Prepare for Possible PG&E Power Shutdowns

Business Interruption Coverage Can Cover Lost Income

PG&E has warned California residents and businesses that it may shut down the power grid for as long as five days for large portions of the state when there are high-wind conditions during the dry fire season. That’s because PG&E’s infrastructure was found to be the cause of several recent wildfires.

PG&E sent letters to customers informing them that “if extreme fire danger conditions threaten a portion of the electric system serving your community, it will be necessary for us to turn off electricity in the interest of public safety.” With the specter of multiple-day power outages, businesses need to be prepared for keeping their operations going and preventing losses that may not be covered by insurance.

Just think how difficult it would be if you lost access to your computers, which are the nervous system of any business today. If you have no power, your operations could be shuttered for all intents and purposes.

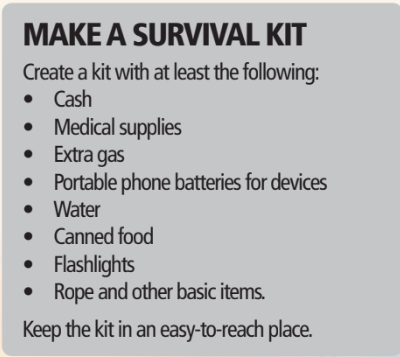

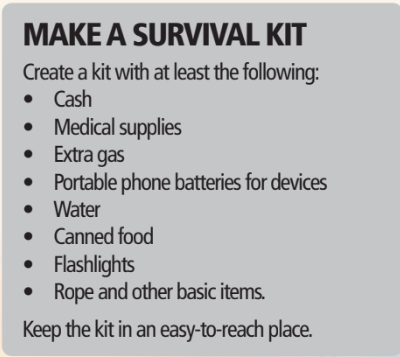

There a number of steps you can take to make sure your business is resilient and can keep functioning during power outages, especially if they last a few days:

Identify vital business functions

Identify business processes that will be affected by a power outage. These processes will differ from business to business, but once you put them all down on paper, it will be easier for you to make a plan to keep them going.

Create a continuity plan

Once you’ve identified those processes, you should brainstorm on how you can keep them going without your regular power supply.

- Create a plan outlining how employees should respond to the power outage.

- Post emergency numbers on sight for employees to call, including your electricity supplier to get an estimate on when power may be restored.

Back-up power a must

Consider investing in a back-up generator that can keep the critical functions of your firm going during a power outage. Generators need to be used with adequate ventilation to avoid risk of carbon monoxide poisoning. Never plug generators directly into power outlets. Never use a generator under wet conditions, and let it cool off before refueling.

Cloud storage and MiFi

If you have not done so, you should secure a means of paperless document and file storage on the cloud. If there is a power outage and an accompanying surge, you could quickly lose your data. Plan ahead with a cloud server.

You should also prepare a system of personal wireless hotspots, or MiFi devices, so that even when the internet goes down, you can finish important tasks requiring web access, such as setting up an e-mail auto-response.

Consider business interruption coverage

The best way to minimize the financial blow is to have the

proper insurance in place. A multiple-day power outage could really crimp your income stream and, if you lose money due to your inability to operate, the typical business owner’s policy won’t cover lost revenue.

But, a business interruption policy would. These policies will reimburse you for lost revenues due to a number of events, including “service interruption” due to power outages and other utility services interruptions.

The important caveat is that the interruption was not caused by any of your own faulty equipment or wiring. But if the power company is shutting down power, any losses you incur should be a valid claim.

WEATHER-RELATED RISK – Commercial Properties Increasingly Vulnerable

A NEW report highlights the risks to commercial real estate owners from natural catastrophes and climate-related disasters, which are happening with increasing frequency. The report by Heitman LLC, a global real estate company, in conjunction with the Urban Land Institute, found that the increasing risks from catastrophes are bringing new challenges to commercial property owners in terms of risk mitigation and securing appropriate property coverage, which may become more difficult in the future.

There are two main risks facing commercial property owners: physical and transitional risks associated with increasingly volatile weather.

Physical risks – This includes catastrophes, which can lead to:

• Increased insurance premiums

• Higher capital outlays

• Increased operational costs

• Decreased liquidity

• Falling value of buildings

Transitional risks – This includes economic, political and societal responses to climate change and more volatile weather that can make entire regions or metropolitan areas less appealing due to increasing weather events.

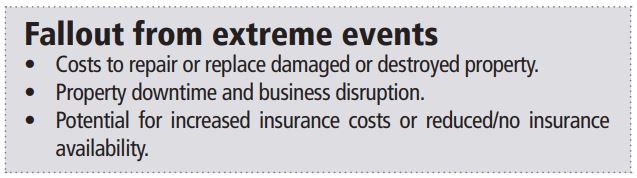

Fallout from extreme events

-

Costs to repair or replace damaged or destroyed property.

-

Property downtime and business disruption.

-

Potential for increased insurance costs or reduced/no insurance availability

The report notes that commercial property owners in areas that have seen regular catastrophes have started seeing either higher premiums for their property policies or decreased coverage.

Main impacts facing property owners

First, there are catastrophic events, like extreme weather such as hurricanes and wildfires. Gradual changes in temperature and precipitation – such as higher temperatures, rising sea levels, increasing frequency of heavy rain and wind, and decreased rainfall – are likely to exaggerate the impact of catastrophic events.

This can affect commercial properties in the form of:

• Increased wear and tear on or damage to buildings, leading to higher maintenance costs.

• Increased operating costs due to the need for more, or alternative, resources (energy and/or water) to operate a building.

• Cost of investment in adaptation measures, such as elevating buildings or incorporating additional cooling methods.

• Potential for more damages from weather events.

• Higher insurance costs or lack of availability.

What owners are doing

Survey respondents said that they currently use insurance as their primary means of protection against extreme weather and climate events. But 70% of real estate and hospitality industry managers said they had seen an increase in rates in the year to the end of the third quarter of 2018, with an average rise of 9.1%.

While insurance will cover damages from catastrophic events, it will not cover loss in value if investors start shying away from an area due to vulnerability to natural catastrophes. Although insurance might provide short-term protection, more property owners and investors are looking for better tools and common standards to help the industry get better at pricing in climate risk in the future.

These include:

• Mapping risk for the properties they currently own.

• Reviewing climate risk and catastrophe susceptibility before purchasing new properties.

• Using mitigation measures around their properties.

• Working with local policymakers to support investment by cities in mitigating risk.

WEATHER-RELATED RISK – Commercial Properties Increasingly Vulnerable

A new report highlights the risks to commercial real estate owners from natural catastrophes and climate-related disasters, which are happening with increasing

frequency.

The report by Heitman LLC, a global real estate company, in conjunction with the Urban Land Institute, found that the increasing risks from catastrophes are bringing new challenges to commercial property owners in terms of risk mitigation and securing appropriate property coverage, which may become more difficult in the future.

There are two main risks facing commercial property owners: physical and transitional risks associated with increasingly volatile weather.

Physical risks – This includes catastrophes, which can lead to:

- Increased insurance premiums

- Higher capital outlays

- Increased operational costs

- Decreased liquidity

- Falling value of buildingsTransitional risks – This includes economic, political and societal responses to climate change and more volatile weather that can make entire regions or metropolitan areas less appealing due to increasing weather events.

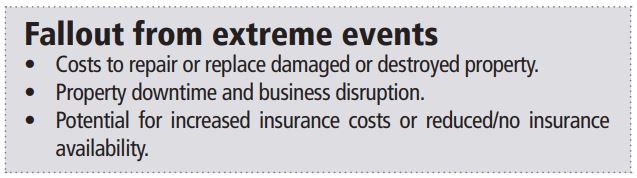

The report notes that commercial property owners in areas that have seen regular catastrophes have started seeing either higher premiums for their property policies or decreased coverage.

MAIN IMPACTS FACING PROPERTY OWNERS

First, there are catastrophic events, like extreme weather such as hurricanes and wildfires. Gradual changes in temperature and precipitation – such as higher temperatures, rising sea levels, increasing frequency of heavy rain and wind, and decreased rainfall – are likely to exaggerate the impact of catastrophic events.

This can affect commercial properties in the form of:

- Increased wear and tear on or damage to buildings, leading to higher maintenance costs.

- Increased operating costs due to the need for more, or alternative, resources (energy and/or water) to operate a building.

- Cost of investment in adaptation measures, such as elevating buildings or incorporating additional cooling methods.

- Potential for more damages from weather events.

- Higher insurance costs or lack of availability.

WHAT OWNERS ARE DOING

Survey respondents said that they currently use

insurance as their primary means of protection against

extreme weather and climate events.

But 70% of real estate and hospitality industry managers

said they had seen an increase in rates in the year to the

end of the third quarter of 2018, with an average rise of

9.1%.

While insurance will cover damages from catastrophic

events, it will not cover loss in value if investors start

shying away from an area due to vulnerability to natural

catastrophes.

Although insurance might provide short-term

protection, more property owners and investors are

looking for better tools and common standards to help the

industry get better at pricing in climate risk in the future.

These include:

- Mapping risk for the properties they currently own.

- Reviewing climate risk and catastrophe susceptibility before purchasing new properties.

- Using mitigation measures around their properties.

- Working with local policymakers to support investment by cities in mitigating risk.