October 2023 – Workers’ Compensation – Insurance Commissioner Orders Rate Reduction

CALIFORNIA INSURANCE Commissioner Ricardo Lara has issued an order that cut the average advisory workers’ compensation benchmark rate across all classes by 2.6%, starting Sept. 1.

The benchmark rate, also known as the pure premium rate, is a baseline that covers just the cost of claims and claims adjusting, but not other overhead like rents, underwriting costs, and provisions for profit.

The rate is advisory, and insurers can use it as a guidepost for pricing their individual policies. Individual premiums that employers pay will depend on a number of factors, including the pure premium rate, the carrier’s own pricing methodology, and the employer’s claims and claims cost history, location, and industry.

Why the rate is falling

The insurance commissioner’s decision cuts the average published pure premium rate to $1.46 per every $100 of payroll, compared to the current $1.50.

Despite the average rate decrease of 2.6%, individual class codes may see swings as much as plus or minus 25%. Several factors are driving the lower rate decision:

- Slowing claims cost inflation

- Falling frequency of claims

- Lower overall claims costs

- Stable medical costs

- Fewer COVID-19 claims

- Lower claims-adjusting costs.

What insurers are doing

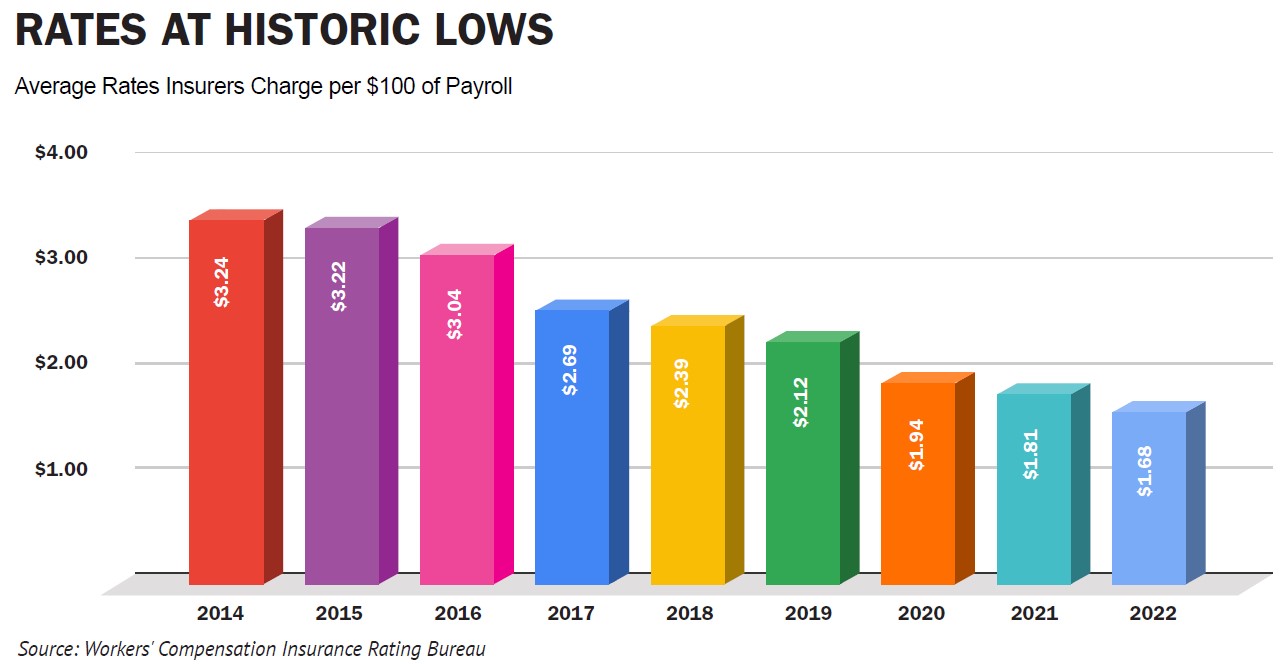

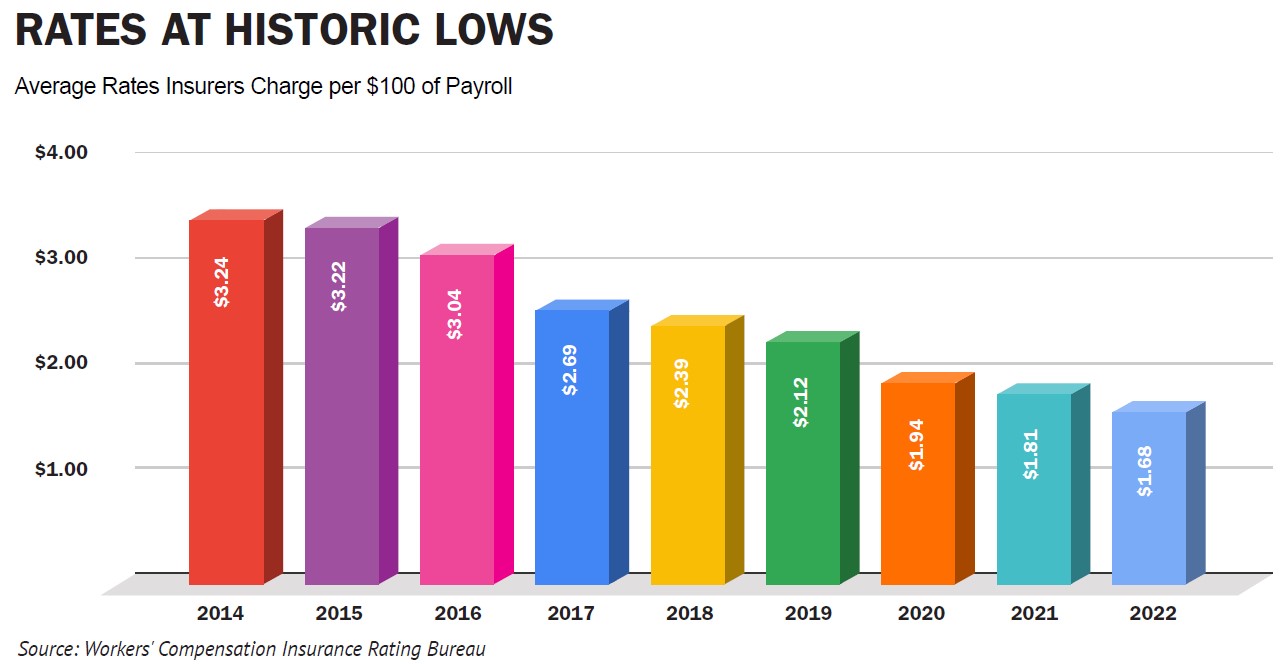

The most recently available industry average level of pure premium rates filed by insurers with the Department of Insurance is $1.71 per $100 of payroll as of Jan. 1, 2023, which is about 14.6% higher than the current published rate of $1.50. In 2022, carriers were charging $1.68 on average.

While the workers’ compensation market remains competitive and rates continue hovering around record lows, the final rate any employer will pay will depend on several factors beyond the pure premium rate. Some employers may see rate increases instead.

Factors that can influence the prices include the employer’s:

- Industry.

- Geographical location (employers in Southern California, for example, face a unique claims environment that results in a surcharge).

- Individual claims experience.