Top New Laws and Regs Affecting Businesses – January 2020 RISK REPORT

The new decade is starting off with a tsunami of new laws and regulations that will affect California businesses. Companies operating in California will have to be prepared for significant changes or open themselves up to potential litigation, fines, and other risks.

Here’s what you need to know coming into the new year:

1. AB 5

The controversial AB 5 creates a more stringent test for determining who is an independent contractor or employee in

California. Known as the “ABC test,” the standard requires companies to prove that people working for them as independent contractors are:

A) Free from the firm’s control when working;

B) Doing work that falls outside the company’s normal business; and

C) Operating an independent business or trade beyond the job for which they were hired.

Legal experts recommend that employers:

• Perform a worker classification audit, and review all contracts with personnel.

• Notify any state agencies about corrections and changes to a

worker’s status.

• Discuss with legal counsel whether they should now also include them as employees for the purposes of payroll taxes, workers’ compensation insurance, federal income tax withholding, and FICA payment and withholding.

2. Wildfire safety regulations

Cal/OSHA issued emergency regulations that require employers of outdoor workers to take protective measures, including providing respiratory equipment, when air quality is significantly affected by wildfires. Under the new regs, when the Air Quality Index (AQI) for particulate matter 2.5 is more than 150, employers with workers who are outdoors are required to comply with the new rules. These include providing workers with protection like respirators, changing work schedules or moving them to a safe location.

3. Arbitration agreements

Starting Jan. 1, the state will bar almost all employee arbitration agreements. AB 51 bars employers from requiring

applicants, employees and independent contractors to sign mandatory arbitration agreements and waive rights to filing

lawsuits if they lodge a complaint for discrimination, harassment, wage and hour issues. Businesses groups sued to overturn the law on the grounds that it is preempted by the Federal Arbitration Act.

4. Overtime rules

New federal overtime regulations are taking effect for non-exempt workers. Under the new rule, employers will be required to pay overtime to certain salaried workers who make less than $684 per week – or $35,568 per year – up from the current threshold of $455, or $23,660 in annual salary.

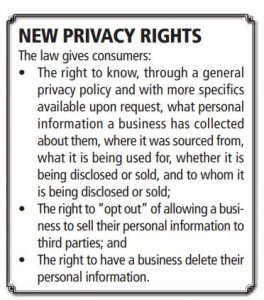

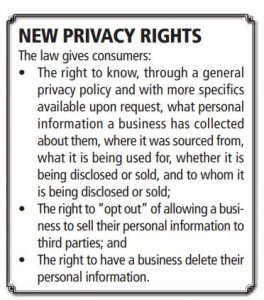

5. Consumer privacy

Starting Jan. 1, under the California Consumer Protection Act, businesses that keep personal data of residents are required to safeguard that information and inform website users how their personal data may be used. The law applies to firms with $25 million or more in annual revenues or those that sell personal information as part of their business.

6. Return of the individual mandate

A new law brings back the individual mandate requiring Californians at least to secure health insurance coverage or face tax penalties. This comes after the penalties for not abiding by the Affordable Care Act’s individual mandate were abolished by Congress in late 2017. Starting in 2020, California residents are required to have health insurance or pay excess taxes. This will affect any of your staff who have opted out of your group health plan as it may mean they are going without coverage, unless they have opted to be covered by their spouse’s plan. If you have staff who didn’t enroll in your plan for 2020, they may have to wait until your group’s next open enrollment at the end of the year. That could force them to pay tax penalties.

7. New audit, X-Mod thresholds

The threshold for physical workers’ compensation audits for California policies incepting on or after Jan. 1 is $10,500 in annual premium, a drop from $13,000. This means that any employer with an annual workers’ comp premium of $10,500 or more will be subject to a physical audit at least once a year. On top of that, the threshold for experience rating (to have an X-Mod) has also fallen – to $9,700 in annual premium as of Jan. 1, from $10,000.

8. Harassment training partly pushed back

Employers with five or more workers were required to conduct sexual harassment prevention training for their staff by the end of 2019 under a California law passed in 2018. A new law extends the compliance deadline for some employers who had already conducted training prior to 2019. The original law, SB 1343, required all employers with five or more staff to conduct sexual harassment prevention training to their employees before Jan. 1, 2020 – and every two years after that. If you have never trained your staff, you should have done so in 2019.

But if you have, here are the new rules:

• If you trained your staff in 2019, you aren’t required to provide refresher training until two years from the time the employee was trained.

• If you trained your staff in 2018, you can maintain the two-year cycle and comply with the new Jan. 1, 2021 deadline. You did not have to repeat the training in 2019.

9. Hairstyle discrimination

A new law makes it illegal for employers to discriminate against employees and job applicants based on their hairstyle if it is part of their racial makeup. The CROWN Act (Create a Respectful and Open Workplace for Natural Hair), defines race or ethnicity as “inclusive of traits historically associated with race, including, but not limited to hair texture and protective hairstyles like braids, locks, and twists.” This new definition of race means that natural hair traits fall under the context of racial discrimination in housing, employment and school matters.

10. Reporting serious injuries

A new law broadens the scope of what will be classified as a serious illness or injury which regulations require employers to report to Cal/OSHA “immediately.” The new rules being implemented by AB 1805 are designed to bring California’s rules more in line with Federal OSHA’s regulations for reporting. It will mean that some injuries that were not reportable before will be, such as:

• Any inpatient hospitalization for treatment of a workplace injury or illness will need to be reported to Cal/OSHA.

• An inpatient hospitalization must be required for something “other than medical observation or diagnostic testing.”

• Employers will need to report any “amputation” to Cal/OSHA. This replaces the terminology “loss of member.” Even if the tip of a finger is cut off, it’s considered an amputation. As of yet, there is no effective date for this new law, as enabling regulations have to be written – a process that will start this year.

New Bill affects Large Group Health Care Service Plan Contracts – In effect July 1st 2020

This new bill, commencing July 1, 2020, would expand those requirements to apply to large group health care service plan contracts and health insurance policies and would impose additional rate filing requirements on large group contracts and policies. On and after July 1, 2020, the bill would require a plan or insurer to disclose with a rate filing specified information by geographic region for individual, grandfathered group, and nongrandfathered group contracts and policies, including the price paid compared to the price paid by the Medicare Program for the same services in each benefit category. The bill would eliminate separate reporting and disclosure requirements for a health plan that exclusively contracts with no more than 2 medical groups in the state.

On and after July 1, 2020, the bill would require a health care service plan that fails to file specified information to disclose other information by market and by geographic region. If a plan or insurer fails to provide all the information required, the bill would specify that the filing is an unjustified rate on and after July 1, 2020. The bill would authorize a large group contract holder that has experience-rated or blended coverage and meets specified criteria to apply to the Department of Managed Health Care or Department of Insurance, as appropriate, within 60 days of receiving notice of a rate change to review a rate change and determine if it is unreasonable or not justified, and would require the appropriate department to use reasonable efforts to complete the review within 60 days of receiving all the information required to make a determination.

The bill would require the Department of Managed Health Care to conduct a public meeting regarding large group rates in every even-numbered year. Because a willful violation of the bill’s requirements relative to health care service plans would be a crime, the bill would impose a state-mandated local program.

Read the full bill here: http://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=201920200AB731

CAL/OSHA REPORTING – New Law Changes When Injuries Must Be Reported

Gov. Gavin Newsom has signed a measure into law that will greatly expand when employers are required to report workplace injuries to Cal/OSHA. The new law, AB 1805, broadens the scope of what will be classified as a serious illness or injury which regulations require employers to report to Cal/OSHA “immediately.” As of yet there is no effective date for this new law, but observers say regulations will first have to be written, a process that would start next year.

The definition of “serious injury or illness” has for decades been an injury or illness that requires inpatient hospitalization for more than 24 hours for treatment, or if an employee suffers a “loss of member” or serious disfigurement. The definition has excluded hospitalizations for medical observation. Serious injuries caused by a commission of a penal code violation (a criminal assault and battery), or a vehicle accident on a public road or highway have also been excluded.

Compliance

Rules for reporting serious injuries and illness or fatalities are as follows:

• The report must be made within eight hours of the employer knowing, or with “diligent inquiry” should have known, about the serious injury or illness (or fatality).

• The report must be made by phone to the nearest Cal/ OSHA district office (note that a companion bill, AB 1804, eliminated e-mail as a means of reporting because e-mail can allow for incomplete incident reporting).

Because of the “diligent inquiry” component, employers should monitor any injured worker’s condition once they learn of an injury, particularly if they need to seek out medical treatment. A member of the staff should be on hand to monitor the employee and report to supervisors immediately if that person will need to be hospitalized. Employers should make sure that supervisors are made aware of the new rules so that any time a worker is injured to the point that they need to be hospitalized, they know to notify Cal/OSHA within eight hours.

Also, if you have an employee that suffers a medical episode at work – such as a seizure, heart attack or stroke – you are required to report the hospitalization to Cal/OSHA. It’s better to err on the side of caution if an employee is hospitalized for any reason. Not doing so can result in penalties for failure to report or failing to report in a timely manner. Accordingly, it is important to educate management representatives, particularly those charged with the responsibility to make reports to Cal/OSHA, about the nuances of Cal/OSHA’s reporting rules.

One final note: The results of a serious injury or illness or workplace fatality will usually trigger a site inspection by Cal/OSHA, so be prepared if one should occur.

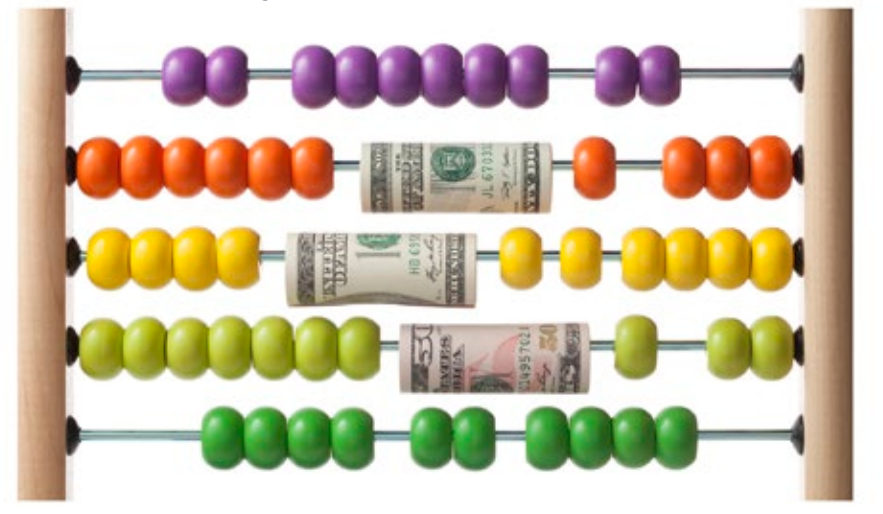

Workers’ Comp – New Experience Rating, Physical Audit Levels Set

Starting in 2020, the threshold for California employers to be eligible for experience rating (X-Mod) has been reduced by order of the state insurance commissioner.

Commissioner Ricardo Lara in September approved the recommendations by the Workers’ Compensation Insurance Rating Bureau to lower thresholds for determining eligibility for experience rating and when a carrier needs to perform a physical audit of an employer’s payroll records.

NEW THRESHOLDS

Annual physical audit

As of Jan. 1, 2020: Any employer with $10,500 or more in annual premium.

Current threshold: $13,000 or more in annual premium.

Threshold for experience rating (to have an X-Mod)

As of Jan. 1, 2020: $9,700 in annual premium.

Current threshold: $10,000 or more in annual premium.

“Physical audit” is defined as an “audit of payroll, whether conducted at the policyholder’s location or at a Remote site, that is based upon an auditor’s examination of the policyholder’s books of accounts and original payroll records (in either electronic or hard copy form), as necessary to determine and verify the exposure amounts by classification.”

The eligibility rating threshold is the amount of payroll developed during the experience period in each classification, multiplied by the expected loss rates for each class. If the total for all assigned classes is at or above the threshold, then the employer is eligible for an X-Mod.

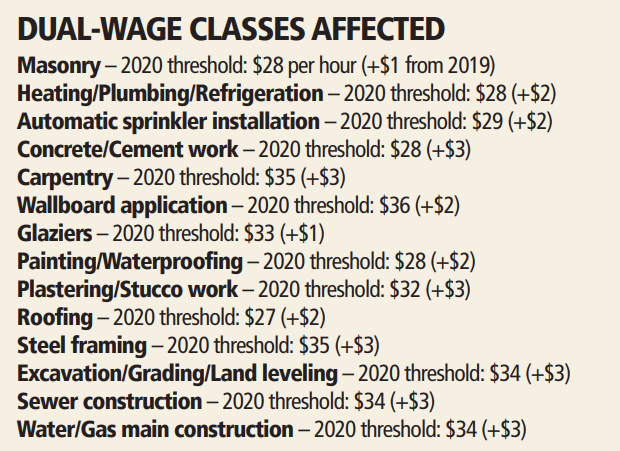

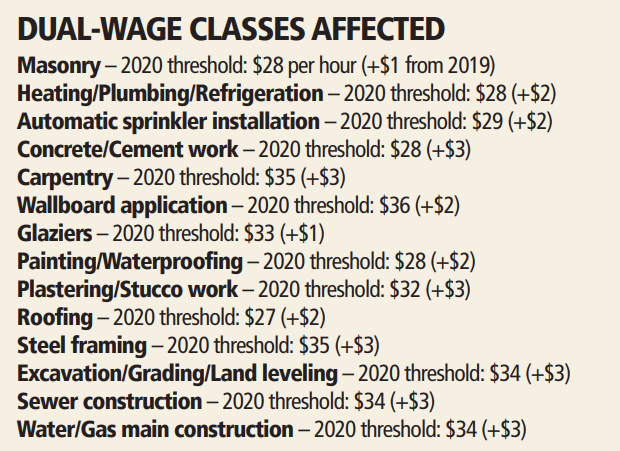

Changes to dual-wage class codes

Lara also approved the Rating Bureau’s recommendations for changes to a number of construction dual-wage class codes. While most workers’ comp classes have one rate, in some classes the difference in claims costs between high- and lowerwage workers is so great that a dual-wage classification is needed. In those cases, the workers above the threshold rate are assigned one rate, while those below that threshold are assigned a higher rate. The new thresholds are for 14 construction classifications, and any workers above the threshold will have a lower rate applied.

New State Law Alters Employment Landscape

Governor Gavin Newsom has signed a bill into law that will codify a court ruling from last year that set new ground rules for what constitutes an independent contractor, and which expands on that ruling.

There’s been a lot written in the media about the law, AB 5, and much of it misses the point. Some news reports have said it will spell the end of independent contractors in the state and that anyone a company hires to do a temporary job on contract must be treated as an employee.

Now that AB 5 is the law, state and federal labor laws will apply to independent contractors who have to be reclassified as employees. That means they would be afforded all of the associated worker protections, from overtime pay and minimum wages to the right to unionize. Employers would have to cover them under their workers’ comp policies, and extend benefits to them as they do to other employees. The law also gives the state and cities the right to sue employers over misclassification.

AB 5 codifies and expands on a 2018 California Supreme Court decision that adopted a strict, three-part standard for determining whether workers should be treated as employees. Known as the “ABC test,” the standard requires firms to prove that people working for them as independent contractors meet certain standards:

THE ABC TEST

A) Must be free from the company’s control when they’re on the job;

B) Must be doing work that falls outside the company’s normal business; and

C) Must be operating an independent business or trade beyond the job for which they were hired.

The first prong aligns with the common-law test for employment and evaluates the degree of control exercised by the company over the worker.

The second prong examines whether the worker can reasonably be viewed as working in the hiring company’s business.

The third prong inquires whether the worker independently made the decision to go into business. The fact that the hiring company does not prohibit the worker’s engagement in such an independent business is not sufficient.

Occupations exempted include:

• Doctors

• Some licensed professionals (lawyers, architects, engineers)

• Accountants, securities broker-dealers, investment advisors

• Real estate agents

• Direct sales (compensation must be based on actual sales)

• Builders and contractors (who work for construction firms that build major infrastructure projects and large buildings)

• Freelance writers, photographers (provided the worker contributes no more than 35 submissions to an outlet in a year)

• Hairstylists, barbers (must set their own rates and schedule)

• Estheticians, electrologists, manicurists (must be licensed)

• Tutors (must teach their own curriculum)

• AAA-affiliated tow truck drivers.

What employers should do

Legal experts recommend that employers:

• Perform a worker classification audit, and especially review all contracts with personnel.

• Determine which benefits and protections should be provided to any workers who are reclassified from independent contractor to employee (think health insurance and other benefits).

• Notify any state agencies about changes to a worker’s status.

• Discuss with legal counsel whether you should also include a worker as an employee for the purposes of payroll taxes, workers’ comp insurance, federal income tax withholding, ICA payment and withholding.

Note: Federal law remains unchanged. The IRS and National Labor Relations Board have their own independent contractor tests.

Two New Types Of HRAs Expand Health Reimbursement Arrangements

May not be aware that on October 12, 2017, President Trump issued an Executive Order promoting Healthcare Choice and Competition.

This took the form of a Notice to expand the flexibility and use of HRAs to provide more Americans with additional options to obtain quality, affordable, healthcare.

The proposed regulations remove the current prohibition on using HRA funds to purchase individual health insurance coverage; however, an array of stipulations apply to assure these new HRAs do not create an unstable individual market and that they coordinate with current Affordable Care Act premium subsidies.

Download and read the whole story: (pass it on!)

2 new types pf HRAs expand Health reimbursement arrangements

Human Resources – Don’t Forget Anti-Harassment Training for Your Staff

If you have not yet started on your efforts to provide antisexual harassment training to your California employees, you need to get working on it now. Law passed last year puts the onus on most employers in the state to provide anti-sexual harassment training to their staff every two years.

Starting this year, employers with five or more workers must provide:

• At least two hours of sexual harassment prevention training to all supervisory employees, and

• At least one hour of sexual harassment prevention training to all non-supervisory staff.

To be compliant by Jan. 1, 2020, as per the law, these trainings need to take place in 2019. They must then be provided every two years thereafter. This new law builds on legislation that has been in place since 2005 requiring employers with 50 or more employees to provide two hours of training to managers and supervisors every two years.

Timing of training

All employees – Under the new law, ushered in by SB 1343, most California employees must undergo anti-harassment training this year and every two years thereafter.

Supervisory employees – Supervisors and managers who are already covered by the aforementioned training requirements must continue to receive at least two hours of anti-harassment training within six months of becoming a supervisor, and at least every two years thereafter.

New employees – New employees must receive at least one hour of anti-harassment training within six months of being hired, and at least every two years thereafter.

Seasonal and temporary workers – This includes any employee that is hired to work for less than six months. These workers are required to receive training within 30 calendar days after the date they were hired, or within 100 hours worked, whichever comes first. Temp workers provided by an outside employment agency must receive anti-harassment training by the temp agency.

Training guidelines

Guidelines for what training should cover for employees have yet to be released.

The Department of Fair Employment and Housing is required to make available to employers on its website interactive training courses that satisfy the two-hour supervisory and one-hour nonsupervisory employee training requirements. Those materials are not scheduled to be available until “late 2019,” according to the department’s website.

The agency has on its website some materials to help employers, including a sample training kit, which you can find here.

Trainers

>nder the regulations for supervisory training, the training must be conducted by either:

• An employment law attorney, or

• A human resources or harassment prevention consultant with a minimum of two years of practical experience in sexual harassment prevention training, or

• A professor or instructor in a law school, college or university, and who teaches about employment law.

What training must cover

The training requirements for one hour of training have yet to be released. But you should use as a guide the following, which are in the California Code of Regulations:

• Definition of unlawful sexual harassment under the law.

• The types of conduct that constitute sexual harassment.

• Remedies available for sexual harassment victims in civil actions; potential employer/individual exposure/liability.

• Strategies to prevent sexual harassment in the workplace.

• Supervisors’ obligation to report sexual harassment, discrimination, and retaliation of which they become aware.

• Examples that illustrate harassment and discrimination.

• Confidentiality of the complaint process.

• How to report harassment to management.

• The employer’s obligation to conduct an effective workplace investigation of a harassment complaint, and to take remedial action.

• Training on what to do if the supervisor is accused of harassment.

• The essential elements of an anti-harassment policy, and how to utilize it if a harassment complaint is filed.

Trainers

Under the regulations for supervisory training, the training must be conducted by either:

• An employment law attorney, or

• A human resources or harassment prevention consultant with a minimum of two years of practical experience in sexual harassment prevention training, or

• A professor or instructor in a law school, college or university, and who teaches about employment law.

What training must cover

The training requirements for one hour of training have yet to be released. But you should use as a guide the following, which are in the California Code of Regulations:

• Definition of unlawful sexual harassment under the law.

• The types of conduct that constitute sexual harassment.

• Remedies available for sexual harassment victims in civil actions; potential employer/individual exposure/liability.

• Strategies to prevent sexual harassment in the workplace.

• Supervisors’ obligation to report sexual harassment, discrimination, and retaliation of which they become aware.

• Examples that illustrate harassment and discrimination.

• Confidentiality of the complaint process.

• How to report harassment to management.

• The employer’s obligation to conduct an effective workplace investigation of a harassment complaint, and to take remedial action.

• Training on what to do if the supervisor is accused of harassment.

• The essential elements of an anti-harassment policy, and how to utilize it if a harassment complaint is filed.

Top 10 Laws and Regulations for 2019

EVERY YEAR comes with new laws and regulations that affect employers. It pays to stay on top of all the few requirements, so we are here to help you understand those that are most likely to affect your business. The following are the top 10 laws, regulations and trends that you need to know about going into 2019.

1. Sexual harassment training

Existing state law requires employers with 50 or more workers to provide at least two hours of sexual harassment training to supervisors every two years. SB 1343 changes this by requiring employers with five or more employees to provide all employees with at least one hour by Jan. 1, 2020. Training must be held every two years. Also, employers with five or more workers must provide (or continue to provide) two hours of the biennial supervisory training.

2. Data privacy

Companies that collect data on their customers online should start gearing up in 2019 for the Jan. 1, 2020 implementation of the California Consumer Privacy Act of 2018, which is the state’s version of the European Union’s General Data Protection Regulation.

The law applies to businesses that:

• Have annual gross revenues in excess of $25 million,

• Annually buy, receive for their own commercial purposes, or sell or share for commercial purposes, the personal information of 50,000 or more consumers, households or devices, and/or

• Derive 50% or more of their annual revenues from selling consumers’ personal information.

3. Independent contractors

While this legal development happened in 2018, now is a good time to go over it. In May 2018, the California Supreme Court handed down a decision that rewrites the state’s independent contractor law. In its decision in Dynamex Operations West, Inc. vs. Superior Court, the court rejected a test that’s been used for more than a decade in favor of a more rigid three-factor approach, often called the “ABC” test.

Employers now must be able to answer ‘yes’ to the following if they want to classify someone as an independent contractor:

• The worker is free from the control and direction of the hirer in relation to the performance of the work, both under the contract and in fact;

• The worker performs work that is outside the usual course of the hirer’s business; and

• The worker is customarily engaged in an independently established trade, occupation or business of the same nature as the work performed for the hirer.

The second prong of the test is the sentence that really changes the game. Now, if you hire a worker to do anything that is central to your business’s offerings, you must classify them as an employee.

4. Electronic submission of Form 300A

In November 2018, Cal/OSHA issued an emergency regulation that required California employers with more than 250 workers to submit Form 300A data covering calendar year 2017 by Dec. 31, 2018. The new regulation was designed to put California’s regulations in line with those of Federal OSHA.

This year, affected employers will be required to submit their prior year Form 300A data by March 2. The law applies to:

• Employers with 250 or more employees, and

• Employers with 20 to 249 employees in high-risk sectors.

5. Harassment non-disclosure

5. Harassment non-disclosure

This law, which took effect Jan. 1, 2019, bars California employers from entering into settlement agreements that prevent the disclosure of information regarding:

• Acts of sexual assault;

• Acts of sexual harassment;

• Acts of workplace sexual harassment;

• Acts of workplace sex discrimination;

• The failure to prevent acts of workplace sexual harassment or sex discrimination; and

• Retaliation against a person for reporting sexual harassment or sex discrimination

6. New tiered minimum wage

On Jan. 1, 2019, the state minimum wage increased, depending on employer size, to:

• $11 per hour for employers with 25 or fewer workers.

• $12 an hour for employers with 26 or more workers.

7. Overtime laws

The U.S. Department of Labor plans to propose new regulations governing overtime exemptions from the Fair Labor Standards Act in March 2019.

The DOL is aiming to update FLSA regulations that set a salary threshold below which employees must be paid overtime. Today, it remains at $23,660, after the Obama administration unsuccessfully attempted to raise it to $47,476. President Trump’s DOL is expected to propose a threshold somewhere between $32,000 and $35,000.

8. Accommodating lactating mothers

A new law for 2019 brings California statute into conformity with federal law that requires employers to provide a location other than a bathroom for a lactating mother to express milk.

9. New bar for harassment liability

A California Appeals Court ruling in 2018 set a new standard for what constitutes harassment in the workplace in a case that concerned a correctional officer at a prison who was mocked about his speech impediment on numerous occasions by co-workers.

The significance of the case for employers is that even teasing and sporadic verbal harassment can be enough to create a hostile work environment and, hence, liability. This year, reduce the chances of liability by having an antiharassment policy. Include training and make sure there are steps for reporting harassment, a mechanism for investigating it, and that the ramifications for harassers are clear. Look for the Division of Occupational Safety and Health to release its proposed indoor heat illness regulations in the first quarter, with possible implementation by the summer.

Draft rules that have been floated so far would apply the standard to indoor work areas where temperatures equal or exceed 82 degrees. All of the provisions would apply to workplaces where it’s at least 92 degrees.

Under draft rules, those employers would have to:

• Provide cool-down areas at all times.

• Encourage and allow employees to take preventative cool- down rests when they feel the need to protect themselves.

• Implement control measures like:

– Engineering controls

– Isolating employees from heat

– Using air conditioning, cooling fans, cooling-mist fans, and natural ventilation

Court Makes New Pay Rules for On-Call Workers

Employers with on-call workers who have to phone in to check on a scheduled shift are now required to pay them reporting pay, a California appellate court has ruled. The court held in the precedent-setting case of Ward vs. Tilly’s, Inc. that an employee scheduled for an on-call shift may be entitled to partial wages for that shift despite never physically reporting to work. The case hinged on what’s known as “reporting pay.”

DEFINITION OF ‘REPORTING PAY’

California’s Industrial Welfare Commission (IWC) has wage orders that require employers to pay workers who show up for a shift and then are told they won’t be working the scheduled shift.

Under the wage orders, an employer has to pay an employee who is required to report for work and does report, but is not put to work or works less than half their usual or scheduled day’s work. Reporting pay is a minimum of two hours’ pay and a maximum of four hours.

THE CASE

In the Ward vs. Tilly’s, Inc. case, employees were required to phone in to see if they would be working that day. The plaintiff in the case said that he was owed reporting pay because calling in to see if he was scheduled was essentially the same as showing up at work and being told he didn’t have to work that day, as per the IWC’s wage orders.

The appellate court on Feb. 4, 2019, upheld a lower court’s ruling that had sided with the plaintiff. It’s unclear whether the defendant will appeal the case to the California Supreme Court, but until that time and up to any potential decision, the ruling stands.

WHAT IT MEANS FOR EMPLOYERS

Previously, reporting pay was limited to those employees who physically reported to work. Now, any employee that has to call in to check on a scheduled shift will be due half of the wages they would have earned by working the shift they were on call for. The amount of reporting pay is based on the number of hours the employee normally works.

EXAMPLE: Justin, an on-call worker, is usually scheduled for six-hour shifts. When he called in on Wednesday, he was told he did not need to come into work that day. Based on the appellate court ruling, Justin must receive up to one-half of his scheduled shift, or three hours’ pay.

WHAT YOU CAN DO

- Conduct a cost-benefit analysis of retaining or keeping on-call status for employees.

- If you have on-call workers, update your employee handbook to reflect the new policy.

- If any of your workers were on call and were told not to work a shift after the Feb. 4 court ruling, you should pay them for the reporting pay they are owed.

Senate Bill 189 Amendments

Senate Bill 189 (SB 189) amended Sections 3351 and 3352 of the California Labor Code, allowing more corporate officers, and/or directors and owners of professional corporations to waive workers’ compensation insurance coverage.

The following summarizes the SB 189 changes, effective July 1, 2018:

- Corporations: The stock ownership requirement for exclusion eligibility for officers and directors is reduced from 15 percent to 10 percent. Additionally, an officer or director with at least one percent ownership who is also a direct relative of an officer or director with at least 10 percent is eligible for exclusion.

- Licensed Professional Corporations: Owners of businesses who practice a licensed profession and who have health insurance coverage are eligible for exclusion.

- Trusts: A trustee or grantor of a trust is eligible for exclusion if s/he is an employee of the Corp, LLC, or Partnership in which the trust has an ownership stake and s/he is eligible to elect exclusion as an officer, managing-member, or general partner of those entities.

- Cooperative Corporations: To be eligible for exclusion, SB 189 requires the policyholder have a disability policy that is comparable to workers’ compensation coverage as determined by the California Department of Insurance (CDI). Currently CDI has not identified any insurance product on the market that meets this requirement.

State Fund will endorse SB 189 exclusions for eligible policyholders who have submitted a valid exclusion waiver. State Fund also has a comprehensive plan to assist those who want to elect exclusion under the new law. Here are important highlights from that plan:

- On April 30, 2018, State Fund sent a package to potentially impacted policyholders that explains the new law, instructs them on how to complete and submit valid exclusion waivers, and includes a waiver form.

- The policyholder will be provided information about exclusions, including the SB 189 rules, on statefundca.com, under the “I’m an Employer” tab where our customers can access and submit all waiver forms.

- SB 189 only grants a 15-day grace period for back dating exclusions so policyholders who wish to be excluded from coverage are encouraged to submit valid waivers to State Fund as soon as possible via the following options:

- Option 1: Sign and submit the waiver form electronically. Visit statefundca.com and click “I’m an Employer.” Go to lower left-hand navigation and click “How to Exclude Owners, Management Members, Sole Shareholders, and Partners from your Workers’ Compensation Policy.” Open the appropriate waiver form for your company. Then follow the instructions to sign and submit the form via Adobe Sign using Chrome internet browser.

- Option 2: Sign the waiver form, scan it, and email it to SB189form@scif.com.

- Option 3: Sign the waiver form and fax it to 707-452-7849.

- Option 4: Sign the waiver form and mail it to: State Fund–Attn: SB 189 Waiver, 1030 Vaquero Circle, Vacaville, CA 95688.

5. Harassment non-disclosure

5. Harassment non-disclosure