April 2024 – Commercial Property Insurance – New Rules Aim to Ease Availability Crisis

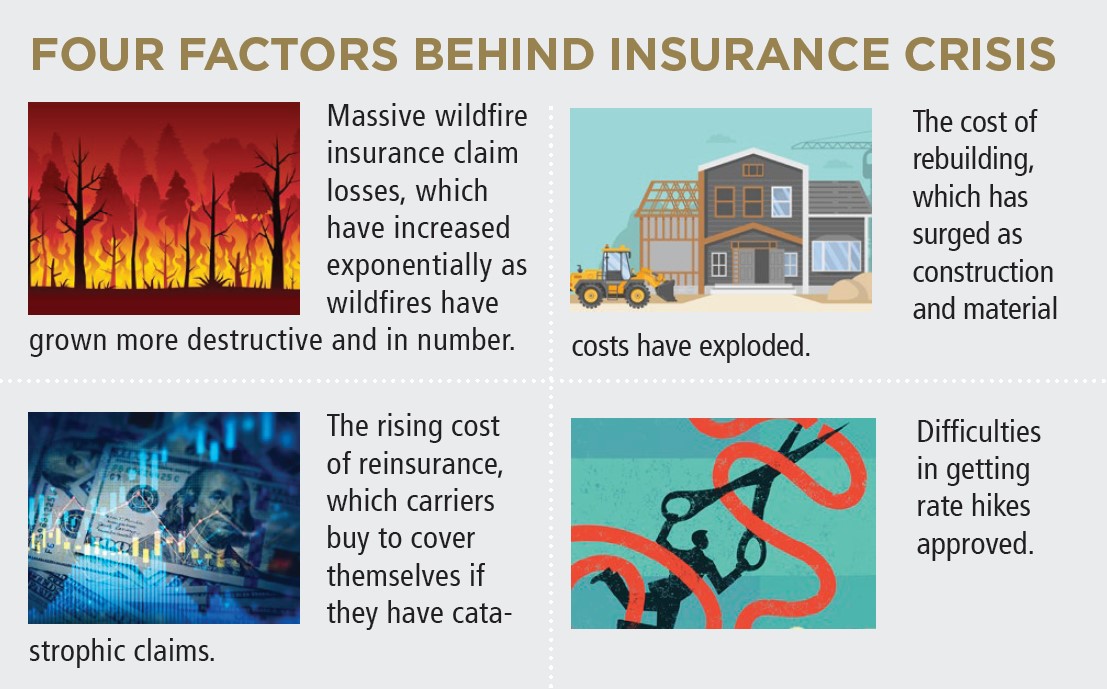

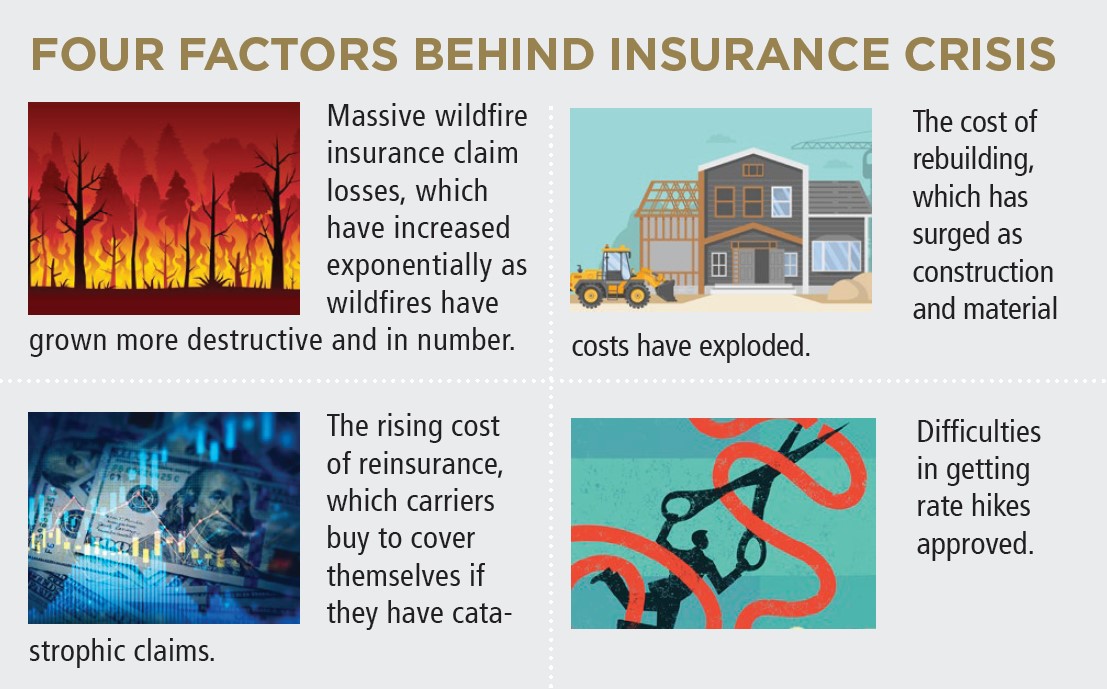

WITH THE California commercial property market increasingly stressed with fewer and fewer insurers willing to write policies in the Golden State, the state insurance commissioner has floated a plan aimed at easing the crisis.

The main thrust of the new proposal is to make it easier for insurers to get their rate-hike requests approved, efforts that have been stifled due to laws that have been on the books since the early 1990s from a law known as Prop. 103. As well, insurers are limited in the types of data they can use to justify rate increases, which has constrained them from being able to ask for hikes that are adequate to cover their potential liabilities.

The proposed rule changes, along with others that are coming this year, are aimed at luring insurers back into the marketplace after one carrier after another has either stopped writing commercial property in the state altogether, or restricted how many policies they will write in California, and where.

While insurers are still writing policies in California, their numbers are shrinking, making renewals a difficult process for many businesses. Insurers have also gotten pickier about properties they are willing to cover, with some setting limits on the age of a building and taking into consideration whether the property owner has filed any claims in the last three years.

The commissioner’s plan

Insurance Commissioner Ricardo Lara’s proposed regulations, one of those prongs, would allow insurers to use catastrophe models to better predict insurance rates for wildfire, terrorism and flooding. Currently, they are only allowed to use historical claims data, which is backward-looking and does not account for the surge in risk and costs that’s occurred during the last five to 10 years.

As well, they are not allowed to consider the growing risk caused by climate change, or wildfire risk mitigation measures taken by communities or regionally as a result of local, state and federal investments.

Mark Sektnan, vice president for state government relations for the American Property Casualty Insurance Association, said this change would go a long way towards addressing the insurance crisis in the state.

“As Californians grapple with record inflation and become increasingly vulnerable to climate-driven extreme weather, including catastrophic wildfires, this is a critically needed tool to help identify future risks more accurately and set rates that reflect our new reality,” he said. “More accurate ratemaking will help restore balance to the insurance market and ensure all Californians have access to the coverage they need.”

The trade-off for consumers will be the likelihood of more insurers coming back into the market to write commercial property and homeowner’s insurance in exchange for them asking for large rate hikes.

The latest proposed regulation follows another that was introduced in late February that would speed up approvals of rate-increase requests. These can sometimes take years if the Department

of Insurance asks for more supporting documentation, which can reset the rate approval process, delaying final approval.

Some insurers have waited more than two years to get their rate hikes even considered.

Current rules “lack clarity and fail to specify the exact materials and information required in a complete rate filing application given the change in times and increased complexity of filing,” according to the Department.

This proposed rule codifies clearer instructions for what supporting documentation insurers must submit when filing for rate increases.

The takeaway

A public hearing on the proposed catastrophe-modeling regulations will be held on April 23 and it’s the department’s plan to get these new rules implemented by the end of 2024, along with the rules on speeding up rate-increase requests.

In the coming months, the department plans to propose additional regulations as well as legislation in order to get insurers to write business in the state again.

If enacted, it’s hoped that the various planned changes will provide some relief to homeowners and businesses in the state.

We’ll keep you posted as this develops.