EVERY YEAR starts with a bevy of new laws and regulations affecting employers and business in California, and many of the new rules this time around are an outgrowth of the COVID-19 pandemic and its effects on workers.

Employers in the year ahead have a number of changes they will have to contend with, some of which were enacted near the end of 2020 as emergency regulations or legislation. The following are the top 10 laws and regulations affecting employers in 2021.

1. COVID-19 workers’ compensation rules

AB 1159, which took effect in September, requires that workers’ compensation benefits be extended so that any employee who reports to a workplace and contracts COVID-19 is presumed to have contracted it at work, making them eligible for workers’ comp benefits.

But the law also imposes sweeping reporting rules for employers that have outbreaks in their workplaces (it’s considered an outbreak if 4% of an employer’s workers test positive for COVID-19). Under new rules by the Workers’ Compensation Insurance Rating Bureau, though, COVID-19 illness claims will not count against employers’ experience modifiers (X-Mods).

Under the law, when reporting a COVID-19 claim employers must provide the following information:

- The date the worker tested positive

- The workplace address of the worker during the 14 days before the positive test, and

- The highest number of employees who reported to work in the 45 days preceding the last day the employee worked in the workplace.

The above must be reported for each worker COVID-19 case. The law sunsets on Jan. 1, 2023.

2. Cal/OSHA COVID-19 regulations

Cal/OSHA in November enacted emergency regulations that require employers to implement safeguards i to reduce the risk of COVID-19 spreading in the workplace. The rules require employers to create a COVID-19 prevention plan, require masks in the workplace, social distancing and other ways to reduce the likelihood of virus spread.

Employers must investigate coronavirus cases in their workplace. If a worker contracts COVID-19, they must notify all staff who may have been exposed, within one day. Workers who may have been exposed must be offered COVID-19 testing at no cost. Employers must report every new case to local health authorities.

3. Cal/OSHA law adds confusion

Before Cal/OSHA came out with its emergency COVID-19 regulations, Governor Newsom signed into law AB 685, which adds to Cal/OSHA’s responsibilities in policing COVID-19 protections.

The law expands the agency’s authority to issue stop-work orders to workplaces it deems a COVID-19 “imminent hazard.” The law also requires employers to notify a number of parties (state agencies, local authorities, employees, contractors and more) if they have coronavirus infections in any of their facilities.

Notice to employees must include information regarding benefits the employee may be eligible for under federal, state and local laws, including workers’ comp, COVID-19-related leave, company

sick leave, state-mandated leave, and more.

4. Expansion of California Family Rights Act

SB 1383 expands the California Family Rights Act to cover even smaller employers – those with five or more staff. The CFRA, which requires covered employers to provide up to 12 weeks of unpaid leave a year for family and medical leave purposes, had until now applied to employers with 50 or more workers .

The new law also expands the scope of “family members” for whom employees can take leave to help care for them to include siblings, grandparents, grandchildren and domestic partners. Also, the law expands the definition of “child” to include all adult children.

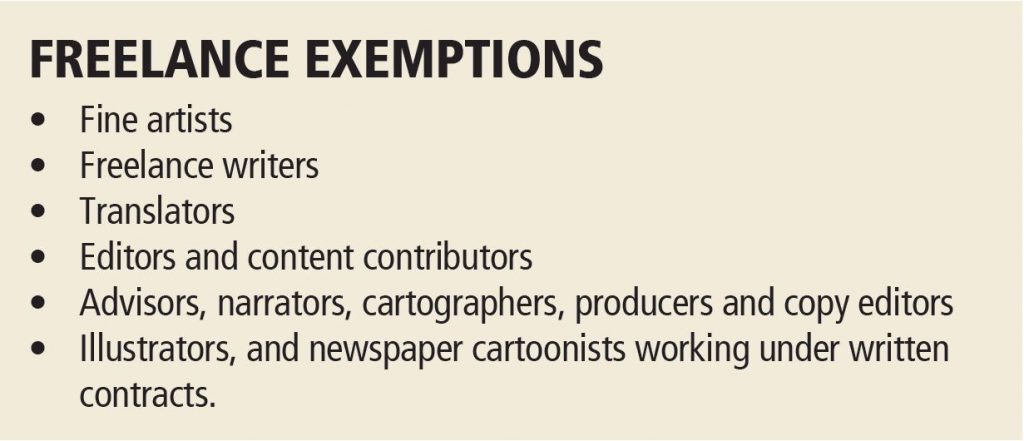

5. Independent contractor law tweaked

AB 2257, which took effect in September 2020, revises the controversial AB 5 independent contractor law by adding a number of exceptions for certain classes of workers.

AB 5 created a new standard for discerning what workers should be classified as employees or independent contractors and it swept up a number of professions in its net, causing some

consternation and hand-wringing among both employers of those contractors and the independent contractors themselves. The professions that are now exempt include (among others):

- Graphic designers

- Web designers

- Consultants

- Freelance writers

- Translators

- Editors and content contributors.

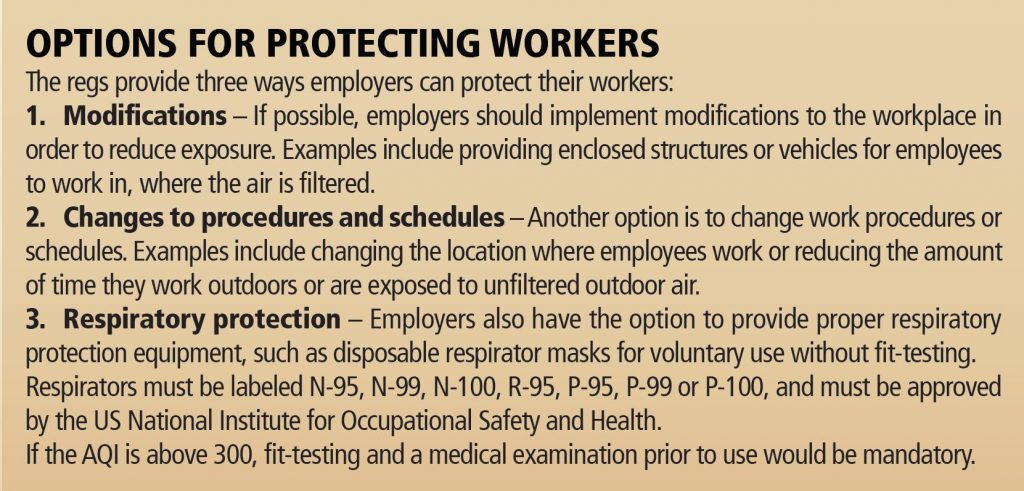

6. Wildfire smoke safety regulations

Cal/OSHA is working on permanent wildfire smoke regulations to protect outdoor workers when the air worsens during major events. An emergency regulation is set to expire Jan. 31, 2021, at which time Cal/OSHA hopes to introduce the permanent replacement that would require employers to protect their outdoor workers from smoke if the Air Quality Index (AQI) exceeds 150.

The regulations apply when the AQI for airborne particulate matter 2.5 microns (PM2.5) or smaller is 151 or greater. The permanent regulations are expected to cover training and methods for protecting workers (like moving them inside or providing N95 respirators during high-smoke conditions).

7. New classification for telecommuters

There is a new workers’ compensation class code to assign to employees who work from home, an outgrowth of the coronavirus pandemic which thrust so many people into working from home. The new class code, (Clerical Telecommuter Employees – N.O.C.), applies to employees that work from home or “away from any location of their employer,” doing office clerical work. This class code, available on policies effective Jan. 1 or later, is to be used for employees which would have been classified under class code 8810, Office Clerical employees, that are doing work at home 50% or more of the time.

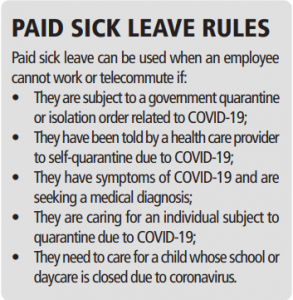

8. Sick leave and kin care law

Under Labor Code, an employee was entitled to use up to half of their annual accrued sick leave to care for a family member, but not the full amount of sick leave they have. AB 2017 gives employees the sole discretion to use as much of their sick leave as they want to care for a family member, with no approval from their employer required. The law took effect. Jan. 1.

A “family member” is defined as a child, parent or guardian, spouse or domestic partner, grandparent, grandchild or sibling.

9. Data protections strengthened further

California voters last year passed Prop. 24, which established a new law: the California Privacy Rights Act of 2020. The CPRA amends and strengthens the state’s current data protection

privacy law, the California Consumer Privacy Act (CCPA), which governs how organizations have to protect personal data that they collect. The CPRA gives additional rights to consumers and places extra obligations on businesses. It provides additional protections for sensitive personal information, expands the CCPA’s opt-out rights to include new types of information-sharing, and requires businesses to provide additional mechanisms for individuals to access, correct or delete data, with a particular focus on information used by automated decision-making systems.

While the law doesn’t take full effect until Jan. 1, 2023, it has a 12-month look-back period. Privacy experts advise companies to start working on their data protection infrastructure in 2021 in order to be ready for this expansive new law.

10. State minimum wage increases

As of Jan. 1, California’s minimum wage increased to $14 for employers with 26 or more employees, and to $13 for those with 25 or fewer employees. Local minimum wages may also have risen. Check your local rules for other minimum wage requirements.