Law Adds Independent Contractor Exemptions – OCTOBER 2020

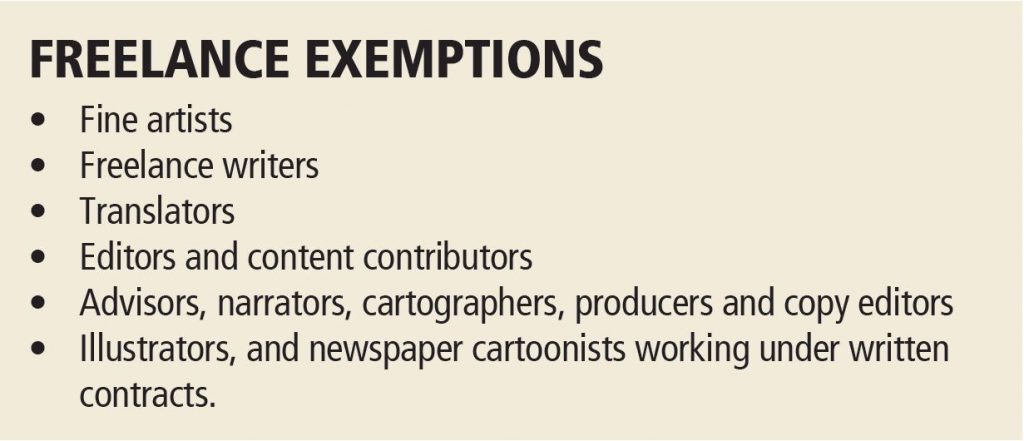

A NEW LAW has come to the rescue of a number of freelance professions by exempting them from the onerous requirements of AB 5, which required most independent contractors to be classified as employees in California. Governor Gavin Newsom on Sept. 1 signed AB 2257 as an urgency measure so that it took effect immediately. If you remember, AB 5 set a new standard for hiring independent contractors, requiring many to be reclassified as employees covered by minimum wage, overtime, workers’ compensation, unemployment and disability insurance. It created a three-pronged test that needs to be satisfied to determine if someone is an independent contractor or an employee.

To be independent contractors under AB 5’s “ABC test,” workers must (A) work independently, (B) do work that is different from what the business does, and (C) offer their work to other businesses or the public. All three conditions must be met.

It is prong B that’s problematic. For example, a freelance writer working for a magazine would not be doing something different than the business does. The new law sets limits on the amount of income someone can receive while doing this kind of work before being considered an employee. AB 2257 also expands the “business-to-business” definition in AB 5 to cover a relationship between two or more sole proprietors.