On March 19, 2020, Governor Newsom issued Executive Order N-33-20 directing all residents immediately to heed current State public health directives to stay home, except as needed to maintain continuity of operations of essential critical infrastructure sectors and additional sectors as the State Public Health Officer may designate as critical to protect health and well-being of all Californians.

In accordance with this order, the State Public Health Officer has designated the following list of “Essential Critical Infrastructure Workers” to help state, local, tribal, and industry partners as they work to protect communities while ensuring continuity of functions critical to public health and safety, as well as economic and national security.

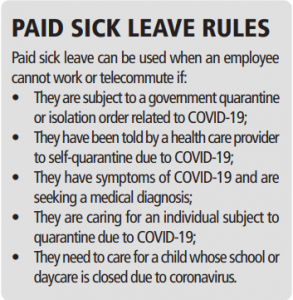

Note: Employees have 14 days to file and the employer has 30 days to respond. The new rules apply to workers who tested positive for COVID-19 within 14 days of performing work, or those who received a diagnosis within 14 days that was confirmed by a positive test no more than 30 days later. Employers have 30 days to rebut a claim.

HEALTHCARE / PUBLIC HEALTH

Sector Profile

The Healthcare and Public Health (HPH) Sector is large, diverse, and open, spanning both the public and private sectors. It includes publicly accessible healthcare facilities, research centers, suppliers, manufacturers, and other physical assets and vast, complex public-private information technology systems required for care delivery and to support the rapid, secure transmission and storage of large amounts of HPH data.

Essential Workforce

• Workers providing COVID-19 testing; Workers that perform critical clinical research needed for COVID-19 response.

• Health care providers and caregivers (e.g., physicians, dentists, psychologists, mid-level practitioners, nurses and assistants, infection control and quality assurance personnel, pharmacists, physical and occupational therapists and assistants, social workers, speech pathologists and diagnostic and therapeutic technicians and technologists).

• Hospital and laboratory personnel (including accounting, administrative, admitting and discharge, engineering, epidemiological, source plasma and blood donation, food service, housekeeping, medical records, information technology and operational technology, nutritionists, sanitarians, respiratory therapists, etc.).

• Workers in other medical facilities (including Ambulatory Health and Surgical, Blood Banks, Clinics, Community Mental Health, Comprehensive Outpatient rehabilitation, End Stage Renal Disease, Health Departments, Home Health care, Hospices, Hospitals, Long Term Care, Organ Pharmacies, Procurement Organizations, Psychiatric, Residential, Rural Health Clinics and Federally Qualified Health Centers, cannabis retailers).

• Manufacturers, technicians, logistics and warehouse operators, and distributors of medical equipment, personal protective equipment (PPE), medical gases, pharmaceuticals, blood and blood products, vaccines, testing materials, laboratory supplies, cleaning, sanitizing, disinfecting or sterilization supplies, personal care/hygiene products, and tissue and paper towel products.

• Public health/community health workers, including those who compile, model, analyze, and communicate public health information.

• Behavioral health workers (including mental and substance use disorder) responsible for coordination, outreach, engagement, and treatment to individuals in need of mental health and/or substance use disorder services.

• Blood and plasma donors and the employees of the organizations that operate and manage related activities.

• Workers that manage health plans, billing, and health information, who cannot practically work remotely.

• Workers who conduct community-based public health functions, conducting epidemiologic surveillance, compiling, analyzing and communicating public health information, who cannot practically work remotely.

• Workers who provide support to vulnerable populations to ensure their health and well-being including family care providers

• Workers performing cybersecurity functions at healthcare and public health facilities, who cannot practically work remotely.

• Workers conducting research critical to COVID-19 response.

• Workers performing security, incident management, and emergency operations functions at or on behalf of healthcare entities including healthcare coalitions, who cannot practically work remotely.

• Workers who support food, shelter, and social services, and other necessities of life for economically disadvantaged or otherwise needy individuals, such as those residing in shelters.

• Pharmacy employees necessary for filling prescriptions.

• Workers performing mortuary services, including funeral homes, crematoriums, and cemetery workers.

• Workers who coordinate with other organizations to ensure the proper recovery, handling, identification, transportation, tracking, storage, and disposal of human remains and personal effects; certify the cause of death; and facilitate access to behavioral health services to the family members, responders, and survivors of an incident.

• Workers supporting veterinary hospitals and clinics

EMERGENCY SERVICES SECTOR

Sector Profile

The Emergency Services Sector (ESS) is a community of highly-skilled, trained personnel, along with the physical and cyber resources, that provide a wide range of prevention, preparedness, response, and recovery services during both day-to-day operations and incident response. The ESS includes geographically distributed facilities and equipment in both paid and volunteer capacities organized primarily at the federal, state, local, tribal, and territorial levels of government, such as city police departments and fire stations, county sheriff’s offices, Department of Defense police and fire departments, and town public works departments. The ESS also includes private sector resources, such as industrial fire departments, private security organizations, and private emergency medical services providers.

Essential Workforce – Law Enforcement, Public Safety, and First Responders

• Including front line and management, personnel include emergency management, law enforcement, Emergency Management Systems, fire, and corrections, search and rescue, tactical teams including maritime, aviation, and canine units.

• Emergency Medical Technicians

• Public Safety Answering Points and 911 call center employees

• Fusion Center employees

• Fire Mitigation Activities

• Hazardous material responders and hazardous devices teams, from government and the private sector.

• Workers – including contracted vendors — who maintain digital systems infrastructure supporting law enforcement and emergency service operations.

• Private security, private fire departments, and private emergency medical services personnel.

• County workers responding to abuse and neglect of children, elders, and dependent adults.

• Animal control officers and humane officers

Essential Workforce – Public Works

• Workers who support the operation, inspection, and maintenance of essential dams, locks, and levees

• Workers who support the operation, inspection, and maintenance of essential public works facilities and operations, including bridges, water and sewer main breaks, fleet maintenance personnel, construction of critical or strategic infrastructure, construction material suppliers, traffic signal maintenance, emergency location services for buried utilities, maintenance of digital systems infrastructure supporting public works operations, and other emergent issues

• Workers such as plumbers, electricians, exterminators, and other service providers who provide services that are necessary to maintain the safety, sanitation, and essential operation of residences.

• Support, such as road and line clearing, to ensure the availability of needed facilities, transportation, energy, and communications support to ensure the effective removal, storage, and disposal of residential and commercial solid waste and hazardous waste.

FOOD AND AGRICULTURE

Sector Profile

The Food and Agricultural (FA) Sector is composed of complex production, processing, and delivery systems and has the capacity to feed people and animals both within and beyond the boundaries of the United States. Beyond domestic food production, the FA Sector also imports many ingredients and finished products, leading to a complex web of growers, processors, suppliers, transporters, distributors, and consumers. This sector is critical to maintaining and securing our food supply.

Essential Workforce

• Workers supporting groceries, pharmacies, and other retail that sells food and beverage products, including but not limited to Grocery stores, Corner stores and convenience stores, including liquor stores that sell food, Farmers’ markets, Food banks, Farm and produce stands, Supermarkets, Similar food retail establishments, Big box stores that sell groceries and essentials

• Restaurant carry-out and quick-serve food operations – including food preparation, carry-out, and delivery food employees

• Food manufacturer employees and their supplier employees—to include those employed in food processing (packers, meat processing, cheese plants, milk plants, produce, etc.) facilities; livestock, poultry, seafood slaughter facilities; pet and animal feed processing facilities; human food facilities producing by-products for animal food; beverage production facilities; and the production of food packaging

• Farmworkers to include those employed in animal food, feed, and ingredient production, packaging, and distribution; manufacturing, packaging, and distribution of veterinary drugs; truck delivery and transport; farm and fishery labor needed to produce our food supply domestically

• Farmworkers and support service workers to include those who field crops; commodity inspection; fuel ethanol facilities; storage facilities; and other agricultural inputs

• Employees and firms supporting food, feed, and beverage distribution (including curbside distribution and deliveries), including warehouse workers, vendor-managed inventory controllers, blockchain managers, distribution

• Workers supporting the sanitation of all food manufacturing processes and operations from wholesale to retail

• Company cafeterias – in-plant cafeterias used to feed employees

• Workers in food testing labs in private industries and in institutions of higher education

• Workers essential for assistance programs and government payments

• Workers supporting cannabis retail and dietary supplement retail

• Employees of companies engaged in the production of chemicals, medicines, vaccines, and other substances used by the food and agriculture industry, including pesticides, herbicides, fertilizers, minerals, enrichments, and other agricultural production aids

• Animal agriculture workers to include those employed in veterinary health; manufacturing and distribution of animal medical materials, animal vaccines, animal drugs, feed ingredients, feed, and bedding, etc.; transportation of live animals, animal medical materials; transportation of deceased animals for disposal; raising of animals for food; animal production operations; slaughter and packing plants and associated regulatory and government workforce

• Workers who support the manufacture and distribution of forest products, including, but not limited to timber, paper, and other wood products

• Employees engaged in the manufacture and maintenance of equipment and other infrastructure necessary to agricultural production and distribution

ENERGY

Sector Profile

The Energy Sector consists of widely-diverse and geographically-dispersed critical assets and systems that are often interdependent of one another. This critical infrastructure is divided into three interrelated segments or subsectors—electricity, oil, and natural gas—to include the production, refining, storage, and distribution of oil, gas, and electric power, except for hydroelectric and commercial nuclear power facilities and pipelines. The Energy Sector supplies fuels to the transportation industry, electricity to households and businesses, and other sources of energy that are integral to growth and production across the Nation. In turn, it depends on the Nation’s transportation, information technology, communications, finance, water, and government infrastructures.

Essential Workforce – Electricity industry:

• Workers who maintain, ensure, or restore the generation, transmission, and distribution of electric power, including call centers, utility workers, reliability engineers and fleet maintenance technicians

• Workers needed for safe and secure operations at nuclear generation

• Workers at generation, transmission, and electric blackstart facilities

• Workers at Reliability Coordinator (RC), Balancing Authorities (BA), and primary and backup Control Centers (CC), including but not limited to independent system operators, regional transmission organizations, and balancing authorities

• Mutual assistance personnel

• IT and OT technology staff – for EMS (Energy Management Systems) and Supervisory Control and Data

• Acquisition (SCADA) systems, and utility data centers; Cybersecurity engineers; cybersecurity risk management

• Vegetation management crews and traffic workers who support

• Environmental remediation/monitoring technicians

• Instrumentation, protection, and control technicians

Essential Workforce – Petroleum workers:

• Petroleum product storage, pipeline, marine transport, terminals, rail transport, road transport

• Crude oil storage facilities, pipeline, and marine transport

• Petroleum refinery facilities

• Petroleum security operations center employees and workers who support emergency response services

• Petroleum operations control rooms/centers

• Petroleum drilling, extraction, production, processing, refining, terminal operations, transporting, and retail for use as end-use fuels or feedstocks for chemical manufacturing

• Onshore and offshore operations for maintenance and emergency response

• Retail fuel centers such as gas stations and truck stops, and the distribution systems that support them.

Essential Workforce – Natural and propane gas workers:

• Natural gas transmission and distribution pipelines, including compressor stations

• Underground storage of natural gas

• Natural gas processing plants, and those that deal with natural gas liquids

• Liquefied Natural Gas (LNG) facilities

• Natural gas security operations center, natural gas operations dispatch and control rooms/centers natural gas emergency response and customer emergencies, including natural gas leak calls

• Drilling, production, processing, refining, and transporting natural gas for use as end-use fuels, feedstocks for chemical manufacturing, or use in electricity generation

• Propane gas dispatch and control rooms and emergency response and customer emergencies, including propane leak calls

• Propane gas service maintenance and restoration, including call centers

• Processing, refining, and transporting natural liquids, including propane gas, for use as end-use fuels or feedstocks for chemical manufacturing

• Propane gas storage, transmission, and distribution centers

WATER AND WASTEWATER

Sector Profile

The Water and Wastewater Sector is a complex sector composed of drinking water and wastewater infrastructure of varying sizes and ownership types. Multiple governing authorities pertaining to the Water and Wastewater Sector provide for public health, environmental protection, and security measures, among others.

Essential Workforce

Employees needed to operate and maintain drinking water and wastewater/drainage infrastructure, including:

• Operational staff at water authorities

• Operational staff at community water systems

• Operational staff at wastewater treatment facilities

• Workers repairing water and wastewater conveyances and performing required sampling or monitoring

• Operational staff for water distribution and testing

• Operational staff at wastewater collection facilities

• Operational staff and technical support for SCADA Control systems

• Chemical disinfectant suppliers for wastewater and personnel protection

• Workers that maintain digital systems infrastructure supporting water and wastewater operations

TRANSPORTATION AND LOGISTICS

Sector Profile

The Transportation Systems Sector consists of seven key subsectors, or modes:

– Aviation includes aircraft, air traffic control systems, and airports, heliports, and landing strips. Commercial aviation services at civil and joint-use military airports, heliports, and seaplane bases. In addition, the aviation mode includes commercial and recreational aircraft (manned and unmanned) and a wide variety of support services, such as aircraft repair stations, fueling facilities, navigation aids, and flight schools.

– Highway and Motor Carrier encompasses roadway, bridges, and tunnels. Vehicles include trucks, including those carrying hazardous materials; other commercial vehicles, including commercial motorcoaches and school buses; vehicle and driver licensing systems; taxis, transportation services including Transportation Network Companies, and delivery services including Delivery Network Companies; traffic management systems; AND cyber systems used for operational management.

– Maritime Transportation System consists of coastline, ports, waterways, and intermodal landside connections that allow the various modes of transportation to move people and goods to, from, and on the water.

– Mass Transit and Passenger Rail includes terminals, operational systems, and supporting infrastructure for passenger services by transit buses, trolleybuses, monorail, heavy rail—also known as subways or metros—light rail, passenger rail, and vanpool/rideshare.

– Pipeline Systems consist of pipelines carrying natural gas hazardous liquids, as well as various chemicals. Above-ground assets, such as compressor stations and pumping stations, are also included.

– Freight Rail consists of major carriers, smaller railroads, active railroad, freight cars, and locomotives.

– Postal and Shipping includes large integrated carriers, regional and local courier services, mail services, mail management firms, and chartered and delivery services.

Essential Workforce

• Employees supporting or enabling transportation functions, including dispatchers, maintenance and repair technicians, warehouse workers, truck stop and rest area workers, and workers that maintain and inspect infrastructure (including those that require cross-border travel)

• Employees of firms providing services that enable logistics operations, including cooling, storing, packaging, and distributing products for wholesale or retail sale or use.

• Mass transit workers

• Taxis, transportation services including Transportation Network Companies, and delivery services including Delivery Network Companies

• Workers responsible for operating dispatching passenger, commuter and freight trains and maintaining rail infrastructure and equipment

• Maritime transportation workers – port workers, mariners, equipment operators

• Truck drivers who haul hazardous and waste materials to support critical infrastructure, capabilities, functions, and services

• Automotive repair and maintenance facilities

• Manufacturers and distributors (to include service centers and related operations) of packaging materials, pallets, crates, containers, and other supplies needed to support manufacturing, packaging staging, and distribution operations

• Postal and shipping workers, to include private companies

• Employees who repair and maintain vehicles, aircraft, rail equipment, marine vessels, and the equipment and infrastructure that enables operations that encompass the movement of cargo and passengers

• Air transportation employees, including air traffic controllers, ramp personnel, aviation security, and aviation management

• Workers who support the maintenance and operation of cargo by air transportation, including flight crews, maintenance, airport operations, and other on- and off-airport facilities workers

COMMUNICATIONS AND INFORMATION TECHNOLOGY

Sector Profile

The Communications Sector provides products and services that support the efficient operation of today’s global information-based society. Communication networks enable people around the world to contact one another, access information instantly, and communicate from remote areas. This involves creating a link between a sender (including voice signals) and one or more recipients using technology (e.g., a telephone system or the Internet) to transmit information from one location to another. Technologies are changing at a rapid pace, increasing the number of products, services, service providers, and communication options. The national communications architecture is a complex collection of networks that are owned and operated by individual service providers. Many of this sector’s products and services are foundational or necessary for the operations and services provided by other critical infrastructure sectors. The nature of communication networks involve both physical infrastructure (buildings, switches, towers, antennas, etc.) and cyberinfrastructure (routing and switching software, operational support systems, user applications, etc.), representing a holistic challenge to address the entire physical-cyber infrastructure.

The IT sector provides products and services that support the efficient operation of today’s global information-based society and are integral to the operations and services provided by other critical infrastructure Sectors. The IT Sector is comprised of small and medium businesses, as well as large multinational companies. Unlike many critical infrastructure Sectors composed of finite and easily identifiable physical assets, the IT Sector is a function-based Sector that comprises not only physical assets but also virtual systems and networks that enable key capabilities and services in both the public and private sectors.

Essential Workforce – Communications:

• Maintenance of communications infrastructure- including privately owned and maintained communication systems- supported by technicians, operators, call-centers, wireline and wireless providers, cable service providers, satellite operations, undersea cable landing stations, Internet Exchange Points, and manufacturers and distributors of communications equipment

• Workers who support radio, television, and media service, including, but not limited to front line news reporters, studio, and technicians for newsgathering and reporting

• Workers at Independent System Operators and Regional Transmission Organizations, and Network Operations staff, engineers and/or technicians to manage the network or operate facilities

• Engineers, technicians and associated personnel responsible for infrastructure construction and restoration, including contractors for construction and engineering of fiber optic cables

• Installation, maintenance and repair technicians that establish, support or repair service as needed

• Central office personnel to maintain and operate central office, data centers, and other network office facilities

• Customer service and support staff, including managed and professional services as well as remote providers of support to transitioning employees to set up and maintain home offices, who interface with customers to manage or support service environments and security issues, including payroll, billing, fraud, and troubleshooting

• Dispatchers involved with service repair and restoration

Essential Workforce – Information Technology:

• Workers who support command centers, including, but not limited to Network Operations Command Center, Broadcast Operations Control Center and Security Operations Command Center

• Data center operators, including system administrators, HVAC & electrical engineers, security personnel, IT managers, data transfer solutions engineers, software and hardware engineers, and database administrators

• Client service centers, field engineers, and other technicians supporting critical infrastructure, as well as manufacturers and supply chain vendors that provide hardware and software, and information technology equipment (to include microelectronics and semiconductors) for critical infrastructure

• Workers responding to cyber incidents involving critical infrastructure, including medical facilities, SLTT governments and federal facilities, energy and utilities, and banks and financial institutions, and other critical infrastructure categories and personnel

• Workers supporting the provision of essential global, national and local infrastructure for computing services (incl. cloud computing services), business infrastructure, web-based services, and critical manufacturing

• Workers supporting communications systems and information technology used by law enforcement, public safety, medical, energy and other critical industries

• Support required for continuity of services, including janitorial/cleaning personnel

OTHER COMMUNITY-BASED GOVERNMENT OPERATIONS AND ESSENTIAL FUNCTIONS

Essential Workforce

• Critical government workers, as defined by the employer and consistent with Continuity of Operations Plans and Continuity of Government plans.

• County workers responsible for determining eligibility for safety net benefits

• The Courts, consistent with guidance released by the California Chief Justice

• Workers to ensure continuity of building functions

• Security staff to maintain building access control and physical security measures

• Elections personnel

• Federal, State, and Local, Tribal, and Territorial employees who support Mission Essential Functions and communications networks

• Trade Officials (FTA negotiators; international data flow administrators)

• Weather forecasters

• Workers that maintain digital systems infrastructure supporting other critical government operations

• Workers at operations centers necessary to maintain other essential functions

• Workers who support necessary credentialing, vetting and licensing operations for transportation workers

• Workers who are critical to facilitating trade in support of the national, state, and local emergency response supply chain

• Workers supporting public and private childcare establishments, pre-K establishments, K-12 schools, colleges, and universities for purposes of distance learning, provision of school meals, or care and supervision of minors to support essential workforce across all sectors

• Workers and instructors supporting academies and training facilities and courses for the purpose of graduating students and cadets that comprise the essential workforce for all identified critical sectors

• Hotel Workers where hotels are used for COVID-19 mitigation and containment measures, including measures to protect homeless populations.

• Construction Workers who support the construction, operation, inspection, and maintenance of construction sites and construction projects (including housing construction)

• Workers such as plumbers, electricians, exterminators, and other service providers who provide services that are necessary to maintaining the safety, sanitation, construction material sources, and essential operation of construction sites and construction projects (including those that support such projects to ensure the availability of needed facilities, transportation, energy and communications; and support to ensure the effective removal, storage, and disposal of solid waste and hazardous waste)

• Commercial Retail Stores, that supply essential sectors, including convenience stores, pet supply stores, auto supplies and repair, hardware and home improvement, and home appliance retailers • Workers supporting the entertainment industries, studios, and other related establishments, provided they follow covid-19 public health guidance around social distancing. • Workers critical to operating Rental Car companies that facilitate continuity of operations for essential workforces, and other essential travel

• Workers that provide or determine eligibility for food, shelter, in-home supportive services, child welfare, adult protective services and social services, and other necessities of life for economically disadvantaged or otherwise needy individuals (including family members)

• Professional services, such as legal or accounting services, when necessary to assist in compliance with legally mandated activities and critical sector services

• Faith-based services that are provided through streaming or other technology • Laundromats and laundry services

• Workers at animal care facilities that provide food, shelter, veterinary and/or routine care and other necessities of life for animals.

CRITICAL MANUFACTURING

Sector Profile

The Critical Manufacturing Sector identifies several industries to serve as the core of the sector: Primary Metals Manufacturing, Machinery Manufacturing, Electrical Equipment, Appliance, and Component Manufacturing, Transportation Equipment Manufacturing Products made by these manufacturing industries are essential to many other critical infrastructure sectors.

Essential Workforce

• Workers necessary for the manufacturing of materials and products needed for medical supply chains, transportation, energy, communications, food and agriculture, chemical manufacturing, nuclear facilities, the operation of dams, water and wastewater treatment, emergency services, and the defense industrial base.

HAZARDOUS MATERIALS

Essential Workforce

• Workers at nuclear facilities, workers managing medical waste, workers managing waste from pharmaceuticals and medical material production, and workers at laboratories processing test kits

• Workers who support hazardous materials response and cleanup

• Workers who maintain digital systems infrastructure supporting hazardous materials management operations

FINANCIAL SERVICES

Sector Profile

The Financial Services Sector includes thousands of depository institutions, providers of investment products, insurance companies, other credit and financing organizations, and the providers of the critical financial utilities and services that support these functions. Financial institutions vary widely in size and presence, ranging from some of the world’s largest global companies with thousands of employees and many billions of dollars in assets to community banks and credit unions with a small number of employees serving individual communities. Whether an individual savings account, financial derivatives, credit extended to a large organization, or investments made to a foreign country, these products allow customers to: Deposit funds and make payments to other parties; Provide credit and liquidity to customers; Invest funds for both long and short periods; Transfer financial risks between customers.

Essential Workforce

• Workers who are needed to process and maintain systems for processing financial transactions and services (e.g., payment, clearing, and settlement; wholesale funding; insurance services; and capital markets activities)

• Workers who are needed to provide consumer access to banking and lending services, including ATMs, and to move currency and payments (e.g., armored cash carriers)

• Workers who support financial operations, such as those staffing data and security operations centers

CHEMICAL

Sector Profile

The Chemical Sector—composed of a complex, global supply chain—converts various raw materials into diverse products that are essential to modern life. Based on the end product produced, the sector can be divided into five main segments, each of which has distinct characteristics, growth dynamics, markets, new developments, and issues: Basic chemicals; Specialty chemicals; Agricultural chemicals; Pharmaceuticals; Consumer products

Essential Workforce

• Workers supporting the chemical and industrial gas supply chains, including workers at chemical manufacturing plants, workers in laboratories, workers at distribution facilities, workers who transport basic raw chemical materials to the producers of industrial and consumer goods, including hand sanitizers, food and food additives, pharmaceuticals, textiles, and paper products.

• Workers supporting the safe transportation of chemicals, including those supporting tank truck cleaning facilities and workers who manufacture packaging items

• Workers supporting the production of protective cleaning and medical solutions, personal protective equipment, and packaging that prevents the contamination of food, water, medicine, among others essential products

• Workers supporting the operation and maintenance of facilities (particularly those with high risk chemicals and/ or sites that cannot be shut down) whose work cannot be done remotely and requires the presence of highly trained personnel to ensure safe operations, including plant contract workers who provide inspections

• Workers who support the production and transportation of chlorine and alkali manufacturing, single-use plastics, and packaging that prevents the contamination or supports the continued manufacture of food, water, medicine, and other essential products, including glass container manufacturing

DEFENSE INDUSTRIAL BASE

Sector Profile

The Defense Industrial Base Sector is the worldwide industrial complex that enables research and development, as well as design, production, delivery, and maintenance of military weapons systems, subsystems, and components or parts, to meet U.S. military requirements. The Defense Industrial Base partnership consists of Department of Defense components, Defense Industrial Base companies and their subcontractors who perform under contract to the Department of Defense, companies providing incidental materials and services to the Department of Defense, and government-owned/contractor-operated and government-owned/government-operated facilities. Defense Industrial Base companies include domestic and foreign entities, with production assets located in many countries. The sector provides products and services that are essential to mobilize, deploy, and sustain military operations.

Essential Workforce

• Workers who support the essential services required to meet national security commitments to the federal government and U.S. Military. These individuals include but are not limited to, aerospace; mechanical and software engineers, manufacturing/production workers; IT support; security staff; security personnel; intelligence support, aircraft and weapon system mechanics and maintainers

• Personnel working for companies, and their subcontractors, who perform under contract to the Department of Defense providing materials and services to the Department of Defense, and government-owned/contractor-operated and government-owned/government-operated facilities

Download a pdf