Environments.

Ventilation – Employers must evaluate ventilation systems to maximize outdoor air and increase filtration efficiency, and must evaluate the use of additional air cleaning systems.

What remains

Parts of the Emergency Standard still in effect include:

• Employers must maintain an effective written COVID-19 Prevention Program that includes:

» Identifying and evaluating your employees’ exposures to COVID-19 health hazards.

» Implementing effective policies and procedures to correct unsafe and unhealthy conditions.

» Allowing adequate time for handwashing and cleaning frequently touched surfaces and objects.

• Employers must provide training to employees on how COVID-19 is spread, infection-prevention techniques, and information regarding COVID-19-related benefits that affected employees may be entitled to under state or federal laws.

• Employers must bar from coming to work employees who have COVID-19 symptoms and/or are not fully vaccinated and have had close contact from the workplace if that close contact is work-related.

Cal/OSHA Rulemaking – Permanent Wildfire Safety Rules on Tap – OCTOBER 2020

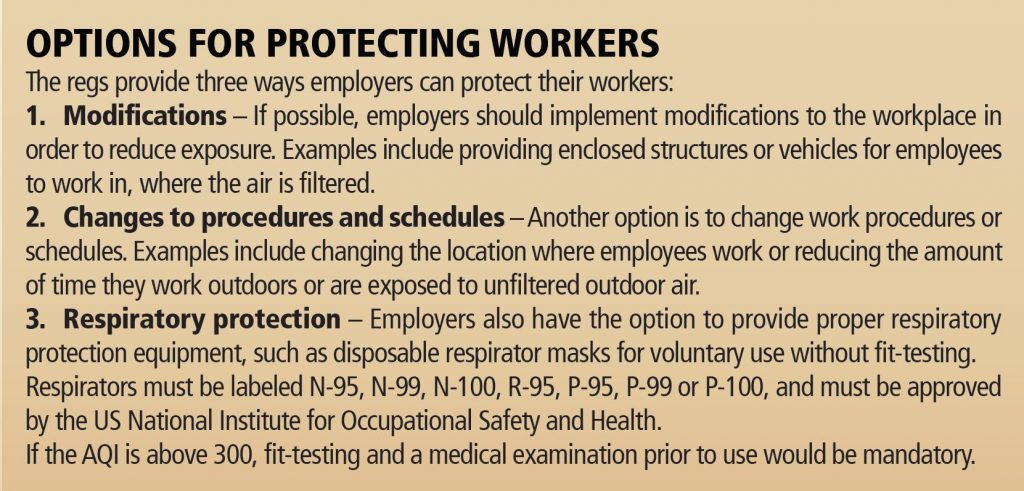

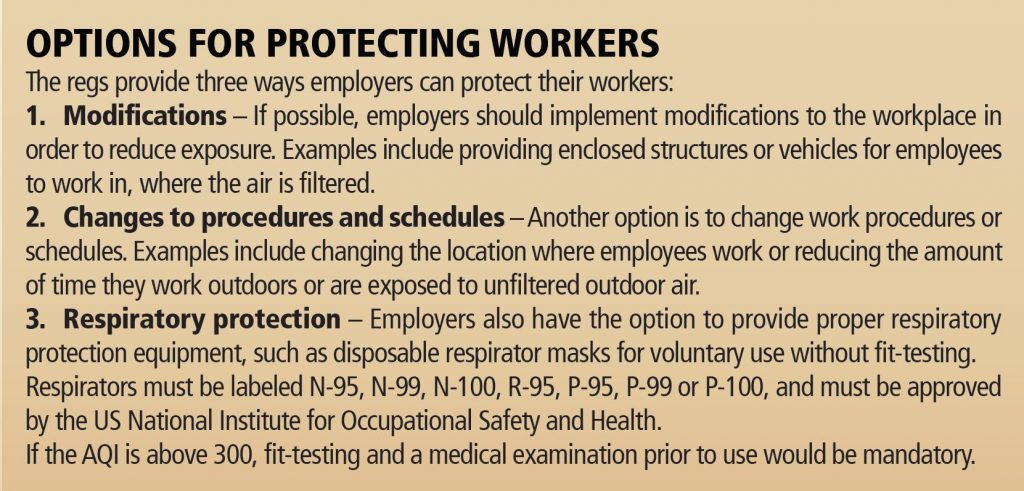

AS WILDFIRES continue raging throughout California, Cal/OSHA has issued a reminder to employers that they are required to protect their outdoor workers from smoke if the Air Quality Index exceeds 150. Cal/OSHA has extended an emergency regulation it put in place in August 2019 through January 2021 as it works on a permanent regulation on wildfire smoke protection for outdoor workers in the state.

For the safety of your workers and to comply with the regulation, it’s important that you follow the regs and know when you will need to take action to protect them from outdoor smoke.

The regulation applies when the AQI for airborne particulate matter 2.5 microns (PM2.5) or smaller is 151 or greater in an area where employees are working outdoors. Here are the details:

Identification

Employers must monitor the AQI for PM2.5. You can monitor the index using the following websites:

- U.S. EPA AirNow

- U.S. Forest Service Wildland Air Quality Response Program

- California Air Resources Board

- Local air pollution control district websites or local air quality management district websites.

Training and instruction

Employers with outdoor workers need train their workers in:

- The health effects of wildfire smoke.

- Their right to obtain medical treatment without fear of reprisal.

- How they can obtain the current AQI for PM2.5.

- Actions they must take if the AQI exceeds 150 PM 2.5

Communication

Employers must implement a system for communicating wildfire smoke hazards to all affected employees, as well as a system for employees to inform the employer of smoke hazards.

The takeaway

If you have outside employees who may have to work in smoky conditions, you should stockpile a two-week supply of N-95 masks for all of them if you are unable to implement other controls to reduce their exposure.

Cal/OSHA is in the process of making the emergency rules permanent and has sent them out for public comment. We will continue monitoring the agency’s progress on the rules and update you when they have been completed.

Worker’s Compensation – COVID-19 Prompts Rate Hike Recommendation – OCTOBER 2020

THE COVID-19 pandemic seems to have reversed years of falling workers’ compensation rates in California, as the Workers’ Compensation Insurance Rating Bureau has recommended that average benchmark rates be increased by 2.6% for 2021.

The recommendation was forwarded to the California Department of Insurance, which will schedule a hearing on the recommendation in the fall.

It should be noted that the 2.6% increase recommendation would be an average across all class codes, as the Rating Bureau plans to allocate the expected COVID-19 costs by weight across the state’s overall industrial sector. Note that even low exposure classes will be surcharged.

The Bureau in its recommendation aims to apply the surcharge on a weighted basis according to each class code’s share of growing COVID-19 claims costs. It is considering a tiered surcharge model based on an employer’s risk, as follows (for examples, see below):

High risk – A 12-cent surcharge per $100 of payroll.

Medium risk – A 6-cent surcharge per $100 of payroll.

Low risk – A 4-cent surcharge per $100 of payroll.

The X-factor

The Bureau’s actuarial committee noted that the pandemic does present challenges for predicting workers’ compensation costs. “The 2021 policy year will still be impacted by COVID-19, but some trends may stabilize. The challenge will be projecting exposure and claims frequency (for COVID-19 claims),” the committee wrote in a report. Actually, the overall effect of COVID-19 on rates going into 2021 was 4%, according to the Rating Bureau. Had it not included the COVID-19 surcharge, it would be asking for a 1.3% decrease in benchmark rates.

The reason is that claims costs and claims frequency have been falling and long-term claims are costing less than originally anticipated. The Bureau also forecasts that the recession caused by the pandemic will also have a profound effect on overall claims: it projects an overall 6.3% decrease in claims frequency due to slowing economic conditions.

Interestingly, COVID-19 claims are not supposed to count against employers’ experience rating and loss histories, according to new rules that took effect in May. However, the claims are having an overall effect in terms of workers’ comp benefit payments. The Bureau also has to price in the uncertainty over the future of COVID-19. Will it get worse, or will it begin to wane? Will there be a vaccine and new and improved treatment regimens that reduce mortality or decrease symptoms and hospitalizations?

It is concerned that some low-risk industries may be getting a surcharge that is still out of proportion to their actual risk, particularly with people who are working remotely. It plans to further study the issue and will likely amend the filing depending on the results.