EVERY YEAR comes with new laws and regulations that affect employers. It pays to stay on top of all the few requirements, so we are here to help you understand those that are most likely to affect your business. The following are the top 10 laws, regulations and trends that you need to know about going into 2019.

1. Sexual harassment training

Existing state law requires employers with 50 or more workers to provide at least two hours of sexual harassment training to supervisors every two years. SB 1343 changes this by requiring employers with five or more employees to provide all employees with at least one hour by Jan. 1, 2020. Training must be held every two years. Also, employers with five or more workers must provide (or continue to provide) two hours of the biennial supervisory training.

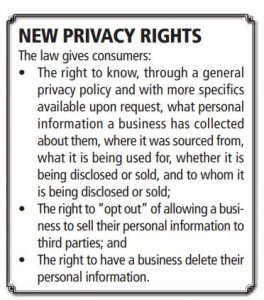

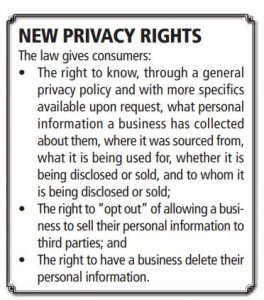

2. Data privacy

Companies that collect data on their customers online should start gearing up in 2019 for the Jan. 1, 2020 implementation of the California Consumer Privacy Act of 2018, which is the state’s version of the European Union’s General Data Protection Regulation.

The law applies to businesses that:

• Have annual gross revenues in excess of $25 million,

• Annually buy, receive for their own commercial purposes, or sell or share for commercial purposes, the personal information of 50,000 or more consumers, households or devices, and/or

• Derive 50% or more of their annual revenues from selling consumers’ personal information.

3. Independent contractors

While this legal development happened in 2018, now is a good time to go over it. In May 2018, the California Supreme Court handed down a decision that rewrites the state’s independent contractor law. In its decision in Dynamex Operations West, Inc. vs. Superior Court, the court rejected a test that’s been used for more than a decade in favor of a more rigid three-factor approach, often called the “ABC” test.

Employers now must be able to answer ‘yes’ to the following if they want to classify someone as an independent contractor:

• The worker is free from the control and direction of the hirer in relation to the performance of the work, both under the contract and in fact;

• The worker performs work that is outside the usual course of the hirer’s business; and

• The worker is customarily engaged in an independently established trade, occupation or business of the same nature as the work performed for the hirer.

The second prong of the test is the sentence that really changes the game. Now, if you hire a worker to do anything that is central to your business’s offerings, you must classify them as an employee.

4. Electronic submission of Form 300A

In November 2018, Cal/OSHA issued an emergency regulation that required California employers with more than 250 workers to submit Form 300A data covering calendar year 2017 by Dec. 31, 2018. The new regulation was designed to put California’s regulations in line with those of Federal OSHA.

This year, affected employers will be required to submit their prior year Form 300A data by March 2. The law applies to:

• Employers with 250 or more employees, and

• Employers with 20 to 249 employees in high-risk sectors.

5. Harassment non-disclosure

5. Harassment non-disclosure

This law, which took effect Jan. 1, 2019, bars California employers from entering into settlement agreements that prevent the disclosure of information regarding:

• Acts of sexual assault;

• Acts of sexual harassment;

• Acts of workplace sexual harassment;

• Acts of workplace sex discrimination;

• The failure to prevent acts of workplace sexual harassment or sex discrimination; and

• Retaliation against a person for reporting sexual harassment or sex discrimination

6. New tiered minimum wage

On Jan. 1, 2019, the state minimum wage increased, depending on employer size, to:

• $11 per hour for employers with 25 or fewer workers.

• $12 an hour for employers with 26 or more workers.

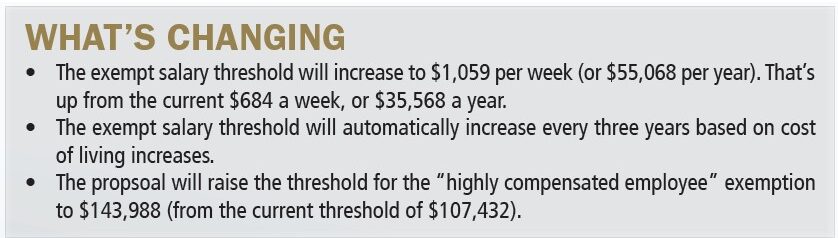

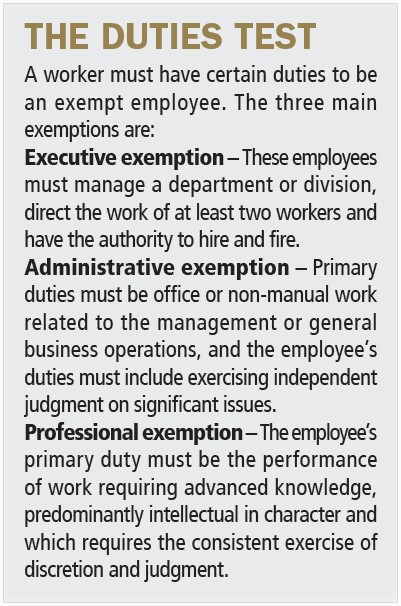

7. Overtime laws

The U.S. Department of Labor plans to propose new regulations governing overtime exemptions from the Fair Labor Standards Act in March 2019.

The DOL is aiming to update FLSA regulations that set a salary threshold below which employees must be paid overtime. Today, it remains at $23,660, after the Obama administration unsuccessfully attempted to raise it to $47,476. President Trump’s DOL is expected to propose a threshold somewhere between $32,000 and $35,000.

8. Accommodating lactating mothers

A new law for 2019 brings California statute into conformity with federal law that requires employers to provide a location other than a bathroom for a lactating mother to express milk.

9. New bar for harassment liability

A California Appeals Court ruling in 2018 set a new standard for what constitutes harassment in the workplace in a case that concerned a correctional officer at a prison who was mocked about his speech impediment on numerous occasions by co-workers.

The significance of the case for employers is that even teasing and sporadic verbal harassment can be enough to create a hostile work environment and, hence, liability. This year, reduce the chances of liability by having an antiharassment policy. Include training and make sure there are steps for reporting harassment, a mechanism for investigating it, and that the ramifications for harassers are clear. Look for the Division of Occupational Safety and Health to release its proposed indoor heat illness regulations in the first quarter, with possible implementation by the summer.

Draft rules that have been floated so far would apply the standard to indoor work areas where temperatures equal or exceed 82 degrees. All of the provisions would apply to workplaces where it’s at least 92 degrees.

Under draft rules, those employers would have to:

• Provide cool-down areas at all times.

• Encourage and allow employees to take preventative cool- down rests when they feel the need to protect themselves.

• Implement control measures like:

– Engineering controls

– Isolating employees from heat

– Using air conditioning, cooling fans, cooling-mist fans, and natural ventilation

WORKER’S COMP – Most Common Audit Mistakes: What to Look For

No company owner wants to undergo a workers’ compensation audit, but they are a fact of life if you run a business and have employees.

Unfortunately, many audits don’t go smoothly and sometimes your insurer may make mistakes. Missouri-based Workers’ Compensation Consultants, which helps employers through the audit process, recently listed the 10 most common audit mistakes insurers make.

The list highlights a common problem and how you can detect the mistakes. Insurance companies allow you to review the audit with your broker. If you have received an audit bill that is obviously overstated, you should contact us.

Here are the things to look for when reviewing an audit by your insurance company:

Wrong class code – Misapplication of job classifications occurs in many audits. With hundreds of job classes to choose from, mistakes can happen. Talk to us and review your old policies to see if any of your class codes have

changed.

X-Mod is changed – After your insurer finishes the audit, it will use the information to calculate your premium. When that happens, it has to include your X-Mod to get the right rate. But sometimes the insurer may use an incorrect X-Mod.

Subcontractors are counted – Sometimes insurers will include subcontractors as employees, which results in a new audit bill to account for the additional “employees.”

But if they are genuine subcontractors, they should not be counted. Often, uninsured contractors will be included as employees. Make sure to use insured contractors only.

Disappearing credits – Most policies will have some sort of premium credits or other modifiers. Sometimes during audits, the insurer will remove them when recalculating the premium they think you owe. Watch out for missing credits and other modifiers if you get an audit bill, like:

- Premium discount

- Schedule credits

- Deductible credits

- State-specific credits

Audit worksheets missing – If the auditor fails to provide you with audit worksheets, which are used do compile your payroll and other audit information, you should ask to check their work.

They will provide you with the information you need to carry out such a check.

Your rates changed – The rates you are charged at the beginning of your policy period must remain the same for the entire period. If your base rates have changed, the insurer may have made a mistake.

Separation of payroll – Depending on your industry, you may or may not be able to split your employees’ payroll between job classifications (like cabinet installers and sheetrock hangers). This is a pinch point when errors can occur. If the auditor says you are not allowed to split job classifications even though you have in the past, your audit may be in error.

Unexpected large premium due – If you get a significant bill for your insurance company after your audit, the auditor may have made mistakes, particularly if you know that your employment has remained relatively stable and you’ve had no significant claims, if any. If it seems out of whack, call us.

Payroll data doesn’t match – If there is a discrepancy between your payroll data and what you see on the audit, a mistake may have been made. Try to match the payroll on the audit with that generated from your accountant. If the insurer made a mistake, you could end up paying for phantom payroll numbers.

No physical audit – There are three types of audits:

- Mail audit

- Phone audit, and

- Physical auditThe mail and phone audits are prone to errors, since neither you nor your staff likely have any experience in premium auditing. If you have a big bill after a mail or phone audit, mistakes could have been made.

Update to the Health Savings Account (HSA) Family Maximum for 2018

On Thursday, April 26th, the IRS released Revenue Procedure 2018-27.

This guidance modifies the annual limit for health savings accounts (HSAs) for individuals with family coverage under an HDHP. Specifically, this guidance allows health savings account holders to again treat the 2018 limit as $6,900.

As background, on May 4, 2017, the IRS set the maximum HSA contribution for family coverage for 2018 at $6,900. On March 2, 2018, Tax Reform legislation reduced the limit to $6,850 for HSA account holders with family coverage under HDHPs. Due to administrative and financial burdens that outweigh any tax benefit associated with an unreduced HSA limit, the Treasury Department and the IRS have determined it is in the best interest to allow account holders to continue to treat $6,900 as the HSA contribution maximum for 2018.

5. Harassment non-disclosure

5. Harassment non-disclosure