July 2021 – Non-Admitted Carriers – The Option When No Insurers Will Cover You

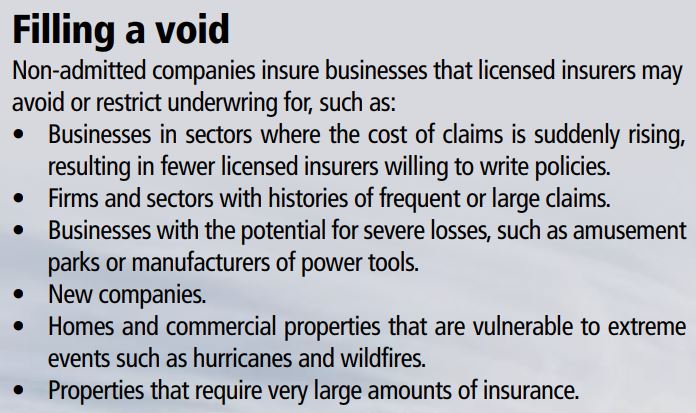

SOME BUSINESSES are finding fewer insurers willing to write their policies for certain types of coverage that are seeing rapidly rising claims costs, particularly in liability lines as well as property insurance in areas with exposure to natural catastrophes.

When no insurers that are licensed in California are willing to write a policy, we as your agent have to go to another market made up of insurance companies that are not licensed or regulated by the state.

It’s called the surplus lines (or “non-admitted”) market, and it can be a valuable alternative for insurance buyers.

As insurers get more selective writing some risks, it’s important for you as an insurance buyer to understand this market.

Why use a non-admitted carrier?

The most well-known non-admitted insurer is Lloyd’s of London, famous for insuring insurance companies and celebrities’ or sports figures’ body parts and global sporting events. Often non-admitted insurance companies are located in other states or domiciled abroad, like Bermuda or another tax-haven country.

Unlike licensed insurance companies, non-admitted companies do not have to obtain approval from state regulators for the policy forms they use or the rates they charge.

Since they are not regulated by the state, non-admitted insurers can offer creative coverage options and they can quickly and easily introduce new types of insurance that businesses need.

Some types of policies that are standard today, such as cyber insurance and employment practices liability insurance, got their start in the non-admitted market.

State laws typically permit a broker to obtain coverage from a non-admitted insurer only if at least a few standard insurance companies refuse to offer coverage. However, most also have coverage options that are not available in the standard market.

When someone needs one of the latter coverages, no rejections from licensed companies are required. An example might be liability insurance for contractors who demolish buildings.

Risks

There are risks to purchasing insurance in the non-admitted market. Policies may provide less coverage than do standard policies, or there may be restrictions on when coverage applies. Policies should be reviewed carefully. Also, because the insurers can charge whatever they feel is appropriate, premiums can be higher than you may expect. The policies may also be exempt from state laws regarding notices of cancellation and non-renewal.

Also, in every state but one (New Jersey), non-admitted policies are not backed by a guaranty fund. Guaranty funds cover claims left unpaid when an insurer is unable to pay for them. If a non-admitted company becomes insolvent, the policyholder has no recourse.

The takeaway

Despite the risks, the non-admitted market serves an important function, giving buyers a place to get needed coverage that would be otherwise unavailable.

Those who think they may need to tap this market should consult with us to find the right coverage at an acceptable price.