AN ALLEGEDLY Chinese state-sponsored hacker campaign dubbed “Salt Typhoon” has infiltrated major cell phone providers, including AT&T and Verizon, potentially exposing your company’s communications to threat actors.

The attack has been described as the most significant telecommunications hack in U.S. history. While the breach is alarming for individuals, the implications for businesses are profound and demand immediate attention.

What is Salt Typhoon?

Salt Typhoon is a sophisticated cyber-espionage operation allegedly orchestrated by the Chinese government.

The campaign has targeted vulnerabilities in telecom providers’ infrastructure to access text messages, monitor communications, and extract sensitive metadata.

The ongoing breach has affected at least eight major U.S. telecom companies and poses a severe threat to national security and corporate privacy.

Government warning

In response to Salt Typhoon, the U.S. government recommended using end-to-end encrypted communication platforms.

Unlike standard text messaging or phone calls, end-to-end encryption ensures that only the sender and recipient can read the messages.

Protecting your firm

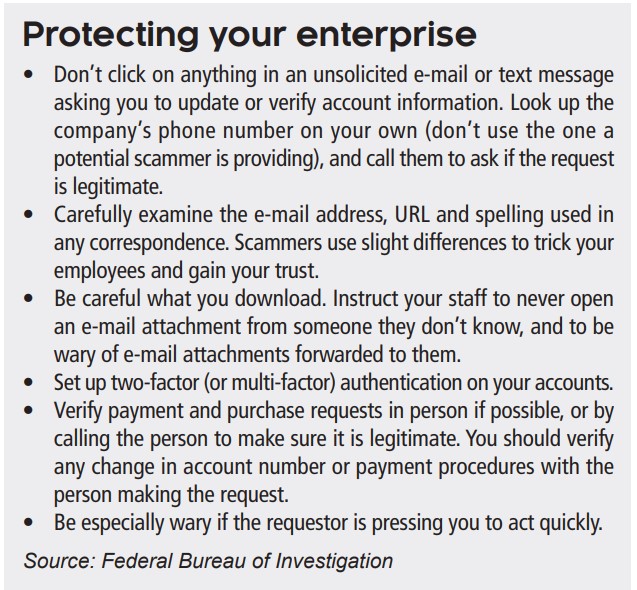

Some steps businesses can take include:

• Shifting internal and external communications to end-toend encrypted platforms such as Signal or WhatsApp, or enterprise solutions with encryption features.

• Avoiding using text-based, one-time passwords for authentication; instead, deploy hardware security keys or app-based authenticators.

• Updating systems regularly: Ensure all devices and software are updated to patch known vulnerabilities.

• Conducting regular training to educate employees about phishing, secure communications and device management.

• Limiting data access: Implement least-privilege access controls to restrict sensitive data to only those who need it.

• Regularly auditing your infrastructure for vulnerabilities.